PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755301

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755301

Europe Used Pickup Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

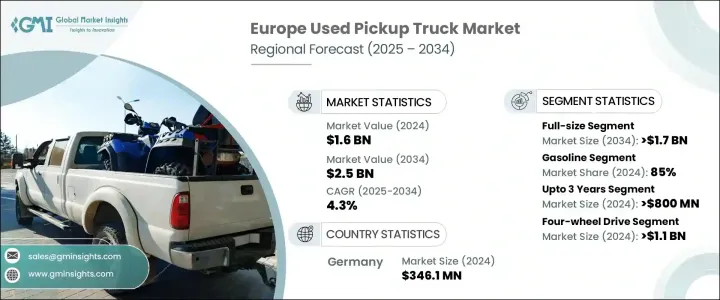

Europe Used Pickup Truck Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 2.5 billion by 2034. This growth is being fueled by a steady rise in the demand for cost-efficient utility vehicles that can serve both commercial and personal needs. Pickup trucks are increasingly seen as a practical solution for various transportation tasks, especially in sectors like construction, agriculture, and logistics, where dependable, versatile, and budget-friendly vehicles are crucial. As infrastructure investment continues across Europe, used pickup trucks are filling a vital gap in the transport needs of contractors, SMEs, and rural users alike.

Buyers are increasingly drawn to pickups that offer fuel efficiency, rugged performance, and lower ownership costs compared to new models. The surge in digital retail platforms for pre-owned vehicles is further simplifying the purchasing process, making it easier for both individuals and businesses to access reliable inventory. Digital tools like AI-powered listings and virtual vehicle walkthroughs are changing the way vehicles are bought and sold, offering consumers more transparency and confidence in their purchases. Environmental factors are also starting to play a more important role, with used electric pickups and retrofitted EVs gaining attention as regulations tighten around emissions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.3% |

The market is segmented by truck size into full-size, mid-size, and compact models. In 2024, the full-size category alone generated over USD 1 billion in revenue and is projected to reach approximately USD 1.7 billion by 2034. These vehicles are in high demand for heavy-duty usage, offering large cargo beds, towing capacity, and enhanced engine performance, making them a preferred option in commercial operations. On the other hand, mid-size trucks are gaining traction for their balance between load capability and maneuverability. Their ability to carry substantial payloads while navigating tight urban spaces makes them a smart pick for small enterprises. These vehicles also offer better fuel efficiency than their full-size counterparts, especially in city environments, which enhances their value proposition in the used truck segment. Mid-size pickups are often viewed as the most cost-effective solution for small and medium-sized businesses, offering a solid return on investment without the high upkeep of heavier models.

In terms of propulsion types, the used pickup truck market in Europe is categorized into gasoline, diesel, hybrid, and electric variants. As of 2024, gasoline-powered pickups held a dominant market share of around 85%, driven by their widespread availability and lower initial cost. However, diesel trucks continue to be favored in heavy-duty and long-haul scenarios due to their superior fuel economy and torque under load. Diesel engines also have a reputation for longer lifespan and lower maintenance, making them an attractive choice for commercial users looking to maximize utility and minimize cost. While hybrid and electric models currently hold a smaller market share, their presence is expected to grow in response to evolving emission norms and the availability of EV infrastructure across the continent.

When segmented by vehicle age, trucks that are up to 3 years old accounted for over USD 800 million in 2024. This category is highly desirable due to its alignment with modern safety features, updated technology, and lower wear-and-tear risk. Vehicles aged between 5 to 10 years are also well-represented in the market, offering a favorable trade-off between cost and performance. These trucks typically include the most current features and are priced significantly lower than newer models, appealing to value-driven buyers. Their availability is supported by commercial fleet turnover and lease cycles, ensuring a consistent supply in the used vehicle market. Vehicles over 10 years old remain an option for highly price-sensitive customers, but are generally considered to have higher maintenance needs.

The market is also divided based on drivetrain into rear-wheel drive (RWD) and four-wheel drive (4WD). In 2024, the 4WD segment generated over USD 1.1 billion in revenue. Its popularity is attributed to the enhanced traction, control, and adaptability these vehicles offer, especially in adverse weather and varied terrain. For commercial use, such as transporting goods in remote or rugged areas, 4WD models are often the preferred choice. Consumers are also gravitating toward these vehicles for lifestyle-related uses, valuing their off-road capabilities and all-weather reliability. The influx of used 4WD trucks from fleet renewals and lease returns continues to drive inventory levels and meet growing consumer demand.

