PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755329

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755329

Finance Cloud Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

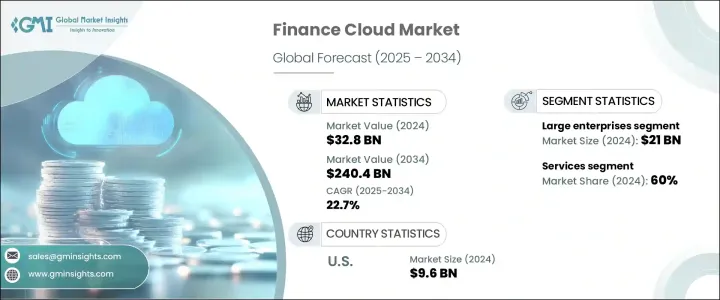

The Global Finance Cloud Market was valued at USD 32.8 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 240.4 billion by 2034. The growth is driven by the rising demand for digital transformation within banking, insurance, investment management, and other financial sectors. Companies shift to cloud-based finance solutions to boost operational efficiency, maintain compliance with regulations, and enhance customer experience. Integrating automation, artificial intelligence (AI), and advanced analytics transform financial workflows by enabling real-time decision-making and proactive risk management.

Finance cloud platforms provide a foundation for optimized financial operations, including automated accounting, real-time financial reporting, and smooth connectivity with enterprise resource planning (ERP) and customer relationship management (CRM) systems. Enhanced security protocols such as encryption, multi-factor authentication, and blockchain-enabled transaction verification protect sensitive financial information and help meet stringent regulatory requirements. Innovations like predictive analytics for cash flow forecasting, robotic process automation (RPA) for transaction handling, and augmented reality (AR) for interactive dashboards accelerate market adoption. These technological advancements allow organizations to differentiate their financial offerings, improve accuracy, and increase business agility in a highly competitive environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.8 Billion |

| Forecast Value | $240.4 Billion |

| CAGR | 22.7% |

The large enterprises segment was valued at USD 21 billion in 2024. Their leadership stems from substantial IT budgets and the ability to deploy scalable, comprehensive cloud infrastructures. These organizations use finance cloud systems to streamline global financial processes, ensure regulatory compliance, and integrate services across diverse business units. Centralized cloud platforms enable consistent enforcement of policies and efficient coordination between departments, delivering standardized processes and robust security across regions.

The services segment held a 60% share in 2024, driven by the increasing need for consulting, implementation, support, and managed services. As financial institutions migrate to cloud-native systems, they depend heavily on specialized service providers to ensure smooth transitions, integration, and adherence to regulatory standards. These services optimize cloud performance by helping institutions customize platforms, manage workloads, and maintain uptime while upholding security. Continuous support and managed services free organizations to focus on core functions while infrastructure management is handled externally. The complexity of financial regulations, cybersecurity risks, and ongoing digital transformation has elevated the strategic importance of specialized cloud services for large corporations and SMEs.

U.S. Finance Cloud Market was valued at USD 9.6 billion in 2024 and is expected to grow at a CAGR of 24% through 2034. The country's robust IT infrastructure, presence of major financial institutions, and early adoption of cloud technologies fuel this growth. A strong regulatory environment along with a dynamic fintech ecosystem accelerates cloud adoption across banking, insurance, and investment sectors. Financial firms in the U.S. leverage cloud platforms to modernize legacy systems, strengthen cybersecurity, and deliver seamless digital experiences. Partnerships with leading cloud service providers like Google LLC, Microsoft, and Amazon support this transition.

Key players in the Global Finance Cloud Industry include Salesforce, IBM, Dell, Oracle, Capgemini, Acumatica, Infosys, Amazon, Microsoft, and Google LLC. To strengthen their market presence, companies in the finance cloud sector focus on continuous innovation and expanding their technology offerings. They invest in developing AI-driven and automation-powered solutions to enhance efficiency and compliance. Strategic alliances and partnerships with financial institutions and cloud providers help accelerate adoption and broaden their reach. Firms prioritize enhancing security features and regulatory compliance capabilities to meet industry standards. Additionally, many are scaling their global footprint through localized services and data centers to cater to regional regulations and reduce latency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Managing customer data and financials

- 3.7.1.2 Increased demand for fraud detection and prevention

- 3.7.1.3 Rising need to enhance business intelligence and strategic planning

- 3.7.1.4 Enhanced financial planning and analysis

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data privacy and security concerns

- 3.7.2.2 Integration with the existing legacy systems can be complex

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Solution

Chapter 6 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Public

- 7.3 Hybrid

- 7.4 Private

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Banking

- 8.3 Insurance

- 8.4 Investment management

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Customer relationship management

- 9.3 Wealth management

- 9.4 Asset management

- 9.5 Account management

- 9.6 Revenue management

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acumatica

- 11.2 Amazon

- 11.3 Aryaka

- 11.4 Capgemini

- 11.5 Cisco

- 11.6 Dell

- 11.7 Google LLC

- 11.8 Hewlett Packard

- 11.9 IBM

- 11.10 Infosys

- 11.11 Microsoft

- 11.12 Oracle

- 11.13 Rapidscale

- 11.14 Sage

- 11.15 Salesforce

- 11.16 ServiceNow

- 11.17 Tata Consultancy

- 11.18 Unit4

- 11.19 Wipro

- 11.20 Workday

- 11.21 Yardi