PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766306

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766306

Commercial and Industrial PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

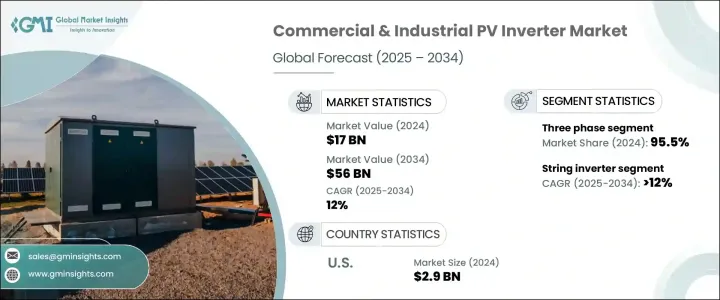

The Global Commercial and Industrial PV Inverter Market was valued at USD 17 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 56 billion by 2034. A major factor driving this growth is the rising instability in electricity prices, prompting businesses to seek more predictable and sustainable energy sources. Commercial and industrial facilities are increasingly turning to solar photovoltaic systems, with inverters playing a crucial role in ensuring the effective conversion and integration of solar energy into everyday operations. This shift is primarily aimed at reducing operational costs, improving energy efficiency, and meeting rising sustainability standards.

As power demands continue to surge across commercial buildings and manufacturing units, solar inverters have emerged as vital tools to help companies optimize their energy consumption, manage peak loads, and meet carbon reduction goals. Their integration with building energy management systems is becoming more common, reflecting the rising need for smarter energy solutions. Companies are not only driven by cost-saving motives but also by mounting pressure to reduce their environmental impact, which is reinforcing the demand for solar-based technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17 Billion |

| Forecast Value | $56 Billion |

| CAGR | 12% |

Governments and private organizations worldwide are setting more aggressive targets for renewable energy adoption, further fueling demand for PV inverters. These goals are supported by favorable regulations and incentive programs aimed at accelerating the shift to solar energy. Policies such as net metering and renewable energy credits continue to create a positive business case for adopting solar energy solutions, especially in commercial and industrial applications. As awareness of climate change and energy security rises, more enterprises are prioritizing energy independence, and inverters are becoming an essential part of that strategy. In addition, the growing availability of compact, high-efficiency, low-voltage inverter systems is making solar technology more viable for a wider range of applications, helping businesses overcome space and infrastructure limitations. This is particularly important for companies operating in urban areas where real estate and installation space come at a premium.

However, trade-related challenges, particularly tariffs imposed on imported solar components, are expected to pose some limitations on the market's momentum. Increased procurement costs for solar equipment can delay project timelines and result in budget overruns for commercial and industrial developers. These barriers could also strain the supply chain, especially when the availability of competitively priced high-performance inverters is already limited. Despite these headwinds, the overall outlook for the market remains strong due to consistent innovation and investments in inverter technology tailored for industrial-grade installations.

Based on product type, the market is divided into string, micro, and central inverters. The string inverter segment is projected to expand at a CAGR exceeding 12% through 2034. Demand for this category is primarily fueled by improvements in design, efficiency, and system scalability, making it a preferred choice for commercial rooftops and mid-sized industrial installations. As solar project developers seek more flexible and modular options, string inverters are becoming increasingly popular across various deployment scales.

In terms of phase configuration, the commercial and industrial PV inverter market is segmented into single phase and three phase systems. The three phase segment accounted for 95.5% of the global market share in 2024, supported by its growing use in large-scale applications such as factory complexes, warehouses, and multi-tenant commercial buildings. Three phase inverters are more efficient for handling high power loads and are better suited for integration with grid systems, which makes them ideal for large-scale installations.

Regionally, the United States has emerged as a key market, with its commercial and industrial PV inverter industry reaching USD 2.9 billion in 2024, up from USD 2.5 billion in 2023 and USD 2.2 billion in 2022. North America held a 17.3% share of the global market in 2024, and this is expected to increase by the end of the forecast period. A robust domestic manufacturing base and faster delivery timelines are helping to accelerate inverter adoption across commercial and industrial installations in the U.S. Market growth is also being reinforced by government-backed initiatives that promote clean energy and reward the use of domestically produced components.

Leading manufacturers are investing heavily in capacity expansion, research and development, and the launch of advanced inverters designed for high-performance applications. These companies are also extending their global reach through strategic partnerships and distribution networks that enable quicker response times and better local service. Collaborations with engineering, procurement, and construction firms, as well as solar developers, have become common, especially for securing large-scale commercial and industrial projects. Local manufacturing and support services continue to be key differentiators in markets with high growth potential.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Standalone

- 7.3 On grid

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Poland

- 8.3.4 Netherlands

- 8.3.5 Austria

- 8.3.6 UK

- 8.3.7 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Canadian Solar

- 9.2 Delta Electronics

- 9.3 Darfon Electronics

- 9.4 Eaton

- 9.5 Fimer Group

- 9.6 Ginlong Technologies

- 9.7 GoodWe

- 9.8 Growatt New Energy

- 9.9 Huawei Technologies

- 9.10 Schneider Electric

- 9.11 SMA Solar Technology

- 9.12 Sungrow

- 9.13 SolarEdge Technologies

- 9.14 Sineng Electric

- 9.15 Tabuchi Electric