Germany led the European market in 2024, contributing over 22% to the regional share, with a valuation of approximately USD 346.1 million. The country's well-established vehicle resale infrastructure, combined with its robust commercial and industrial base, supports a thriving market for used pickup trucks. Consumer behavior trends show a clear preference for high-quality, well-maintained used trucks, particularly those with full service histories and efficient drivetrains. Leasing programs and vehicle certification efforts by dealers and manufacturers have further boosted buyer confidence and strengthened resale values.

Many sellers now offer certified pre-owned (CPO) programs, comprehensive inspections, and value-added services such as financing and warranties. These services not only enhance vehicle reliability but also simplify the purchase process. The increasing use of multi-channel strategies, including online marketplaces and hybrid retail models, continues to redefine the customer experience and broaden access to used pickup inventory across Europe.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Size

- 2.2.3 Age

- 2.2.4 Range

- 2.2.5 Propulsion

- 2.2.6 Drive

- 2.2.7 Sales channel

- 2.2.8 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Ongoing infrastructure development and construction projects

- 3.2.1.2 Growing popularity of electric and hybrid pick-up trucks

- 3.2.1.3 Increased adoption of pick-up trucks for both commercial and private uses

- 3.2.1.4 Cost effectiveness and affordability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Economic downturns and low economic growth

- 3.2.2.2 Regulatory compliance and government regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of e-commerce and last-mile delivery

- 3.2.3.2 Shift toward electrified and hybrid pick-ups

- 3.2.3.3 Expansion of Certified Pre-Owned (CPO) programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Western Europe

- 3.4.2 Eastern Europe

- 3.4.3 Northern Europe

- 3.4.4 Southern Europe

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By country

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer behavior analysis

- 3.13.1 Predominant end use segments

- 3.13.2 Purchase decision factors (price, brand, capacity)

- 3.14 Analysis of insurance and aftermarket trends

- 3.14.1 Insurance cost and risk profile

- 3.14.2 Aftermarket trends and servicing behavior

- 3.14.3 Maintenance cost trends and parts availability

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Northern Europe

- 4.2.4 Southern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product benchmarking

- 4.7.1 Powertrain and towing capability

- 4.7.2 Fuel efficiency and emissions compliance

- 4.7.3 Chassis quality and load handling

- 4.7.4 Cabin features and technology

- 4.7.5 Aftermarket service and parts support

Chapter 5 Market Estimates & Forecast, By Size, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Compact

- 5.3 Mid-size

- 5.4 Full-size

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Age, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Upto 3 years

- 7.3 5-10 years

- 7.4 Above 10 years

Chapter 8 Market Estimates & Forecast, By Range, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Less than 50,000

- 8.3 50,000-1,00,000 km

- 8.4 Above 1,00,000 km

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Franchised dealer

- 9.3 Independent dealer

- 9.4 Peer-to-peer

Chapter 10 Market Estimates & Forecast, By Drive, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Rear-wheel drive

- 10.3 Four-wheel drive

Chapter 11 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 Personal

- 11.3 Commercial

- 11.3.1 Construction and heavy equipment

- 11.3.2 Agriculture and farming

- 11.3.3 Landscaping and outdoor services

- 11.3.4 Utility and municipal use

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 12.1 Key trends

- 12.2 Western Europe

- 12.2.1 Germany

- 12.2.2 Austria

- 12.2.3 France

- 12.2.4 Switzerland

- 12.2.5 Belgium

- 12.2.6 Luxembourg

- 12.2.7 Netherlands

- 12.2.8 Portugal

- 12.3 Eastern Europe

- 12.3.1 Poland

- 12.3.2 Romania

- 12.3.3 Czech Republic

- 12.3.4 Slovenia

- 12.3.5 Hungary

- 12.3.6 Bulgaria

- 12.4 Northern Europe

- 12.4.1 UK

- 12.4.2 Denmark

- 12.4.3 Sweden

- 12.4.4 Finland

- 12.4.5 Norway

- 12.5 Southern Europe

- 12.5.1 Italy

- 12.5.2 Spain

- 12.5.3 Greece

Chapter 13 Company Profiles

- 13.1 Chevrolet

- 13.2 Citroen

- 13.3 Dacia

- 13.4 Fiat

- 13.5 Ford

- 13.6 Hyundai

- 13.7 Isuzu

- 13.8 Jeep

- 13.9 Kia

- 13.10 Land Rover

- 13.11 Mazda

- 13.12 Mercedes-Benz

- 13.13 Mitsubishi

- 13.14 Nissan

- 13.15 Opel

- 13.16 Peugeot

- 13.17 Renault

- 13.18 SsangYong

- 13.19 Toyota

- 13.20 Volkswagen