PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750290

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750290

Vacuum Contactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

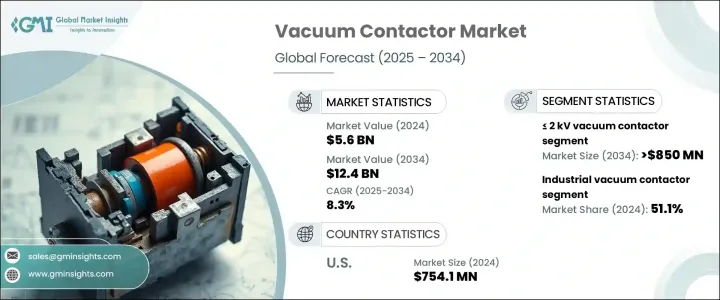

The Global Vacuum Contactor Market was valued at USD 5.6 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 12.4 billion by 2034, driven by increasing investments in power infrastructure, rising demand for energy-efficient solutions, and expanding deployment of smart grid systems. As industries and utilities continue to seek reliable, high-performance switching solutions that support modern energy networks, the demand for vacuum contactors is gaining momentum. Technological advancements, combined with a shift toward automation and the rising share of renewable energy in the power mix, are creating a robust foundation for market expansion.

One of the major factors contributing to this growth is the increasing need for safe, durable, and fast-switching devices that ensure reliable power distribution in mission-critical environments. Vacuum contactors offer advantages such as low maintenance, high electrical endurance, and compact designs that make them suitable for a variety of industrial and utility applications. Their use is expanding due to heightened awareness of equipment safety, especially in medium-voltage environments, where arc flash risks must be minimized. Additionally, the growth in electrification across sectors and an increasing emphasis on operational reliability are pushing end users to upgrade existing systems, which often include aging electromechanical contactors. This transition is further supported by favorable regulations and incentives that promote modernized electrical infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 8.3% |

The market is segmented by voltage rating, including <= 2 kV, > 2 kV to 5 kV, > 5 kV to 10 kV, and > 10 kV. Among these, the <= 2 kV segment is forecast to exceed USD 850 million by 2034. This segment is particularly popular due to the increasing deployment of energy-efficient systems in compact environments. Vacuum contactors in this voltage range are favored for their reliability, smaller footprint, and suitability for space-constrained settings where minimal maintenance is a key requirement.

In terms of end use, the market is classified into commercial, industrial, and utility sectors. The industrial segment dominated the market in 2024 with a share of 51.1%. This dominance can be attributed to stricter energy efficiency standards and the growing need for dependable fault-handling equipment in production facilities and processing units. Moreover, expanding industrial manufacturing capacities, particularly in developing regions, are creating new opportunities for vacuum contactor deployment across a wide range of applications.

Regionally, the United States has emerged as a significant contributor to market growth, with valuations of USD 692.2 million in 2022, USD 720.9 million in 2023, and USD 754.1 million in 2024. The increasing pace of infrastructure development in the country, especially in renewable energy and electric vehicle sectors, is leading to greater adoption of vacuum contactors. Public and private sector initiatives aimed at modernizing the national grid and enhancing operational efficiency in industrial sectors are accelerating product demand. Moreover, the focus on lowering operational costs while ensuring uninterrupted performance is prompting stakeholders to choose vacuum contactors over conventional alternatives.

The competitive landscape is moderately consolidated, with the top five players accounting for approximately 40% of the global market share. These include leading multinational corporations with extensive product portfolios and well-established service networks. Their continued investments in R&D, combined with regional partnerships and integration of smart features into vacuum contactors, are helping them maintain a strong foothold in the market. These companies are increasingly focusing on technologies that enhance product longevity, reduce energy losses, and support remote diagnostics, aligning with the broader trends in digitalization and smart energy systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 Motor starter

- 5.3 Transformer

- 5.4 Capacitor

- 5.5 Reactor

- 5.6 Resistive loads

- 5.7 Others

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 ≤ 2 kV

- 6.3 > 2 kV to 5 kV

- 6.4 > 5 kV to 10 kV

- 6.5 > 10 kV

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 Germany

- 8.3.5 Spain

- 8.3.6 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Iran

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.5.7 Turkey

- 8.5.8 Morocco

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Datsons Electronics

- 9.3 Eaton

- 9.4 EAW Relaistechnik

- 9.5 ElectronTubes

- 9.6 GREENSTONE

- 9.7 Hansen Electric

- 9.8 HIITIO New Energy

- 9.9 Kunshan GuoLi Electronic Technology

- 9.10 Liyond

- 9.11 LS ELECTRIC

- 9.12 Mitsubishi Electric Corporation

- 9.13 Pentagon Switchgears

- 9.14 Rockwell Automation

- 9.15 Schneider Electric

- 9.16 Schrack Technik