PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755393

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755393

North America Insect Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

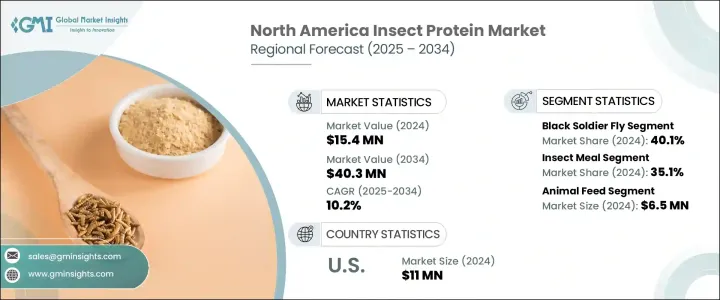

North America Insect Protein Market was valued at USD 15.4 million in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 40.3 million by 2034, driven by the increasing demand for sustainable and alternative protein sources in sectors such as food, animal feed, and pet food. Insects, particularly black soldier fly larvae, crickets, and mealworms, are gaining popularity due to their nutritional value and eco-friendly production processes. Insect protein is used in applications, including animal feed, aquaculture, pet food, protein bars, snacks, and meat alternatives.

The animal feed segment remains the largest application, primarily due to insect protein's excellent digestibility, high amino acid content, and regulatory support in animal feed formulations. The pet food market is also growing significantly, driven by premiumization and clean-label trends. While human consumption of insect protein is still niche, it is gaining traction through protein powders, snacks, and flour derived from insects. Factors such as increasing food security concerns, the rising cost of traditional protein production, and the growing consumer demand for sustainable food sources drive this shift. However, challenges like cultural acceptance, regulatory uncertainty, and high production costs continue to pose barriers to market growth. Despite these challenges, the region holds significant potential for insect protein commercialization, supported by improved scalability, acceptance, and government and corporate awareness campaigns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Million |

| Forecast Value | $40.3 Million |

| CAGR | 10.2% |

In 2024, the black soldier flies segment held a 40.1% share and is expected to grow at a 10.3% CAGR by 2034 attributed to the black soldier fly's high feed conversion efficiency and suitability for large-scale production. Its larvae are rich in protein, making it a preferred ingredient in animal and pet food. Similarly, crickets have gained substantial market presence, particularly for use in protein powders and snacks due to their nutritional profile. Mealworms are also widely recognized for their high protein and fat content, making them popular in both animal feed and human food products. Other insects like silkworms and grasshoppers serve specialized markets, though they hold a smaller share.

The insect meal segment held a 35.1% share in 2024 and is anticipated to grow with a CAGR of 10.3%. Insect meal is highly valued in the animal feed industry for its nutritional benefits, particularly in aquaculture, poultry, and pet food. Its digestibility and sustainability make it a popular alternative to traditional ingredients like fishmeal and soybean meal. As demand rises, companies are expanding their production capacity, making insect meal the most economically viable and widely produced form of insect protein in the region.

U.S. Insect Protein Market reached USD 11 million in 2024 driven by its strong research ecosystem, the presence of leading insect protein startups, and favorable investment policies. The rising demand for alternative proteins in animal feed, pet food, and functional foods is accelerating in the U.S., driven by consumer advocacy for sustainability and environmentally friendly products. Supportive regulatory changes and public-private partnerships solidify the U.S. market's position. Innovations in large-scale insect farms and processing technologies have improved production efficiency and scalability, positioning U.S. companies to dominate the regional market and meet growing global demand.

The key players in the North America Insect Protein Market include InnovaFeed, Aspire Food Group, Ynsect, Protix, and Entomo Farms.To strengthen their market presence, companies in the North America Insect Protein Market are focusing on increasing production capacity and expanding their product offerings. By leveraging technological advancements in insect farming and processing, these companies aim to improve efficiency and meet the rising demand for alternative proteins. Collaboration with government bodies and public-private partnerships has also played a key role in supporting the growth of this industry. Furthermore, companies invest in research and development to improve scalability, product quality, and sustainability, enhancing their competitive edge. By focusing on innovation, regulatory compliance, and market expansion, they are solidifying their positions in both local and global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring.

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets.

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted.

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration.

