PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766263

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766263

Construction Portable Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

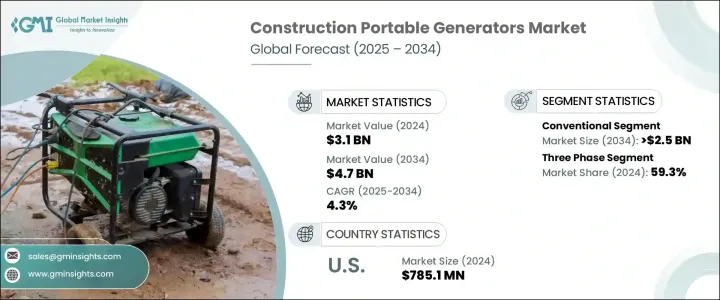

The Global Construction Portable Generators Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.7 billion by 2034. This steady growth is primarily driven by rising demand for cleaner, smarter, and more energy-efficient power solutions across construction operations worldwide. Evolving industry expectations toward reduced emissions, enhanced fuel economy, and ease of transport are shaping the product development strategies of key manufacturers. As construction businesses increasingly adopt sustainable practices, the integration of hybrid systems-combining batteries, solar modules, and inverter technologies-is gaining momentum, creating a favorable landscape for portable generator deployments.

Urban construction activity continues to rise at a rapid pace, especially in regions where government bodies have imposed strict emission norms, and companies are actively working to comply with green-building certifications. The market benefits from consistent requirements for compact, low-noise, and lightweight generators ideal for confined or sensitive work environments. Technological advancements in generator engine performance-particularly those aligned with updated emission standards such as Stage V and Tier 4-are crucial in boosting product appeal. Simultaneously, the shift toward cleaner fuel alternatives and the growing use of dual-fuel systems are addressing environmental concerns while maintaining reliable power access across job sites. These evolving standards are fostering new opportunities in the mobile energy solutions space and encouraging rapid product innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.3% |

The construction portable generators market is segmented by product into conventional portable and inverter portable types. Among these, conventional units remain widely used and are projected to exceed USD 2.5 billion in revenue by 2034. Their popularity is rooted in the dependable power supply they provide, especially in regions frequently affected by weather-related outages or where reliable grid access is limited. Continuous product improvements, ranging from quieter engine operation to fuel-efficient designs, are increasing their acceptance across various construction settings, from large-scale infrastructure to residential projects.

The market is also divided based on phase into single-phase and three-phase systems. Three-phase portable generators held a dominant market share of 59.3% in 2024 and are increasingly preferred for their ability to deliver high-capacity, stable power, making them well-suited for larger construction applications requiring higher electrical loads. As power needs on construction sites become more sophisticated, this segment is expected to maintain its strong position throughout the forecast period.

In contrast, single-phase construction portable generators are projected to grow at a faster rate of 4.2% through 2034. These generators are becoming more popular among users who need steady, clean energy for lower-capacity tools or sensitive electronic equipment. Many models are now equipped with inverter technology, offering advanced control over output quality and energy consumption. Furthermore, product upgrades such as ergonomic digital displays, wireless monitoring through mobile applications, and integrated safety features are significantly improving usability and onsite reliability, making these units an increasingly attractive choice.

Across North America, the U.S. remains a major contributor to overall industry revenue. The country's construction portable generators market was valued at USD 687.6 million in 2022, USD 735.9 million in 2023, and reached USD 785.1 million in 2024. This growth is driven by an uptick in urban redevelopment, renovation initiatives, and the need for mobile power during temporary infrastructure setups. From equipment support on short-term projects to emergency use in disaster recovery operations, portable generators have become vital in ensuring uninterrupted workflow and safety on job sites.

Leading the global competitive landscape are five key players-Honda India Power Products, Generac Power Systems, Atlas Copco, Cummins, and Yamaha Motor. These companies account for nearly 50% of the total market share. Their dominance is fueled by their commitment to continuous innovation, a strong global distribution footprint, and diverse product offerings that are designed to meet the specific needs of construction professionals across various geographic markets. Their investments in cleaner technologies and integration of smart features are further reinforcing their positions as trusted solution providers in the portable power sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Conventional portable

- 5.3 Inverter portable

Chapter 6 Market Size and Forecast, By Fuel & Power Rating, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.2.1 < 20 kW

- 6.2.2 20 - 50 kW

- 6.2.3 > 50 - 100 kW

- 6.3 Gasoline

- 6.3.1 < 2 kW

- 6.3.2 2 kW - 5 kW

- 6.3.3 6 kW - 8 kW

- 6.3.4 > 8 kW - 15 kW

- 6.4 Others

Chapter 7 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 Australia

- 8.4.2 Japan

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Singapore

- 8.4.9 South Korea

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Mozambique

- 8.7 Latin America

- 8.7.1 Mexico

- 8.7.2 Chile

- 8.7.3 Argentina

- 8.7.4 Brazil

Chapter 9 Company Profiles

- 9.1 Allmand Bros

- 9.2 Atlas Copco

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Champion Power Equipment

- 9.6 Cummins

- 9.7 Deere & Company

- 9.8 DEWALT

- 9.9 DuroMax Power Equipment

- 9.10 FIRMAN Power Equipment

- 9.11 Generac Power Systems

- 9.12 GENMAC

- 9.13 HIMOINSA

- 9.14 Honda India Power Products

- 9.15 Kirloskar Oil Engines

- 9.16 Rehlko

- 9.17 Wacker Neuson

- 9.18 Westinghouse Electric Corporation

- 9.19 Yamaha Motor

- 9.20 YANMAR HOLDINGS