PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1782035

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1782035

Knee Replacement Surgery Market by Procedure Type, Product, Application, End User - Global Forecast to 2030

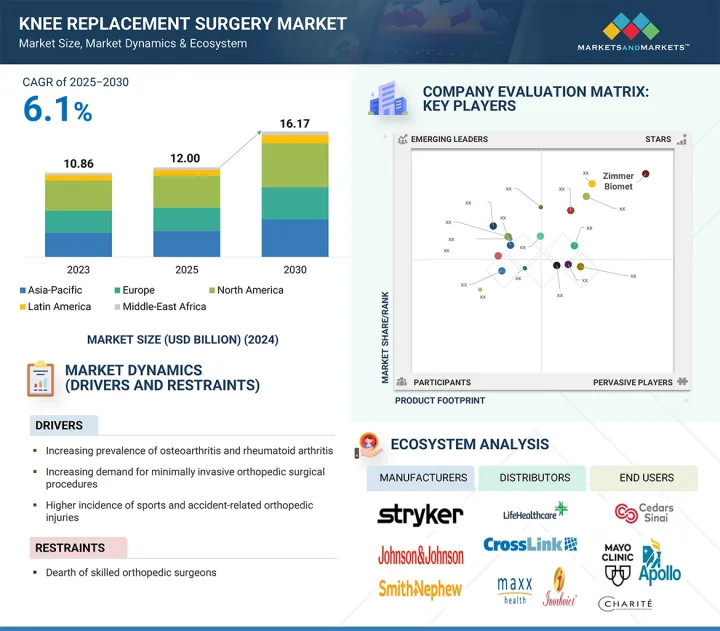

The global knee replacement surgery market is expected to reach USD 16.17 billion by 2030 from USD 12.00 billion in 2025, at a CAGR of 6.1% from 2025 to 2030. The Knee replacement surgery market is witnessing substantial growth driven by several key factors. A heightened awareness of various treatment modalities, coupled with improved healthcare infrastructure in developing regions, is facilitating an increase in surgical procedures.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Procedure Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Additionally, government initiatives and insurance reforms are enhancing both the affordability and accessibility of knee surgeries, further propelling market activity. Notably, the rising incidence of sports-related injuries among the younger population is contributing to the premature onset of knee conditions, thereby expanding the patient demographic that requires surgical intervention. Collectively, these factors are catalyzing the expansion of the global knee replacement surgery market.

"The total knee replacement segment held the largest procedure type market share in 2024."

The knee replacement surgery market is divided into total knee replacement, partial knee replacement, revision knee replacement, and other procedure types. In 2024, the total knee replacement (TKR) segment is projected to dominate the market, primarily driven by the rising prevalence of osteoarthritis, particularly within the geriatric population. This trend underscores the growing demand for durable and effective therapeutic interventions such as TKR. Furthermore, enhanced healthcare infrastructure and increasing awareness of treatment options have facilitated broader accessibility to knee implants in both developed and emerging economies.

"The osteoarthritis & rheumatoid arthritis segment commanded the largest applications market share in 2024."

The knee replacement surgery market is segmented by application: osteoarthritis & rheumatoid arthritis, degenerative disease, cancers, and other applications. In 2024, the osteoarthritis & rheumatoid arthritis segment held the major share. Degenerative joint diseases and inflammatory conditions, such as arthritis, can be exacerbated during their initial stages due to sedentary behavior, suboptimal postural alignment, and mechanical stress on the joints resulting from routine activities.

"The knee implants segment held the largest product market share in 2024."

The knee implants segment represents the predominant share of the knee replacement surgery market. These implants are pivotal in enhancing patients' quality of life by providing long-lasting analgesia and restoring joint mobility. Their preference among orthopedic surgeons and patients alike can be attributed to their high success and satisfaction rates. Continuous advancements in materials-such as biocompatible alloys and polymers-coupled with innovative design enhancements and superior fixation techniques, have increased the reliability and longevity of these implants. Consequently, there has been a notable uptick in their adoption across various clinical settings.

"The hospitals segment accounted for the largest end user market share in 2024."

