PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750284

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750284

Solar PV Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

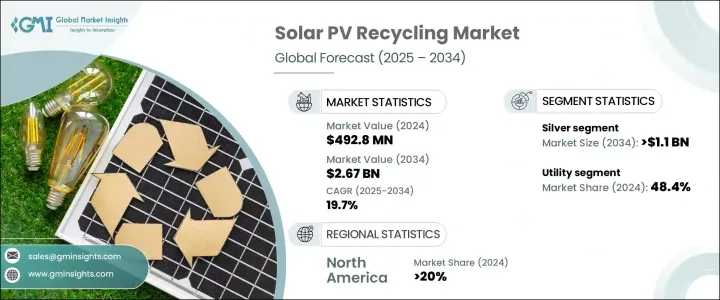

The Global Solar PV Recycling Market was valued at USD 492.8 million in 2024 and is estimated to grow at a CAGR of 19.7% to reach USD 2.67 billion by 2034, driven by increasing global awareness around environmental sustainability and the urgent need to manage the growing volume of solar photovoltaic waste. As more PV panels installed two to three decades ago reach the end of their lifecycle, the market is witnessing a surge in demand for efficient recycling processes. Governments, environmental agencies, and private stakeholders push for better recycling infrastructure to prevent landfill accumulation and recover critical materials used in panel production.

The solar industry's reliance on finite resources such as high-purity silicon, indium, and silver pushes for greater recycling innovation. Escalating geopolitical instability and disruptions in the global supply chain have heightened interest in domestic material recovery, which enhances supply security while supporting environmental goals. Companies are turning toward advanced recovery technologies to optimize costs and reduce waste. Modern techniques are helping manufacturers reclaim valuable materials while aligning with circular economy policies, further propelling market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $492.8 Million |

| Forecast Value | $2.67 Billion |

| CAGR | 19.7% |

In 2024, copper secured a notable 17.3% share, attributed to its increasing material scarcity and consistently high market recovery value. With copper being a critical component in solar panels and overall renewable energy systems, its recovery from decommissioned panels has become a major priority for recyclers. As pressure mounts globally to reduce dependency on mining and support a circular economy, copper extraction from used solar modules offers both environmental and financial benefits.

The residential segment is expected to generate USD 801 million by 2034, backed by heightened consumer awareness about the environmental impact of solar waste. Homeowners are increasingly seeking sustainable solutions, and the integration of panel recycling into residential solar energy systems is steadily becoming the norm. National regulations surrounding electronic and hazardous waste disposal, along with tax credits and take-back programs, are reinforcing this behavior. As consumers prioritize eco-friendly energy systems, recyclers are capitalizing on this shift by offering household-friendly, compliant, and cost-effective recycling services that extend the lifecycle of solar components.

Asia Pacific Solar PV Recycling Market generated USD 1,120 million by 2034, driven by the widespread solar infrastructure established across nations like China, Japan, and India, and the volume of outdated or failing solar panels. This mounting waste challenge is pushing governments and private enterprises in the region to invest in localized recycling facilities. These efforts are not only meeting national sustainability targets but also generating new employment opportunities and advancing regional manufacturing ecosystems.

Key players in the Global Solar PV Recycling Market include Aurubis, SunPower Corporation, SILCONTEL, Solarcycle, Reiling, Veolia, Canadian Solar, Trina Solar, Marubeni Corporation, We Recycle Solar, Echo Environmental, and First Solar. To secure their foothold in the evolving solar PV recycling market, companies are implementing strategies such as establishing local recycling facilities, forming public-private partnerships, and investing in R&D for next-generation recovery methods. Many are expanding their geographic reach, upgrading processing capacities, and aligning operations with environmental compliance standards to improve profitability and brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic initiatives

- 4.3 Company market share

- 4.4 Strategic dashboard

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Recyclable Material, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Silver

- 5.3 Aluminum

- 5.4 Copper

- 5.5 Glass

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Process, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Mechanical

- 7.3 Thermal

- 7.4 Laser

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 France

- 8.3.4 UK

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 Aurubis

- 9.2 Canadian Solar

- 9.3 Echo Environmental

- 9.4 First Solar

- 9.5 Marubeni Corporation

- 9.6 Reiling

- 9.7 SILCONTEL

- 9.8 Solarcycle

- 9.9 SunPower Corporation

- 9.10 Trina Solar

- 9.11 Veolia

- 9.12 We Recycle Solar