PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755200

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755200

North America Used Pickup Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

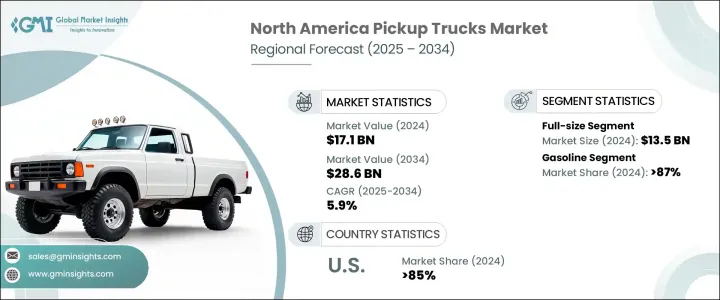

North America Used Pickup Truck Market was valued at USD 17.1 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 28.6 billion by 2034. This growth is driven by the increasing availability of Certified Pre-Owned (CPO) options, which provide added peace of mind to buyers with thorough inspections, warranties, and guarantees. As a result, more consumers are opting for used trucks, knowing they come with the same level of quality and reliability as new ones. The demand for used pickups is further amplified by their essential role in both work and recreational activities. These vehicles are a staple for people in rural areas, particularly farmers and those involved in outdoor hobbies like camping, hiking, and fishing, where their ability to transport goods and haul heavy loads is vital.

With agricultural growth and the expanding popularity of outdoor pursuits, the need for affordable, reliable second-hand pickups is expected to increase throughout the forecast period. The rise of online platforms for buying used pickup trucks has revolutionized the market, allowing consumers to access detailed vehicle histories and competitive pricing, making it easier to shop for used vehicles from the comfort of their homes. With the convenience of browsing large inventories online, the demand for pre-owned trucks is rapidly increasing, further fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.1 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 5.9% |

In 2024, the full-size pickup segment generated USD 13.5 billion and is expected to see substantial growth throughout 2034. Full-size pickups are known for retaining their value over time, making them a reliable option for buyers looking for quality vehicles at a more affordable price. They are also popular for their robust build and dependability, with multiple models offering a range of customization options for engine size, cab configurations, and trim levels.

Gasoline-powered pickup trucks segment made up 87% share in 2024. These trucks, while typically costing more to run, are often chosen by buyers who are on a tighter budget because they are less expensive upfront compared to diesel alternatives. The availability of gasoline is also more widespread, which makes these trucks more practical for everyday use, especially in areas where diesel fuel is less accessible. Additionally, gasoline engines are generally less costly to maintain and repair, making them an attractive option for those seeking long-term affordability.

U.S. Used Pickup Truck Market held an 85% share in 2024, owing to the high demand from sectors such as construction, logistics, and fleet management. These industries rely heavily on used trucks for daily operations due to their cost-effectiveness and durability. The constant need for dependable vehicles in these sectors leads to a robust resale market, with pickups maintaining consistent demand across states with high levels of infrastructure and development.

Key players in the North America Used Pickup Truck Market include: AutoNation, Lithia Motors, Hendrick Automotive Group, CarMax, Penske Automotive Group, DriveTime, Group 1 Automotive, Sonic Automotive, Asbury Automotive Group, and Carvana. To strengthen their market position, companies in the used pickup truck industry are focusing on offering comprehensive services like CPO options, extended warranties, and financing programs. They are also leveraging advanced digital platforms to enhance the buying experience, making it more accessible and user-friendly for customers. Additionally, many of these companies are building a strong online presence and enhancing their inventory management to cater to a wider audience, improving convenience for buyers across different regions. By offering tailored solutions and continuously refining their customer service, they are increasing brand loyalty and expanding their market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Size

- 2.2.3 Age

- 2.2.4 Range

- 2.2.5 Powertrain

- 2.2.6 Drive

- 2.2.7 Sales channel

- 2.2.8 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Strong demand from construction and logistics sectors

- 3.2.1.2 Affordability compared to new pickup models

- 3.2.1.3 Robust resale value and vehicle longevity

- 3.2.1.4 Expansion of e-commerce and last-mile delivery

- 3.2.1.5 Availability of certified pre-owned programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited inventory of high-quality used pickups