Hospitals command the largest market share in knee treatment surgical products due to their central role in providing advanced and specialized interventions for knee pathologies. They are equipped to perform cutting-edge procedures, such as total knee arthroplasty, positioning themselves as the preferred venues for orthopedic surgeries. Furthermore, hospitals typically have the financial resources and infrastructure necessary to handle complex cases, execute minimally invasive techniques, and deliver comprehensive postoperative care, all of which contribute to sustained demand for knee treatment surgical devices.

"The Asia Pacific market is expected to register the highest growth rate during the forecast period."

The knee replacement surgery market covers five key geographies-North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, a significant market share for knee treatment surgery devices was held by the market in the North American region, comprising the US and Canada. On the other hand, the Asia Pacific market is estimated to register the highest growth rate during the forecast period. The Asia Pacific region is witnessing unprecedented expansion in the market for knee treatment surgical devices, driven by several key factors. The demographic shift towards an aging population is significant, with increased prevalence of musculoskeletal disorders such as arthritis and osteoporosis particularly evident in nations like Japan, China, and India. This demographic change is compounded by rising disposable incomes and improved access to healthcare services. The region's healthcare infrastructure is rapidly evolving, with investments in advanced technologies such as minimally invasive surgical techniques and robotic-assisted procedures, which are enhancing surgical outcomes and patient recovery times. Moreover, the surge in medical tourism, particularly in India and Thailand, along with proactive government initiatives aimed at bolstering healthcare infrastructure, further catalyzes market growth. These dynamics collectively position the Asia Pacific as a pivotal market for advancements in orthopedic treatment devices.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 30%, Tier 2- 42%, and Tier 3- 28%

- By Designation: Directors- 10%, Managers- 14%, and Others- 76%

- By Region: North America- 40%, Europe- 30%, Asia Pacific- 22%, Latin America- 6%, Middle East & Africa- 2%

The prominent players in the Knee replacement surgery market are Stryker (US), Johnson & Johnson Services, Inc. (US), Globus Medical, Inc. (US), Medacta International SA (Switzerland), Zimmer Biomet (US), Maxx Orthopedics (US), Enovis Corporation (US), Microport Scientific Corporation (China), B. Braun Melsungen AG (Germany), Meril Life Sciences Pvt. Ltd. (India), Smith & Nephew PLC (UK), and Exactech Inc. (US)

Research Coverage

This market research report analyzes the knee replacement surgery market along several different segments, such as procedure type, product, application, end user, and region. The report further sheds light on market growth-driving factors, mentions opportunities and threats, and presents an analysis of the competitive rivalry of leading companies. It further studies micro markets by focusing on growth tendencies and predicts revenues for industry segments for five leading geographies, along with corresponding countries.

Reasons to Buy the Report

The report would assist both small and new businesses in comprehending the market pattern, which can help them grow their market. Businesses procuring the report can implement any one or several of the approaches discussed to extend their market position.

This report provides insights on the following pointers:

- Key drivers (increasing prevalence of osteoarthritis and rheumatoid arthritis, Increasing adoption of telemedicine and telesurgery, rising demand for minimally invasive procedures, increasing demand for minimally invasive knee surgical procedures, and higher incidence of sports and accident-related orthopedic injuries), restraints (risk and complications associated with knee surgery procedures, high cost of knee treatment surgery and treatments), opportunities (Growing focus on orthobiologics, increasing hospitals and trend towards outpatient care and innovations in robotic-assisted orthopedic surgeries and 3D printing), and challenges (dearth of orthopedic surgeons ) fueling the market growth of knee treatment surgery devices

- Product Development/Innovation: In-depth study of emerging technologies, R&D programs, and new product & service launches in the knee replacement surgery market

- Market Growth: In-depth insights into remunerative markets report analyze the knee replacement surgery market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the knee replacement surgery market

- Competitive Analysis: In-depth analysis of market shares, growth strategies, and services of leading players, such as Zimmer Biomet (US), Stryker (US), Johnson & Johnson Services, Inc. (US), Smith+Nephew PLC (UK), and B. Braun (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DESIGN

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- 2.2.2.1 Primary sources

- 2.2.2.2 Key industry insights

- 2.2.1 SECONDARY RESEARCH

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Customer-based market estimation

- 2.3.1.3 Approach 3: Primary interviews

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.6 MARKET SHARE ASSESSMENT

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 KNEE REPLACEMENT SURGERY MARKET OVERVIEW

- 4.2 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT

- 4.3 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE

- 4.4 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY END USER

- 4.5 KNEE REPLACEMENT SURGERY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of osteoarthritis and rheumatoid arthritis

