PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766295

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766295

Human Microbiome Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

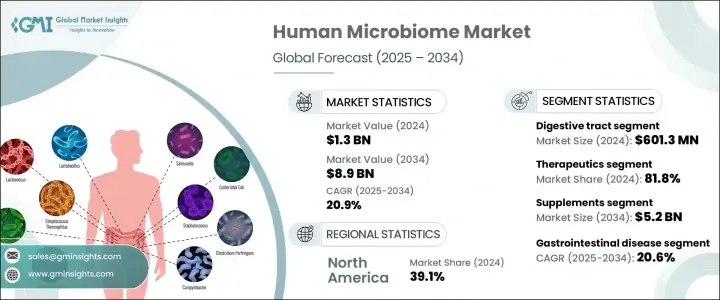

The Global Human Microbiome Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 20.9% to reach USD 8.9 billion by 2034. Market expansion is largely fueled by the increasing global awareness about the critical role of microbiomes in maintaining human health and preventing disease. Microbial communities in the human body are now recognized as fundamental to various biological processes, including digestion, immunity, and even neurological balance. With new scientific breakthroughs uncovering how these microbes influence overall health, demand for microbiome-based products is accelerating.

Growing interest in the human microbiome is transforming the healthcare landscape. A key driver is the rising shift toward precision medicine, which relies on tailoring treatments to a patient's unique microbial profile. This personalization approach is making microbiome-based diagnostics and therapeutics more effective, driving increased adoption. The demand for targeted therapies is encouraging collaborations between pharmaceutical firms, biotech companies, and research institutes, further fueling innovation and commercial growth. Advancements in sequencing technologies and bioinformatics are also improving microbiome mapping capabilities, encouraging the development of novel treatment solutions, and enabling a data-driven approach to drug development and disease prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 20.9% |

Among the various anatomical sites studied for microbiome applications, the digestive tract segment held a substantial share, with a market value of USD 601.3 million in 2024. This segment continues to dominate due to the high density and diversity of microbes found in the gut. These gut microorganisms are instrumental in managing digestion, regulating metabolism, supporting immune function, and defending against harmful pathogens. The gut microbiome's involvement in chronic health conditions such as metabolic disorders, autoimmune diseases, and neurodegenerative issues has positioned it as a central focus for ongoing research and product development. The widespread interest in gut health has led to the launch of targeted solutions like probiotics, prebiotics, postbiotics, and microbiome-based therapeutics.

In terms of application, the market is segmented into therapeutics and diagnostics, with therapeutics taking the lead in 2024 by capturing an 81.8% share. This dominance is attributed to the increasing number of health conditions now linked to disruptions in the microbiome, including metabolic syndromes, gastrointestinal diseases, and neurological disorders. Innovations such as live biotherapeutic products, microbiota-based transplants, and microbiome-modulating drugs are strengthening this segment. As more healthcare providers adopt personalized treatments based on individual microbiome profiles, the therapeutic value of microbiome products continues to expand, offering tailored and more efficient solutions across various diseases.

By disease type, the market is categorized into gastrointestinal disease, endocrine and metabolic diseases, infectious disease, cancer, central nervous system disorder, and others. The gastrointestinal disease segment is projected to grow at a CAGR of 20.6% over the forecast period. Disruptions in the gut microbiota are increasingly associated with conditions like irritable bowel syndrome, ulcerative colitis, and Crohn's disease. The demand for microbiome-targeted interventions is rising as these therapies offer less invasive and more focused treatment alternatives. Growing patient preference for solutions that restore microbiota balance is expected to significantly contribute to the expansion of this segment.

When evaluated by product type, the market includes drugs, supplements, diagnostic tests, and other offerings. The supplements category led the market in 2024 and is forecasted to reach USD 5.2 billion by 2034. This dominance stems from rising interest in preventive care and wellness, which is pushing consumers toward non-prescription options that support gut and immune health. Probiotic and prebiotic supplements are readily available and widely accepted, contributing to their growing consumption. Additionally, the emergence of customized formulations, including synbiotics and personalized supplement blends, is further boosting demand in this segment as consumers seek tailored health solutions.

Regionally, North America led the market with a commanding share of 39.1% in 2024. The U.S. market alone grew from USD 400.2 million in 2023 to USD 476.6 million in 2024. This regional dominance is supported by high healthcare spending, rising incidences of chronic illnesses, and strong research infrastructure. Regulatory backing and the presence of leading market players have further accelerated adoption across clinical and commercial applications.

Key participants such as Archer Daniels Midland Company, Ferring, and Seres Therapeutics, Inc. collectively account for around 40% of the global market share. These companies are actively pursuing strategies such as strategic alliances, mergers, and research collaborations to expand their footprint, gain access to new markets, and enhance their competitive positioning in the evolving microbiome landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Site

- 2.2.3 Application

- 2.2.4 Disease

- 2.2.5 Product

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing burden of lifestyle-related diseases and the growing geriatric population

- 3.2.1.2 Increasing funding initiatives and government programs

- 3.2.1.3 Increasing demand for precision medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long regulatory pathways and high development costs

- 3.2.2.2 Ethical and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding therapeutic applications

- 3.2.3.2 Growing demand for probiotic and prebiotic products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Site, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digestive tract

- 5.3 Lung

- 5.4 Reproductive cavity

- 5.5 Skin

- 5.6 Other sites

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Therapeutics

- 6.3 Diagnostics

Chapter 7 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.3 Gastrointestinal diseases

- 7.4 Endocrine and metabolic diseases

- 7.5 Cancer

- 7.6 Central nervous system (CNS) disorder

- 7.7 Other diseases

Chapter 8 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drugs

- 8.3 Supplements

- 8.3.1 Probiotics

- 8.3.2 Prebiotics

- 8.3.3 Synbiotics

- 8.4 Diagnostic tests

- 8.5 Other products

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Archer Daniels Midland Company

- 10.2 Biohm Technologies

- 10.3 BioGaia

- 10.4 Biome Diagnostics

- 10.5 BiomeBank

- 10.6 Ferring

- 10.7 Intralytix

- 10.8 OptiBiotix

- 10.9 Pendulum Therapeutics

- 10.10 Prescient Metabiomics

- 10.11 Seres Therapeutics

- 10.12 Seed Health

- 10.13 The BioArte

- 10.14 Vedanta Biosciences

- 10.15 Viome Life Sciences