PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755274

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755274

Cementless Partial Knee Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

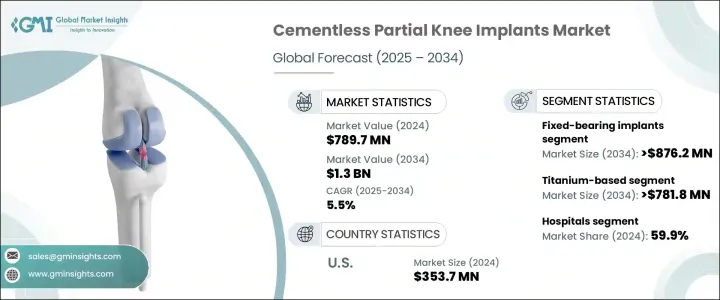

The Global Cementless Partial Knee Implants Market was valued at USD 789.7 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.3 billion by 2034. The key factors contributing to this growth include the rising infection rates leading to an increase in knee revision surgeries, the growing prevalence of osteoarthritis and rheumatoid arthritis, and a greater preference for minimally invasive procedures. The increasing number of elderly individuals with osteoarthritis and the demand for more effective, less invasive surgical options are crucial drivers for this market. Cementless partial knee implants, used in unicompartmental knee arthroplasty (UKA) procedures, only replace the affected portion of the knee joint, preserving more natural bone and ligaments.

These implants eliminate the need for bone cement, facilitating biological fixation instead. This method encourages the natural growth of bone tissue around the implant, leading to stronger and more durable integration between the implant and the bone. The absence of bone cement not only minimizes the risk of implant loosening over time but also reduces the likelihood of complications such as cement-related infections and inflammation. Moreover, biological fixation can enhance the overall stability of the implant, potentially extending its lifespan and improving long-term patient outcomes. As a result, cementless implants offer a more natural healing process and may require fewer revisions, making them an increasingly preferred option in orthopedic procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $789.7 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 5.5% |

Fixed-bearing implants segment is expected to grow at a CAGR of 5.3% to reach USD 876.2 million by 2034. These implants are mechanically simpler and less prone to failure than mobile-bearing systems, making them more popular among surgeons. They offer long-term survival rates of over 90% at ten years in low-demand patients. Additionally, mobile-bearing systems are typically more expensive and complex, which limits their acceptance and widespread use. As a result, fixed-bearing systems are the preferred choice in many cases, accelerating their adoption and contributing to their market dominance.

The titanium-based segment is anticipated to experience a growth rate of 5.4%, reaching USD 781.8 million by 2034. Titanium's biocompatibility makes it ideal for cementless implants, as it promotes osseointegration, which is crucial for the success of these devices. Titanium implants offer better adhesion to bone tissue and greater resistance to loosening compared to cobalt-chromium alloys, enhancing their stability and lifespan. The lightweight nature of titanium alloys, combined with their strength, makes them particularly suitable for younger, more active patients who require greater mobility post-surgery. Additionally, titanium is ideal for individuals with metal sensitivities, further driving demand for personalized knee arthroplasty.

U.S. Cementless Partial Knee Implants Market was valued at USD 353.7 million in 2024. The aging population in the U.S. is one of the fastest-growing demographics globally, contributing to the rising demand for knee replacement procedures. Osteoarthritis, especially medial unicompartmental osteoarthritis, is one of the primary conditions driving the need for partial knee replacements. Additionally, outpatient orthopedic surgeries are on the rise in the U.S., particularly in ambulatory surgical centers, due to the advantages of shorter anesthesia times, minimal blood loss, and quicker recovery. Moreover, the U.S. benefits from a robust reimbursement system, with both private insurers and Medicare increasingly recognizing the cost-effectiveness of partial knee replacements over total knee replacements for suitable patients.

The leading players in the Global Cementless Partial Knee Implants Market include Stryker, Medacta, Amplitude Surgical, Smith+Nephew, Waldemar Link, GRUPPO BIOIMPIANTI, ZIMMER BIOMET, Lepine, Just Medical, and Medacta. To strengthen their market presence, companies in the cementless partial knee implants industry are focusing on several strategies. They are investing in continuous innovation to improve implant designs and functionality, such as enhancing the biocompatibility and osseointegration properties of the implants. Partnerships with healthcare providers, clinics, and hospitals are also being forged to expand product reach and ensure higher adoption rates. Additionally, companies are focusing on regional expansion, particularly in emerging markets where the demand for orthopedic procedures is increasing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising infection rates contributing to the rise in knee revisions

- 3.2.1.2 Increasing prevalence of osteoarthritis and rheumatoid arthritis

- 3.2.1.3 Growing preference for minimally invasive procedures

- 3.2.1.4 Technological advancements in cementless fixation methods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with cementless knee implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Implant Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed-bearing implants

- 5.3 Mobile-bearing implants

- 5.4 Medial pivot implants

- 5.5 Other implant types

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium-based

- 6.3 Cobalt-chromium alloys

- 6.4 Polyethylene components

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic centres

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 amplitude SURGICAL

- 9.2 GRUPPO BIOIMPIANTI

- 9.3 JUST MEDICAL

- 9.4 lepine

- 9.5 Medacta

- 9.6 Smith+Nephew

- 9.7 Stryker

- 9.8 Waldemar Link

- 9.9 ZIMMER BIOMET