- 5.2.1.2 Rising adoption of telemedicine and telesurgery

- 5.2.1.3 Growing demand for minimally invasive knee surgical procedures

- 5.2.1.4 Rise in sports and accident-related knee injuries

- 5.2.1.5 Booming geriatric population and subsequent age-related bone diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risks and complications associated with knee surgical procedures

- 5.2.2.2 High cost of knee replacement surgery products and treatments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing focus on orthobiologics

- 5.2.3.2 Rising number of hospitals and shift toward outpatient care

- 5.2.3.3 Increasing use of robotics and 3D printing in knee replacement

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of orthopedic surgeons

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT

- 5.5.3 MARKETING & SALES, DISTRIBUTION, AND POST-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 MANUFACTURERS

- 5.6.1.1 Prominent companies

- 5.6.1.2 Small and medium-sized enterprises

- 5.6.2 END USERS

- 5.6.1 MANUFACTURERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 3D printed implants/Additive manufacturing

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Robotic-assisted surgery

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Smart implants and sensors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 902110

- 5.11.2 EXPORT DATA FOR HS CODE 902110

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: ANTERIOR CRUCIATE LIGAMENT RECONSTRUCTION AND CHONDROPLASTY OF KNEE

- 5.13.2 CASE STUDY 2: BILATERAL TOTAL KNEE REPLACEMENT IN FUNCTIONALLY IMMOBILE PATIENT WITH TRICOMPARTMENTAL ARTHRITIS

- 5.13.3 CASE STUDY 3: RIGHT TOTAL KNEE ARTHROPLASTY FOR IMPROVED MOTION RANGE

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 UNMET NEEDS

- 5.17 IMPACT OF AI/GEN AI

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI ON KNEE REPLACEMENT SURGERY MARKET

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 KNEE IMPLANTS

- 6.2.1 HYBRID IMPLANTS

- 6.2.1.1 Long-term durability and strong initial fixation to contribute to growth

- 6.2.2 PLASTIC IMPLANTS

- 6.2.2.1 Rising number of joint surgeries to accelerate growth

- 6.2.3 METAL IMPLANTS

- 6.2.3.1 Growing need for long-lasting joint replacements to drive market

- 6.2.4 CERAMIC IMPLANTS

- 6.2.4.1 Minimal propensity to induce inflammation to facilitate growth

- 6.2.1 HYBRID IMPLANTS

- 6.3 ORTHOBIOLOGICS

- 6.3.1 BONE MARROW ASPIRATE CONCENTRATE

- 6.3.1.1 Minimally invasive procedure and less downtime to foster growth

- 6.3.2 VISCOSUPPLEMENTATION PRODUCTS

- 6.3.2.1 Rising occurrence of osteoarthritis to favor growth

- 6.3.3 DEMINERALIZED BONE MATRIX

- 6.3.3.1 Suitability for intricate operations to facilitate growth

- 6.3.4 PLATELET-RICH PLASMA

- 6.3.4.1 Rising application of platelet-rich plasma in sports injuries to support growth

