PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741022

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741022

Car Sharing Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

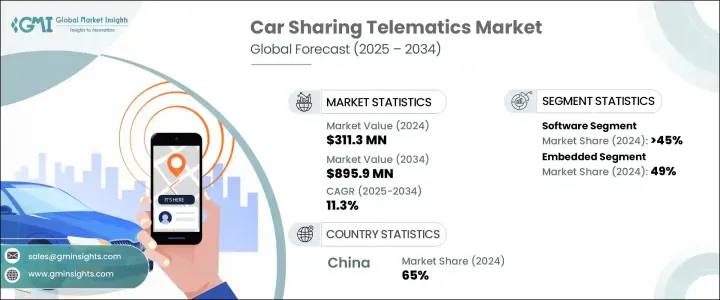

The Global Car Sharing Telematics Market was valued at USD 311.3 million in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 895.9 million by 2034. The market is gaining momentum due to the increasing number of companies entering the sector with innovative strategies aimed at reshaping the mobility landscape. Rising concerns over environmental degradation and traffic congestion are fueling the shift from traditional car ownership to shared vehicle models. Urban populations are becoming more aware of sustainable transportation alternatives that not only reduce the number of vehicles on the road but also contribute to lowering carbon emissions and easing traffic flow. Municipal governments are encouraging these changes by implementing green transportation policies and emission-reduction targets, pushing shared mobility operators to adopt electric vehicles in their fleets. This transition aligns with broader smart city initiatives that aim to optimize urban infrastructure and reduce environmental impact.

The push for digitized and eco-conscious transportation has significantly influenced how telematics systems are designed and deployed. As car sharing becomes more mainstream, telematics software is emerging as the most crucial component, transforming vehicles into connected data hubs. In 2024, the software segment held more than 45% of the total market share, and it is expected to witness substantial growth during the forecast period. These platforms allow operators to track vehicle performance, monitor maintenance schedules, analyze user behavior, and improve overall fleet efficiency. The adoption of artificial intelligence in telematics software now enables systems to adjust fleet sizes dynamically based on real-time demand, reducing operational costs and boosting service quality. Features such as keyless vehicle entry, remote locking, billing automation, and user-friendly interfaces all stem from advanced software capabilities. At the same time, upgraded encryption protocols and cloud-based infrastructure ensure data protection and cybersecurity, making the platforms more robust and compliant with regulatory standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $311.3 Million |

| Forecast Value | $895.9 Million |

| CAGR | 11.3% |

When segmented by component, the market includes GPS receivers, accelerometers, engine interface modules, SIM cards, and software. These components work together to offer seamless connectivity and precise analytics. Software continues to lead in importance, offering real-time visibility and operational control for fleet managers. By integrating with cloud networks, software modules also enable advanced functions like user authentication, geo-fencing, and predictive diagnostics, which ensure safety and maximize fleet availability.

The market is also segmented by form into embedded, tethered, and integrated telematics. Embedded systems accounted for 49% of the market share in 2024 and are expected to dominate over the forecast timeline. These systems are installed by manufacturers directly into the vehicle and are integrated deeply into its electronics. The level of integration in embedded systems allows instant data transfer between the vehicle and backend systems, facilitating real-time performance insights and remote control capabilities. With increasing vehicle connectivity demands, embedded systems are becoming the industry standard for car sharing programs.

From a business model perspective, the subscription-based model stands out as the leading segment. Urban users gravitate toward this model because it offers consistent access to vehicle fleets at predictable monthly or annual rates. This approach supports long-term user engagement by providing transparent, budget-friendly pricing and eliminating the hassles of car ownership. Businesses operating under this model enjoy higher customer retention rates due to the dependable nature of the service.

Regionally, Asia Pacific led the market in 2024, with China holding around 65% of the regional market share and generating USD 74.2 million in revenue. China's leadership position is driven by its rapid urbanization, extensive car production capabilities, and technological advancements in connected vehicle infrastructure. National development policies aimed at promoting smart mobility and vehicle electrification have enabled widespread deployment of telematics systems across shared electric and hybrid vehicles. Additionally, investments in 5G networks, cloud computing, and Internet of Things (IoT) platforms support the expansion of sophisticated car sharing ecosystems. Battery management systems, AI-based vehicle tracking, and real-time fleet analytics are being integrated into shared mobility services, making the country a global leader in this sector.

The major players shaping the global car sharing telematics industry include providers of real-time tracking, behavior analysis, and predictive maintenance technologies. These systems now feature advanced sensor arrays, centralized control units, and 5G-enabled eSIMs that offer cross-border data exchange and cloud-based diagnostics. The market's evolution continues to be driven by a need for smarter, safer, and more efficient transportation solutions tailored to urban lifestyles and sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Car Sharing Telematics Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Automotive manufacturers

- 3.2.3 Technology provider

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Integration of IOT and AI in transportation industry

- 3.9.1.2 Rising demand for sustainable transportation

- 3.9.1.3 Supportive regulations and government initiatives promoting shared mobility

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Concerns about data privacy

- 3.9.2.2 Significant upfront and ongoing costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Automatic Crash Notification (ACN)

- 5.3 Emergency

- 5.4 Navigation

- 5.5 Assistance & access

- 5.6 Diagnostics

- 5.7 Fleet management

- 5.8 Billing

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Integrated

Chapter 7 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 GPS receiver

- 7.3 Accelerometer

- 7.4 Engine interface

- 7.5 Sim card

- 7.6 Software

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Business Model, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Subscription-based model

- 8.3 Pay-per-use model

- 8.4 Corporate fleet management

- 8.5 Partnerships with OEMs

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 U.K.

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 CalAmp

- 10.2 cambio Mobilitatsservice

- 10.3 Cantamen

- 10.4 Carmine

- 10.5 Citiz Reseau

- 10.6 CityBee Solutions

- 10.7 Continental Aftermarket & Services

- 10.8 Fleetster (Next Generation Mobility)

- 10.9 Geotab

- 10.10 INVERS

- 10.11 Mobility Tech Green

- 10.12 Mojio

- 10.13 Octo Group

- 10.14 Ridecell

- 10.15 Samsara

- 10.16 Targa Telematics

- 10.17 Turo

- 10.18 Verizon Communications

- 10.19 Vulog

- 10.20 WeGo