- 3.2.2.2 Rising maintenance costs for older vehicles

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of digital retail platforms for used truck sales

- 3.2.3.2 Development of certified pre-owned (CPO) programs by independent dealers

- 3.2.3.3 Subscription-based ownership models for used pickup trucks

- 3.2.3.4 Growth in rural and semi-urban demand for utility vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trend

- 3.8.1 By country

- 3.8.2 By powertrain

- 3.9 Cost breakdown analysis

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Size, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Compact

- 5.3 Mid-size

- 5.4 Full-size

Chapter 6 Market Estimates & Forecast, By Age, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Up to 3 years

- 6.3 5-10 years

- 6.4 Above 10 years

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 Less than 50,000

- 7.3 50,000-1,00,000 km

- 7.4 Above 1,00,000 km

Chapter 8 Market Estimates & Forecast, By Powertrain, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 Gasoline

- 8.3 Diesel

- 8.4 Electric

- 8.5 Hybrid

Chapter 9 Market Estimates & Forecast, By Drive, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 Rear-wheel drive

- 9.3 Four-wheel drive

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn & Units)

- 10.1 Key trends

- 10.2 Personal

- 10.3 Commercial

- 10.3.1 Construction and heavy equipment

- 10.3.2 Agriculture and farming

- 10.3.3 Landscaping and outdoor services

- 10.3.4 Utility and municipal use

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn & Units)

- 11.1 Key trends

- 11.2 Franchise dealers

- 11.3 Independent dealers

- 11.4 Peer-to-peer

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 12.1 Key trends

- 12.2 U.S.

- 12.2.1 Alabama

- 12.2.2 Alaska

- 12.2.3 Arizona

- 12.2.4 Arkansas

- 12.2.5 California

- 12.2.6 Colorado

- 12.2.7 Florida

- 12.2.8 Georgia

- 12.2.9 Idaho

- 12.2.10 Illinois

- 12.2.11 Indiana

- 12.2.12 Iowa

- 12.2.13 Kansas

- 12.2.14 Kentucky

- 12.2.15 Louisiana

- 12.2.16 Maine

- 12.2.17 Michigan

- 12.2.18 Minnesota

- 12.2.19 Mississippi

- 12.2.20 Missouri

- 12.2.21 Montana

- 12.2.22 Nebraska

- 12.2.23 Nevada

- 12.2.24 New Mexico

- 12.2.25 North Carolina

- 12.2.26 North Dakota

- 12.2.27 Ohio

- 12.2.28 Oklahoma

- 12.2.29 Oregon

- 12.2.30 Pennsylvania

- 12.2.31 South Carolina

- 12.2.32 South Dakota

- 12.2.33 Tennessee

- 12.2.34 Texas

- 12.2.35 Utah

- 12.2.36 Virginia

- 12.2.37 Washington

- 12.2.38 West Virginia

- 12.2.39 Wisconsin

- 12.2.40 Wyoming

- 12.2.41 Rest of U.S.

- 12.3 Canada

- 12.3.1 Alberta

- 12.3.2 British Columbia

- 12.3.3 Manitoba

- 12.3.4 New Brunswick

- 12.3.5 Newfoundland and Labrador

- 12.3.6 Nova Scotia

- 12.3.7 Ontario

- 12.3.8 Prince Edward Island

- 12.3.9 Quebec

- 12.3.10 Saskatchewan

- 12.3.11 Rest of Canada

Chapter 13 Company Profiles

- 13.1 Asbury Automotive Group

- 13.2 AutoNation

- 13.3 Bill Gates Auto Group

- 13.4 CarMax

- 13.5 Carvana

- 13.6 Copart (used vehicle auctions)

- 13.7 DriveTime

- 13.8 Enterprise Car Sales

- 13.9 Ford Certified Pre-Owned

- 13.10 General Motors Certified Pre-Owned

- 13.11 Group 1 Automotive

- 13.12 Hendrick Automotive Group

- 13.13 Larry H. Miller Dealerships

- 13.14 Lithia Motors

- 13.15 Manheim (used vehicle auctions)

- 13.16 Penske Automotive Group

- 13.17 Shift Technologies

- 13.18 Sonic Automotive

- 13.19 Toyota Certified Used Vehicles (for pickup models)

- 13.20 Vroom