- 6.3.5 BONE MORPHOGENETIC PROTEINS

- 6.3.5.1 Essential role in joint reconstructive surgery to aid growth

- 6.3.1 BONE MARROW ASPIRATE CONCENTRATE

- 6.4 KNEE BRACES & SUPPORT SYSTEMS

- 6.4.1 GROWING GERIATRIC AND OBESE POPULATIONS TO PROPEL MARKET

7 KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE

- 7.1 INTRODUCTION

- 7.2 TOTAL KNEE REPLACEMENT

- 7.2.1 ONGOING INNOVATIONS IN KNEE IMPLANTS TO EXPEDITE GROWTH

- 7.3 PARTIAL KNEE REPLACEMENT DEVICES

- 7.3.1 QUICK RECOVERY AND SHORTER HOSPITAL STAYS TO AID GROWTH

- 7.4 REVISION KNEE REPLACEMENT

- 7.4.1 RISING INCIDENCE OF OBESITY AND ADVANCEMENTS IN REVISION SURGICAL TECHNOLOGY TO FACILITATE GROWTH

- 7.5 OTHER KNEE REPLACEMENT PROCEDURES

8 KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 RHEUMATOID ARTHRITIS & OSTEOARTHRITIS

- 8.2.1 RISING POOL OF ELDERLY PATIENTS TO AUGMENT GROWTH

- 8.3 DEGENERATIVE DISEASES

- 8.3.1 GROWING IMPACT OF SECONDARY KNEE CONDITIONS TO DRIVE MARKET

- 8.4 CANCERS

- 8.4.1 GROWING BURDEN OF BONE CANCER TO PROPEL MARKET

- 8.5 OTHER APPLICATIONS

9 KNEE REPLACEMENT SURGERY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 GROWING INVESTMENTS IN HOSPITAL INFRASTRUCTURE TO BOOST MARKET

- 9.3 AMBULATORY SURGERY CENTERS

- 9.3.1 INCREASING PREFERENCE FOR COST-EFFECTIVE TREATMENT TO PROMOTE GROWTH

- 9.4 ORTHOPEDIC CLINICS

- 9.4.1 LIMITED HOSPITALIZATION TIME, LOWER COSTS, AND EFFECTIVE POST-OPERATIVE CARE TO SUPPORT GROWTH

10 KNEE REPLACEMENT SURGERY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing incidence of osteoarthritis and rheumatoid arthritis market to promote growth

- 10.2.3 CANADA

- 10.2.3.1 Rising incidence of degenerative bone diseases to support growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Growing demand for advanced medical technology to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Rising prevalence of musculoskeletal disorders to contribute to growth

- 10.3.4 UK

- 10.3.4.1 Increasing awareness of orthopedic conditions to favor growth

- 10.3.5 ITALY

- 10.3.5.1 Growing awareness of preventive care for musculoskeletal injuries to fuel market

- 10.3.6 SPAIN

- 10.3.6.1 Rising preference for minimally invasive surgical procedures to aid growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Rapidly growing geriatric population to boost market

- 10.4.3 CHINA

- 10.4.3.1 Expanding target patient population to fuel market

- 10.4.4 INDIA

- 10.4.4.1 Increasing number of hospitals adopting robotic-assisted joint replacement surgery to aid growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Favorable government and private initiatives to promote growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing research & development funding to spur growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Strong presence of global players to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Favorable investment scenario for medical device manufacturers to bolster growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Growing public-private partnerships to propel market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 Procedure footprint

- 11.7.5.6 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND APPROVALS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ZIMMER BIOMET

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 STRYKER

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 JOHNSON & JOHNSON MEDTECH

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SMITH+NEPHEW

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 B. BRAUN SE

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 GLOBUS MEDICAL

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.7 ENOVIS

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 MICROPORT SCIENTIFIC CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 MEDACTA INTERNATIONAL

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.10 MAXX ORTHOPEDICS, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.10.3.2 Deals

- 12.1.11 MERIL LIFE SCIENCES PVT. LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.12 WALDEMAR LINK GMBH & CO. KG

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 EXACTECH, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches and approvals

- 12.1.13.3.2 Deals

- 12.1.14 AMPLITUDE SURGICAL

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 RESTOR3D

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches and approvals

- 12.1.1 ZIMMER BIOMET

- 12.2 OTHER PLAYERS

- 12.2.1 BAUERFEIND

- 12.2.2 AK MEDICAL

- 12.2.3 DOUBLE MEDICAL TECHNOLOGY INC.

- 12.2.4 OLYMPUS CORPORATION

- 12.2.5 BIORAD MEDISYS PVT. LTD.

- 12.2.6 UNITED ORTHOPEDIC CORPORATION

- 12.2.7 ALLEGRA

- 12.2.8 TOTAL JOINT ORTHOPEDICS

- 12.2.9 THUASNE GROUP

- 12.2.10 EMBLA MEDICAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 KNEE REPLACEMENT SURGERY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 KNEE REPLACEMENT SURGERY MARKET: RISK ASSESSMENT

- TABLE 3 AVERAGE SELLING PRICE TREND OF KNEE IMPLANTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF KNEE SURGERY PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 5 KNEE REPLACEMENT SURGERY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 KNEE REPLACEMENT SURGERY MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2025

- TABLE 7 IMPORT DATA FOR HS CODE 902110, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 902110, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 KNEE REPLACEMENT SURGERY MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 KNEE REPLACEMENT SURGERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT (%)

