PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740935

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740935

Automotive Ultrasonic Technologies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

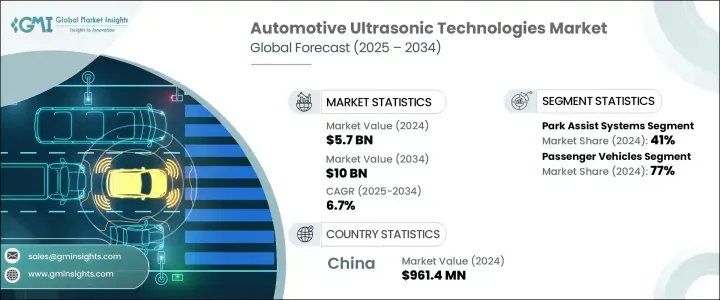

The Global Automotive Ultrasonic Technologies Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 10 billion by 2034, driven by rising demand for advanced automotive safety features and driver assistance systems like ADAS. As vehicle safety continues to take center stage, the integration of ultrasonic technologies has emerged as a critical enabler of next-generation mobility. Automakers are under growing pressure to meet consumer expectations for safer, smarter, and more connected vehicles. This shift is not limited to premium brands; mid-range and budget-friendly car segments are also rapidly incorporating ultrasonic sensor systems to stay competitive in a market increasingly shaped by safety-conscious consumers.

The continuous evolution of vehicle safety norms, technological advancements, and a push for autonomous capabilities are creating an environment where ultrasonic technologies are not just optional but essential. Automakers, suppliers, and tech innovators are collaborating intensively to bring scalable, cost-effective ultrasonic solutions to the market, ensuring that even entry-level vehicles are equipped with cutting-edge safety systems. The industry is witnessing accelerated R&D investments focused on enhancing sensor accuracy, durability, and affordability, thus widening the scope for mass-market adoption. As governments worldwide introduce stringent vehicle safety frameworks and encourage smart mobility innovations, the automotive ultrasonic technologies market is set to experience sustained growth across both mature and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $10 Billion |

| CAGR | 6.7% |

Technologies such as parking sensors, collision avoidance, and blind-spot detection are becoming increasingly popular as safety standards tighten. Governments across various regions are actively updating vehicle safety regulations and introducing new compliance frameworks that emphasize the adoption of advanced driver assistance technologies. Regulatory bodies like UNECE, NHTSA, and other global organizations are playing a central role by mandating features such as obstacle detection, pedestrian alert systems, automated braking, and enhanced parking support, all of which rely heavily on ultrasonic sensing capabilities. As safety regulations shift from basic compliance to proactive accident prevention, ultrasonic technologies are securing a pivotal role in automotive safety innovation. Automakers are now embedding ultrasonic sensors not only in premium models but also across mid-range and entry-level vehicles to meet these global safety norms and capture the loyalty of safety-focused consumers.

Among different applications, parking assist systems hold the largest share, accounting for 41% in 2024. These systems make low-speed maneuvering and parking much easier and safer, especially for compact and mid-range vehicles. Their affordability and simplicity compared to other advanced safety systems have made them a go-to choice for consumers across various vehicle categories.

The market is also segmented by vehicle type, with passenger vehicles dominating a 77% share in 2024. Demand continues to climb as more automakers equip compact and mid-sized cars with ultrasonic-enabled safety features. Regulatory pressures requiring enhanced safety even in economy-class models further fuel this trend.

China held a dominant 38% share of the global market in 2024, driven by its robust automotive industry and government initiatives promoting vehicle safety and smart mobility. Growing demand for electric, hybrid, connected, and autonomous vehicles is further accelerating ultrasonic adoption.

Key players in the Global Automotive Ultrasonic Technologies Market include Hyundai Mobis, Bosch, Continental, Magna International, NXP Semiconductors, Rockwell Automation, Mitsubishi Electric, STMicroelectronics, TE Connectivity, and Texas Instruments. These companies are focusing on strategic partnerships, continuous R&D, and product innovation to drive integration, improve performance, and cater to the rising demand for advanced automotive safety features.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Module and system integrators

- 3.2.4 Automotive original equipment manufacturers

- 3.2.5 Aftermarket suppliers and installers

- 3.3 Profit margin analysis

- 3.4 Trump Administration Tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply Chain Restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (Selling Price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for vehicle safety features and ADAS

- 3.9.1.2 Growth of autonomous and semi-autonomous vehicles

- 3.9.1.3 Government regulations and safety standards

- 3.9.1.4 Technological advancements in ultrasonic sensors

- 3.9.1.5 Increasing consumer preference for smart parking solutions

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Performance limitations in adverse conditions

- 3.9.2.2 Limited range and field of view

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Park assist system

- 5.3 Blind spot detection

- 5.4 Collision avoidance

- 5.5 Self-parking system

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Proximity detection sensors

- 7.3 Range measurement sensors

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Autoliv

- 10.2 Balluff

- 10.3 Baumer Holding

- 10.4 Bosch

- 10.5 Continental

- 10.6 Elmos Semiconductor

- 10.7 Garmin

- 10.8 Honeywell International

- 10.9 Hyundai Mobis

- 10.10 Keyence Corporation

- 10.11 Magna International

- 10.12 Mitsubishi Electric

- 10.13 NXP Semiconductors

- 10.14 Omron Corporation

- 10.15 Pepperl+Fuchs

- 10.16 Rockwell Automation

- 10.17 STMicroelectronics

- 10.18 TDK Corporation

- 10.19 TE Connectivity

- 10.20 Texas Instruments