PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740784

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740784

Metamaterial Absorbers Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

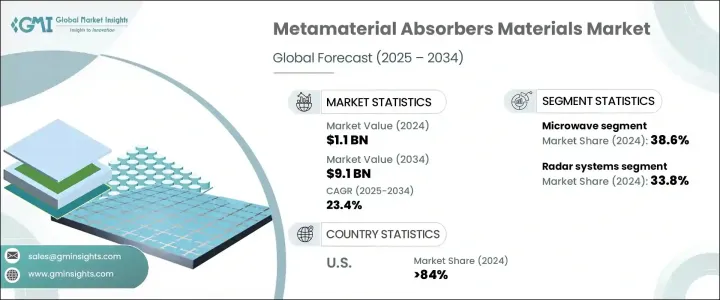

The Global Metamaterial Absorbers Materials Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 23.4% to reach USD 9.1 billion by 2034, driven by the increasing demand for electromagnetic interference shielding and rising investments in high-frequency communication infrastructure, particularly for 5G networks and other advanced systems. In sectors like defense, telecommunications, automotive, and energy, there is a growing focus on wave-absorbing technologies to enhance performance and reduce signal disruptions. As traditional materials struggle to cope with high-frequency electromagnetic waves, metamaterial absorbers offer a promising solution by delivering high absorption efficiency at precise resonance frequencies. Continued research and innovation efforts are enhancing the reliability and range of applications for these materials, enabling the development of lightweight, high-performance absorption technologies that address modern infrastructure challenges.

These advanced materials deliver near-complete absorption performance by manipulating electromagnetic waves with engineered structures. Such absorbers are now essential for improving stealth capabilities and minimizing reflection in both civil and military uses. Recent technological developments have produced broadband absorbers through advanced manufacturing processes, making them valuable for environmental electromagnetic control and radar blocking. With design flexibility and strong performance, metamaterial absorbers integrate into next-generation aerospace, automotive, and defense systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 23.4% |

Based on frequency segmentation, microwave frequency absorbers held the largest share at 38.6% in 2024 due to their ability to effectively dampen electromagnetic waves while being lightweight and adaptable for military use. These materials are highly effective in reducing radar detection by minimizing the radar cross-section, which enhances stealth capabilities in defense applications. Their efficiency and ease of integration make them the preferred choice across security-focused industries. Market dominance in this segment has been reinforced through ongoing innovation expanding angular range and bandwidth.

The radar system applications segment held a 33.8% share in 2024, driven by metamaterials' unmatched ability to enhance detection precision and reduce radar cross-section signatures. These materials allow radar systems to operate effectively by integrating lightweight, compact components that consume less power while delivering superior electromagnetic wave absorption. The performance benefits of metamaterial absorbers make them ideal for modern radar applications where speed, accuracy, and stealth are vital. Ongoing funding from defense and homeland security departments is accelerating innovation, with strategic emphasis on increasing system sensitivity while minimizing detectability. As research deepens, radar integration continues to stand out as a prime sector fueling growth in the metamaterial absorbers materials market.

United States Metamaterial Absorbers Materials Market held an 84% share in 2024 and generated USD 200 million reinforced by advanced military capabilities, a robust scientific infrastructure, and dedicated support from federal agencies for next-generation defense technologies. The U.S. has been at the forefront of developing and deploying metamaterials for high-performance defense and communication systems. With continued innovation, the region maintains its lead through strategic investment in R&D, defense modernization programs, and active collaboration between government institutions and private industry stakeholders.

Key companies in this market include Kymeta, Meta Materials Inc., Metamagnetics, TeraView, and Echodyne. These players are advancing by investing in proprietary technologies, expanding their product portfolios, forming strategic alliances, and leveraging government-backed R&D programs. They are also scaling production capacities and exploring defense-grade certifications to enhance global competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major importing countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major exporting countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Expansion of 5g and next-gen communications

- 3.7.1.2 Growing use of miniaturized electronics requiring compact absorbers

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing cost and complex processing

- 3.7.2.2 High energy consumption in production and fabrication

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Frequency, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Frequency

- 5.3 Microwave

- 5.4 Terahertz

- 5.5 Infrared (IR)

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Electromagnetic metamaterials

- 6.3 Photonic metamaterials

- 6.4 Chiral metamaterials

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Radar systems

- 7.3 Stealth technology

- 7.4 Wireless communication

- 7.5 Medical imaging

- 7.6 Solar energy harvesting

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Echodyne

- 9.2 Entuple Technologies

- 9.3 E-SONG EMC

- 9.4 JEM Engineering

- 9.5 Kymeta

- 9.6 Meta Materials

- 9.7 Metamagnetics

- 9.8 MetaShield

- 9.9 Microwave Measurement System

- 9.10 Nanohmics

- 9.11 Phoebus Optoelectronics

- 9.12 TeraView