- TABLE 12 KEY BUYING CRITERIA, BY END USER

- TABLE 13 KNEE REPLACEMENT SURGERY MARKET: UNMET NEEDS

- TABLE 14 KNEE REPLACEMENT SURGERY MARKET: COMPANIES IMPLEMENTING AI

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 17 KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 18 KNEE IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 19 HYBRID IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 20 PLASTIC IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 21 METAL IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 CERAMIC IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 BONE MARROW ASPIRATE CONCENTRATE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 VISCOSUPPLEMENTATION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 DEMINERALIZED BONE MATRIX MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 PLATELET-RICH PLASMA MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 BONE MORPHOGENETIC PROTEINS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 KNEE BRACES & SUPPORT SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 31 KNEE REPLACEMENT SURGERY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 KNEE REPLACEMENT SURGERY PROCEDURES, BY REGION, 2022-2024 (VOLUME UNIT)

- TABLE 33 TOTAL KNEE REPLACEMENT PROCEDURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 PARTIAL KNEE REPLACEMENT PROCEDURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 REVISION KNEE REPLACEMENT PROCEDURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 OTHER KNEE REPLACEMENT PROCEDURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 38 KNEE REPLACEMENT SURGERY MARKET FOR RHEUMATOID ARTHRITIS & OSTEOARTHRITIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 KNEE REPLACEMENT SURGERY MARKET FOR DEGENERATIVE DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 KNEE REPLACEMENT SURGERY MARKET FOR CANCERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 KNEE REPLACEMENT SURGERY MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 43 KNEE REPLACEMENT SURGERY MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 KNEE REPLACEMENT SURGERY MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 KNEE REPLACEMENT SURGERY MARKET FOR ORTHOPEDIC CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 KNEE REPLACEMENT SURGERY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 48 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 55 US: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 56 US: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 57 US: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 58 US: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 59 US: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 60 US: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 61 CANADA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 62 CANADA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 CANADA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 CANADA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 CANADA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 66 CANADA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 68 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 EUROPE: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 GERMANY: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 76 GERMANY: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 GERMANY: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 GERMANY: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 GERMANY: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 GERMANY: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 81 FRANCE: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 FRANCE: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 FRANCE: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 FRANCE: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 FRANCE: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 FRANCE: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 87 UK: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 88 UK: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 UK: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 UK: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 UK: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 UK: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 93 ITALY: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 94 ITALY: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 ITALY: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 ITALY: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 ITALY: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 98 ITALY: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 99 SPAIN: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 100 SPAIN: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 SPAIN: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 SPAIN: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 103 SPAIN: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 104 SPAIN: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 105 REST OF EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 112 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 119 JAPAN: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 120 JAPAN: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 JAPAN: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 JAPAN: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 123 JAPAN: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 JAPAN: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 125 CHINA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 126 CHINA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 CHINA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 CHINA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 CHINA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 CHINA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 131 INDIA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 132 INDIA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 INDIA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 INDIA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 INDIA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 INDIA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 138 AUSTRALIA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 AUSTRALIA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 AUSTRALIA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 143 SOUTH KOREA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 144 SOUTH KOREA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 SOUTH KOREA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 SOUTH KOREA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 155 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 156 LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 158 LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 159 LATIN AMERICA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 BRAZIL: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 164 BRAZIL: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 BRAZIL: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 BRAZIL: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 167 BRAZIL: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 BRAZIL: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 169 MEXICO: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 170 MEXICO: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 MEXICO: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 MEXICO: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 MEXICO: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 MEXICO: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 175 REST OF LATIN AMERICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 REST OF LATAM: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 179 REST OF LATAM: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 REST OF LATAM: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 182 MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 GCC COUNTRIES: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 190 GCC COUNTRIES: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 GCC COUNTRIES: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 GCC COUNTRIES: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 193 GCC COUNTRIES: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 194 GCC COUNTRIES: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: KNEE IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: ORTHOBIOLOGICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 201 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN KNEE REPLACEMENT SURGERY MARKET, 2022-2025

