PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740936

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740936

Electric Public Transport System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

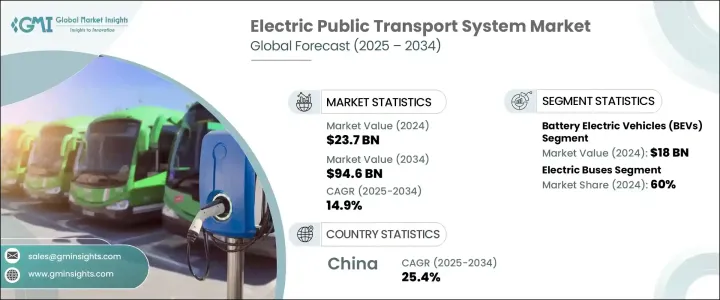

The Global Electric Public Transport System Market was valued at USD 23.7 billion in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 94.6 billion by 2034, driven by increased urban density, stricter environmental regulations, and the global momentum toward clean mobility solutions. Governments and transit agencies worldwide are prioritizing the shift to sustainable, smart transportation systems to combat rising emissions, congestion, and urban sprawl. As cities grow denser and populations surge, the demand for energy-efficient, low-emission public transport networks is becoming a critical priority. Electric public transport systems, combining automation, digitalization, and zero-emission technology, are redefining the future of urban mobility. Cities are investing heavily in electrified fleets, modern infrastructure, and intelligent traffic management systems to create seamless, connected travel experiences for millions of commuters. Innovation in battery technologies, telematics, and wireless charging is further enhancing the operational efficiency and reliability of electric fleets. As smart city initiatives expand globally, electric public transportation is emerging as the backbone of next-generation urban transit ecosystems, making public commuting greener, faster, and smarter.

Public sector investments in electric mass transit-including trams, buses, and metros-are rapidly accelerating as cities aim to lower carbon footprints and upgrade transportation infrastructure. Electrification combined with digital connectivity and automation is transforming urban mobility, bringing advanced functionality and greater efficiency into daily transit operations. Electric public transport networks are now integrating intelligent route planning, zero-emission vehicles, and real-time fleet tracking systems. Operators are adopting energy-saving technologies such as battery management systems, fast-charging solutions, and regenerative braking to drive down operating costs and boost performance. Simultaneously, demand is rising for rider-focused innovations like advanced driver assistance, onboard surveillance systems, and integrated digital ticketing. These upgrades not only enhance transit safety and passenger comfort but also increase ridership appeal. Technological breakthroughs, including over-the-air software updates, lightweight composite materials, and wireless energy transfer systems, are accelerating the market growth trajectory. As electric alternatives steadily replace fossil-fuel-based transit modes, the market is thriving with continuous innovations focused on improving sustainability, automation, and commuter experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Billion |

| Forecast Value | $94.6 Billion |

| CAGR | 14.9% |

The battery electric vehicles (BEVs) segment generated USD 18 billion in 2024, securing the largest share among propulsion categories within the electric public transport system sector. Their sustained leadership is tied to the accelerating shift toward electric urban mobility, where low-emission goals align perfectly with the rising demand for intelligent, user-centric onboard technology. BEVs offer zero tailpipe emissions, lower maintenance needs, and easy integration with digital innovations such as real-time route updates, interactive dashboards, and advanced driver assistance systems, making them the top choice for municipalities modernizing their fleets.

Among vehicle types, the electric buses segment dominated with a 60% market share in 2024, standing out as the most widely adopted mode of electric public transport. This leadership is backed by a global wave of environmental policies, increasing government subsidies, and accelerated expansion of public charging networks. Modern electric buses go beyond sustainable mobility, offering smart features like capacitive touchscreens, intuitive driver displays, adaptive lighting, and ergonomic interiors that enhance both driver experience and passenger comfort. Their scalability and cost-efficiency make them ideal for densely populated cities where demand for clean, high-capacity transit is soaring.

The China Electric Public Transport System Market generated USD 3 billion in 2024 and is forecasted to grow at a remarkable CAGR of 25.4% through 2034. China's dominance in the sector is reinforced by aggressive national strategies favoring sustainable mobility and smart city development. Massive government funding, rapid urbanization, and extensive mass transit electrification plans continue to place China at the forefront of innovation. Local authorities are investing heavily in high-capacity electric bus fleets and intelligent traffic ecosystems that integrate battery management systems, AI-powered scheduling, cloud-based monitoring, and autonomous driving capabilities, all helping to reduce downtime, optimize routes, and extend vehicle lifecycles.

Major players in the Global Electric Public Transport System Market include VDL Bus & Coach, BYD, Yutong Bus, Heliox, EasyMile, Tata Motors, Hitachi Rail, Siemens Mobility, Alstom, and Volvo. Leading companies are strengthening their market positions by investing in modular electric platforms, developing interoperable charging systems, and forming strategic partnerships with urban transit agencies. They are also expanding product portfolios with energy-optimized electric vehicles and focusing R&D efforts on ADAS, telematics, and fleet management software to stay agile and meet evolving regulatory, operational, and environmental requirements across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Production Costs

- 3.8.2.2 Durability and Environmental Sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Mode of Transport, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Electric buses

- 5.3 Electric trains

- 5.4 Electric ferries

- 5.5 Electric taxis/ride-hailing

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Fuel Cell Electric Vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Depot charging

- 7.3 Opportunity charging

- 7.4 Wireless charging

- 7.5 Battery swapping

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Government transit authorities

- 8.3 Private fleet operators

- 8.4 Public-Private Partnerships (PPPs)

- 8.5 Airport & industrial transit operators

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alexander Dennis

- 10.3 Alstom

- 10.4 Ashok Leyland

- 10.5 BYD

- 10.6 CAF

- 10.7 CRRC

- 10.8 EasyMile

- 10.9 Heliox

- 10.10 Hitachi Rail

- 10.11 Keolis

- 10.12 Navya

- 10.13 Proterra

- 10.14 Schneider Electric

- 10.15 Siemens eMobility

- 10.16 Soltaro

- 10.17 Tata Motors

- 10.18 VDL Bus & Coach

- 10.19 Volvo

- 10.20 Yutong Bus