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries, 2021-2024 (Tons)

- 3.3.2 Major importing countries, 2021-2024 (Tons)

- 3.4 Value chain analysis

- 3.5 Insect farming and processing analysis

- 3.5.1 Insect rearing techniques

- 3.5.2 Harvesting methods

- 3.5.3 Processing technologies

- 3.5.4 Quality control measures

- 3.5.5 Sustainability metrics

- 3.6 Raw material analysis and sourcing strategies

- 3.6.1 Feed substrate selection.

- 3.6.2 Organic waste utilization

- 3.6.3 Feed conversion efficiency.

- 3.6.4 Supply chain sustainability.

- 3.7 Nutritional profile analysis

- 3.7.1 Protein content and quality

- 3.7.2 Amino acid profile

- 3.7.3 Fat content and fatty acid composition

- 3.7.4 Micronutrient composition

- 3.7.5 Comparison with traditional protein sources

- 3.8 Market dynamics

- 3.8.1 Market drivers

- 3.8.1.1 Growing demand for sustainable protein sources

- 3.8.1.2 Increasing focus on food security

- 3.8.1.3 Rising costs of traditional protein sources

- 3.8.1.4 Environmental benefits of insect farming

- 3.8.2 Market restraints

- 3.8.2.1 Consumer acceptance challenges

- 3.8.2.2 Regulatory hurdles and uncertainty

- 3.8.2.3 High production costs

- 3.8.2.4 Limited scale of operations

- 3.8.3 Market opportunities

- 3.8.3.1 Technological advancements in insect farming

- 3.8.3.2 Expansion in animal feed applications

- 3.8.3.3 Growing pet food market

- 3.8.3.4 Increasing venture capital interest

- 3.8.4 Market challenges

- 3.8.4.1 Cultural barriers to insect consumption

- 3.8.4.2 Competition from plant-based proteins

- 3.8.4.3 Standardization of production processes

- 3.8.4.4 Supply chain development.