- TABLE 202 KNEE REPLACEMENT SURGERY MARKET: DEGREE OF COMPETITION

- TABLE 203 KNEE REPLACEMENT SURGERY MARKET: REGION FOOTPRINT

- TABLE 204 KNEE REPLACEMENT SURGERY MARKET: PRODUCT FOOTPRINT

- TABLE 205 KNEE REPLACEMENT SURGERY MARKET: APPLICATION FOOTPRINT

- TABLE 206 KNEE REPLACEMENT SURGERY MARKET: PROCEDURE FOOTPRINT

- TABLE 207 KNEE REPLACEMENT SURGERY MARKET: END-USER FOOTPRINT

- TABLE 208 KNEE REPLACEMENT SURGERY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 KNEE REPLACEMENT SURGERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 210 KNEE REPLACEMENT SURGERY MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 211 KNEE REPLACEMENT SURGERY MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 212 ZIMMER BIOMET: COMPANY OVERVIEW

- TABLE 213 ZIMMER BIOMET: PRODUCTS OFFERED

- TABLE 214 ZIMMER BIOMET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 215 ZIMMER BIOMET HOLDINGS: DEALS, JANUARY 2022-MAY 2025

- TABLE 216 STRYKER: COMPANY OVERVIEW

- TABLE 217 STRYKER: PRODUCTS OFFERED

- TABLE 218 STRYKER: DEALS, JANUARY 2022-MAY 2025

- TABLE 219 STRYKER: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 220 JOHNSON & JOHNSON MEDTECH: COMPANY OVERVIEW

- TABLE 221 JOHNSON & JOHNSON MEDTECH: PRODUCTS OFFERED

- TABLE 222 JOHNSON & JOHNSON MEDTECH: DEALS, JANUARY 2022-MAY 2025

- TABLE 223 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 224 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 225 SMITH+NEPHEW: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 226 SMITH+NEPHEW: DEALS, JANUARY 2022-MAY 2025

- TABLE 227 SMITH+NEPHEW: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 228 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 229 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 230 B. BRAUN SE: DEALS, JANUARY 2022-MAY 2025

- TABLE 231 GLOBUS MEDICAL: COMPANY OVERVIEW

- TABLE 232 GLOBUS MEDICAL: PRODUCTS OFFERED

- TABLE 233 GLOBUS MEDICAL: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 234 GLOBUS MEDICAL: DEALS, JANUARY 2022-MAY 2025

- TABLE 235 ENOVIS: COMPANY OVERVIEW

- TABLE 236 ENOVIS: PRODUCTS OFFERED

- TABLE 237 ENOVIS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 238 ENOVIS: DEALS, JANUARY 2022-MAY 2025

- TABLE 239 ENOVIS: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 240 MICROPORT SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 241 MICROPORT SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 242 MICROPORT SCIENTIFIC CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 243 MEDACTA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 244 MEDACTA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 245 MEDACTA INTERNATIONAL: DEALS, JANUARY 2022-MAY 2025

- TABLE 246 MEDACTA INTERNATIONAL: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 247 MAXX ORTHOPEDICS, INC.: COMPANY OVERVIEW

- TABLE 248 MAXX ORTHOPEDICS, INC.: PRODUCTS OFFERED

- TABLE 249 MAXX ORTHOPEDICS, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022- MAY 2025

- TABLE 250 MAXX ORTHOPEDICS, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 251 MERIL LIFE SCIENCES PVT. LTD.: COMPANY OVERVIEW

- TABLE 252 MERIL LIFE SCIENCES PVT. LTD.: PRODUCTS OFFERED

- TABLE 253 MERIL LIFE SCIENCES PVT. LTD.: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 254 WALDEMAR LINK GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 255 WALDEMAR LINK GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 256 EXACTECH, INC.: COMPANY OVERVIEW

- TABLE 257 EXACTECH, INC.: PRODUCTS OFFERED

- TABLE 258 EXACTECH, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 259 EXACTECH, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 260 AMPLITUDE SURGICAL: COMPANY OVERVIEW

- TABLE 261 AMPLITUDE SURGICAL: PRODUCTS OFFERED

- TABLE 262 AMPLITUDE SURGICAL: DEALS, JANUARY 2022-MAY 2025

- TABLE 263 RESTOR3D: COMPANY OVERVIEW

- TABLE 264 RESTOR3D: PRODUCTS OFFERED

- TABLE 265 RESTOR3D: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 266 BAUERFEIND: COMPANY OVERVIEW

- TABLE 267 AK MEDICAL: COMPANY OVERVIEW

- TABLE 268 DOUBLE MEDICAL TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 269 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 270 BIORAD MEDISYS PVT. LTD.: COMPANY OVERVIEW

