PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892869

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892869

Remote Patient Monitoring (RPM) Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

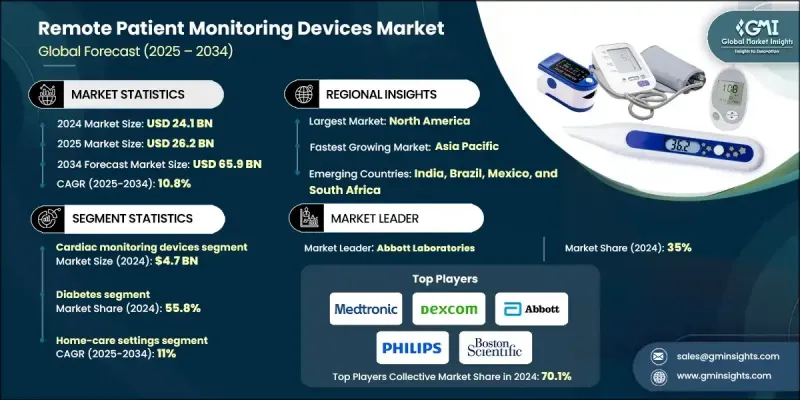

The Global Remote Patient Monitoring Devices Market was valued at USD 24.1 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 65.9 billion by 2034.

Market growth is driven by the rising prevalence of chronic diseases, rapid digitalization of healthcare, and the growing need to reduce hospital readmissions and overall care costs. Remote patient monitoring (RPM) enables continuous tracking of patients' vital signs and health status outside traditional clinical settings, empowering physicians to make faster, data-driven decisions and improving patient adherence to treatment plans. Rising adoption of smartphones, connected medical devices, and cloud-based platforms has significantly enhanced the usability, accuracy, and scalability of RPM solutions. These technologies collectively support more proactive and preventive care models, reducing emergency visits and easing the burden on healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.1 Billion |

| Forecast Value | $65.9 Billion |

| CAGR | 10.8% |

The global shift towards value-based care and home-based healthcare is further accelerating the demand for RPM devices. Payers and providers are increasingly recognizing the economic benefits of remote monitoring, such as reduced inpatient days, lower readmission penalties, and better management of high-risk patient cohorts. Additionally, aging populations worldwide and the rising incidence of conditions like diabetes, cardiovascular diseases, and respiratory disorders are expanding the addressable patient pool for RPM. Government initiatives promoting digital health, telehealth reimbursement, and integration of remote monitoring into standard care pathways are also playing a critical role in enhancing market penetration over the forecast period.

The cardiac monitoring devices segment generated USD 4.7 billion in 2024. This segment includes ECG devices, implantable cardiac monitors, wearable heart monitors, and event recorders used to detect arrhythmias, heart failure exacerbations, and other cardiac abnormalities in real time. The high burden of cardiovascular diseases globally, combined with the critical need for continuous surveillance of high-risk cardiac patients, is a core driver for this segment. Remote cardiac monitoring reduces the need for frequent in-person consultations, enables early identification of life-threatening events, and supports better medication titration.

The home care settings segment held 11% share in 2024 as healthcare delivery shifted from hospitals to patients' homes to improve comfort, reduce costs, and minimize hospital readmissions. In this segment, remote monitoring devices such as vital signs monitors, glucose meters, cardiac wearables, and connected oximeters are used to track patients with chronic conditions, post-operative cases, and elderly individuals on a continuous or scheduled basis. Home-based monitoring enables patients to remain in a familiar environment while still being under the virtual supervision of healthcare professionals, which enhances treatment adherence and quality of life.

North America Remote Patient Monitoring Devices Market held 42.3% share in 2024, accounting for the largest regional share. The region's leadership is supported by a well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of digital health technologies. Favorable reimbursement frameworks for remote monitoring services, particularly in the United States, have significantly encouraged providers to incorporate RPM into chronic disease management programs. Additionally, a high prevalence of lifestyle-related disorders, a large elderly population, and widespread access to the internet and smart devices create an ideal environment for the deployment of remote monitoring solutions.

Key players operating in the Global Remote Patient Monitoring Devices Market include Philips Healthcare, Medtronic plc, GE HealthCare, Abbott Laboratories, Boston Scientific Corporation, Nihon Kohden Corporation, ResMed Inc., Dexcom, Inc., and Masimo Corporation. These companies focus on continuous product innovation, integrating advanced sensors, wireless connectivity, and data analytics into their device portfolios. They are also actively involved in strategic partnerships with hospitals, telehealth platforms, and payers to expand their installed base and enhance recurring revenue streams via monitoring services and software subscriptions. Many of these players are investing in AI-enabled platforms that can automatically flag abnormal readings, support predictive risk scoring, and simplify clinical workflows, making remote monitoring more scalable and effective for large patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases across the globe

- 3.2.1.2 Growing disposable income and healthcare expenditure in emerging countries

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Growing adoption of remote patient monitoring devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of AI-powered predictive monitoring tools

- 3.2.3.2 Emergence of wearable biosensors for continuous, real-time health tracking

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac monitoring devices

- 5.3 Blood pressure monitoring devices

- 5.4 Neurological monitoring devices

- 5.5 Respiratory monitoring devices

- 5.6 Multiparameter monitoring devices

- 5.7 Blood glucose monitoring devices

- 5.8 Fetal and neonatal monitoring devices

- 5.9 Sleep monitoring devices

- 5.10 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular diseases

- 6.3 Cancer

- 6.4 Diabetes

- 6.5 Neurological disorders

- 6.6 Infectious diseases

- 6.7 Respiratory diseases

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Home-care settings

- 7.3 Long-term care

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Poland

- 8.3.8 Switzerland

- 8.3.9 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Thailand

- 8.4.7 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.5.5 Chile

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Israel

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Baxter International

- 9.3 BIOTRONIK

- 9.4 Boston Scientific

- 9.5 Dexcom

- 9.6 F. Hoffmann-La Roche

- 9.7 GE Healthcare

- 9.8 Johnson & Johnson

- 9.9 Koninklijke Philips N.V.

- 9.10 Medtronic

- 9.11 OMRON

- 9.12 Sotera Wireless

- 9.13 Vital Connect