- 3.8.1 Market drivers

- 3.9 Regulatory framework and government initiatives

- 3.9.1 FDA regulations in the United States

- 3.9.2 CFIA regulations in Canada

- 3.9.3 Mexican regulatory framework

- 3.9.4 Gras status and novel food regulations

- 3.9.5 Labeling requirements

- 3.9.6 Food safety standards

- 3.10 Consumer behavior analysis

- 3.10.1 Consumer perception and acceptance

- 3.10.2 Demographic analysis of early adopters

- 3.10.3 Cultural factors influencing acceptance

- 3.10.4 Marketing strategies to overcome barriers

- 3.11 Pricing analysis and trends

- 3.12 Consumer acceptance and marketing strategies

- 3.12.1 Consumer perception analysis

- 3.12.1.1 Cultural and psychological barriers

- 3.12.1.2 Demographic factors influencing acceptance

- 3.12.1.3 Consumer awareness and education

- 3.12.1.4 Willingness to try by product category

- 3.12.2 Marketing strategies for insect protein products

- 3.12.2.1 Product positioning and messaging

- 3.12.2.2 Packaging and presentation strategies

- 3.12.2.3 Pricing strategies

- 3.12.2.4 Distribution channel optimization

- 3.12.3 Case studies of successful market entry

- 3.12.3.1 Food products

- 3.12.3.2 Pet food products

- 3.12.3.3 Feed products

- 3.12.4 Consumer education initiatives

- 3.12.4.1 Industry associations

- 3.12.4.2 Government programs

- 3.12.4.3 Corporate initiatives

- 3.12.5 Future strategies for market penetration

- 3.12.5.1 Targeting early adopters

- 3.12.5.2 Leveraging sustainability messaging

- 3.12.5.3 Collaboration with food industry influencers

- 3.12.5.4 Digital marketing and social media strategies

- 3.12.1 Consumer perception analysis

- 3.13 Investment landscape and funding analysis

- 3.13.1 Investment trends in North America insect protein market

- 3.13.1.1 Venture capital investments

- 3.13.1.2 Private equity investments

- 3.13.1.3 Corporate investments

- 3.13.1.4 Government funding and grants

- 3.13.2 Key investment deals and valuations

- 3.13.2.1 Major funding rounds

- 3.13.2.2 Mergers and acquisitions

- 3.13.2.3 Strategic partnerships

- 3.13.3 Investor perspective and expectations

- 3.13.3.1 Return on investment analysis

- 3.13.3.2 Risk assessment

- 3.13.3.3 Growth projections

- 3.13.4 Startup ecosystem analysis

- 3.13.4.1 Key startups and their business models

- 3.13.4.2 Innovation hubs and incubators

- 3.13.4.3 Success factors and challenges

- 3.13.5 Future investment outlook

- 3.13.5.1 Emerging investment opportunities

- 3.13.5.2 Potential consolidation trends

- 3.13.5.3 Long-term investment strategies

- 3.13.1 Investment trends in North America insect protein market

- 3.14 Future outlook and emerging trends

- 3.14.1 Technological innovations in insect farming

- 3.14.1.1 Automation and robotics

- 3.14.1.2 Artificial intelligence and IOT applications

- 3.14.1.3 Genetic improvement and selective breeding

- 3.14.1.4 Biorefinery concepts and circular economy

- 3.14.2 Emerging applications of insect proteins

- 3.14.2.1 Novel food products

- 3.14.2.2 Specialized animal feeds

- 3.14.2.3 Pharmaceutical and biomedical applications

- 3.14.2.4 Industrial applications

- 3.14.3 Sustainability and environmental impact

- 3.14.3.1 Carbon footprint reduction

- 3.14.3.2 Water conservation

- 3.14.3.3 Land use efficiency

- 3.14.3.4 Waste valorization

- 3.14.4 Regulatory evolution and policy development

- 3.14.4.1 Expected regulatory changes in the United States

- 3.14.4.2 Canadian regulatory outlook

- 3.14.4.3 Mexican regulatory developments

- 3.14.4.4 Harmonization of standards

- 3.14.5 Market growth projections (2035–2040)

- 3.14.5.1 Long-term market size estimates

- 3.14.5.2 Potential market disruptions

- 3.14.5.3 Scenario analysis

- 3.14.1 Technological innovations in insect farming

- 3.15 PESTLE Analysis

- 3.16 Porter's Five Forces Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Brand positioning & consumer perception analysis

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Insect Type 2021 – 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Black soldier fly

- 5.3 Crickets

- 5.4 Mealworms

- 5.5 Grasshoppers

- 5.6 Silkworms

- 5.7 Others

Chapter 6 Market Size and Forecast, By Product Form, 2021 – 2034 (USD Million, Kilo Tons)

- 6.1 Key trend

- 6.2 Whole insects

- 6.3 Insect powder

- 6.4 Insect meal

- 6.5 Insect oil/fat

- 6.6 Insect protein isolates/concentrates

- 6.7 Others

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, Kilo Tons)

- 7.1 Key trend

- 7.2 Animal feed

- 7.2.1 Aquaculture feed

- 7.2.2 Poultry feed

- 7.2.3 Swine feed

- 7.2.4 Other livestock feed

- 7.3 Pet food

- 7.3.1 Dog food

- 7.3.2 Cat food

- 7.3.3 Other pet food

- 7.4 Food & beverages

- 7.4.1 Protein bars & snacks

- 7.4.2 Bakery products

- 7.4.3 Meat substitutes

- 7.4.4 Protein shakes & supplements

- 7.4.5 Others

- 7.5 Pharmaceuticals & nutraceuticals

- 7.6 Cosmetics

- 7.7 Others

- 7.8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Kilo Tons)

- 7.9 Key trends

- 7.10 North America

- 7.10.1 U.S.

- 7.10.2 Canada

Chapter 8 Company Profiles

- 8.1 Aspire Food Group

- 8.2 Entomo Farms

- 8.3 EnviroFlight, LLC (Darling Ingredients)

- 8.4 Chapul, LLC

- 8.5 Exo Inc.

- 8.6 Tiny Farms Inc.

- 8.7 All Things Bugs LLC

- 8.8 Protix

- 8.9 Ynsect

- 8.10 InnovaFeed

- 8.11 Beta Hatch

- 8.12 Enterra Feed Corporation

- 8.13 Bitty Foods

- 8.14 Cricket Flours LLC

- 8.15 Aketta (Aspire Food Group)

- 8.16 Cowboy Cricket Farms

- 8.17 Proti-Farm Holding N.V.

- 8.18 Nutribug Ltd

- 8.19 Bugsolutely Ltd.

- 8.20 3 Cricketeers