- TABLE 271 UNITED ORTHOPEDIC CORPORATION: COMPANY OVERVIEW

- TABLE 272 ALLEGRA: COMPANY OVERVIEW

- TABLE 273 TOTAL JOINT ORTHOPEDICS: COMPANY OVERVIEW

- TABLE 274 THUASNE GROUP: COMPANY OVERVIEW

- TABLE 275 EMBLA MEDICAL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 KNEE REPLACEMENT SURGERY MARKET AND REGIONAL SCOPE

- FIGURE 2 KNEE REPLACEMENT SURGERY MARKET: RESEARCH DESIGN

- FIGURE 3 KNEE REPLACEMENT SURGERY MARKET: MARKET RESEARCH METHODOLOGY

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 KNEE REPLACEMENT SURGERY MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 8 KNEE REPLACEMENT SURGERY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 KNEE REPLACEMENT SURGERY MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 KNEE REPLACEMENT SURGERY MARKET, BY PROCEDURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 KNEE REPLACEMENT SURGERY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 KNEE REPLACEMENT SURGERY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GEOGRAPHIC SNAPSHOT OF KNEE REPLACEMENT SURGERY MARKET

- FIGURE 16 RISING PREVALENCE OF KNEE DISEASES AND INCREASING GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 17 KNEE IMPLANTS SEGMENT TO REGISTER SIGNIFICANT GROWTH IN NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 18 TOTAL KNEE REPLACEMENT SEGMENT TO DOMINATE EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 19 HOSPITALS SEGMENT TO LEAD END-USER MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 20 JAPAN TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 KNEE REPLACEMENT SURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE OF KNEE REPLACEMENT SURGERY PRODUCTS, 2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE OF KNEE SURGERY PRODUCTS, BY REGION, 2024 (USD)

- FIGURE 25 KNEE REPLACEMENT SURGERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 KNEE REPLACEMENT SURGERY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 KNEE REPLACEMENT SURGERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 29 NUMBER OF INVESTOR DEALS IN KNEE REPLACEMENT SURGERY MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 30 VALUE OF INVESTOR DEALS IN KNEE REPLACEMENT SURGERY MARKET, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 31 KNEE REPLACEMENT SURGERY MARKET: PATENT ANALYSIS, 2014-2025

- FIGURE 32 IMPORT DATA FOR HS CODE 902110, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR HS CODE 902110, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 34 KNEE REPLACEMENT SURGERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 36 KEY BUYING CRITERIA, BY END USER

- FIGURE 37 KNEE REPLACEMENT SURGERY MARKET: AI USE CASES

- FIGURE 38 NORTH AMERICA: KNEE REPLACEMENT SURGERY MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: KNEE REPLACEMENT SURGERY MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN KNEE REPLACEMENT SURGERY MARKET, 2021-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN KNEE REPLACEMENT SURGERY MARKET, 2024

- FIGURE 42 RANKING OF KEY PLAYERS IN KNEE REPLACEMENT SURGERY MARKET, 2024

- FIGURE 43 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 44 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 45 KNEE REPLACEMENT SURGERY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 KNEE REPLACEMENT SURGERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 KNEE REPLACEMENT SURGERY MARKET: COMPANY FOOTPRINT

- FIGURE 48 KNEE REPLACEMENT SURGERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 ZIMMER BIOMET: COMPANY SNAPSHOT (2024)

- FIGURE 50 STRYKER: COMPANY SNAPSHOT (2023)

- FIGURE 51 JOHNSON & JOHNSON MEDTECH: COMPANY SNAPSHOT (2024)

- FIGURE 52 SMITH+NEPHEW: COMPANY SNAPSHOT (2024)

- FIGURE 53 B. BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 54 GLOBUS MEDICAL: COMPANY SNAPSHOT (2024)

- FIGURE 55 ENOVIS: COMPANY SNAPSHOT (2024)

- FIGURE 56 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 57 MEDACTA INTERNATIONAL: COMPANY SNAPSHOT (2024)

- FIGURE 58 AMPLITUDE SURGICAL: COMPANY SNAPSHOT (2024)