PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773218

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773218

Merchant Hydrogen Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

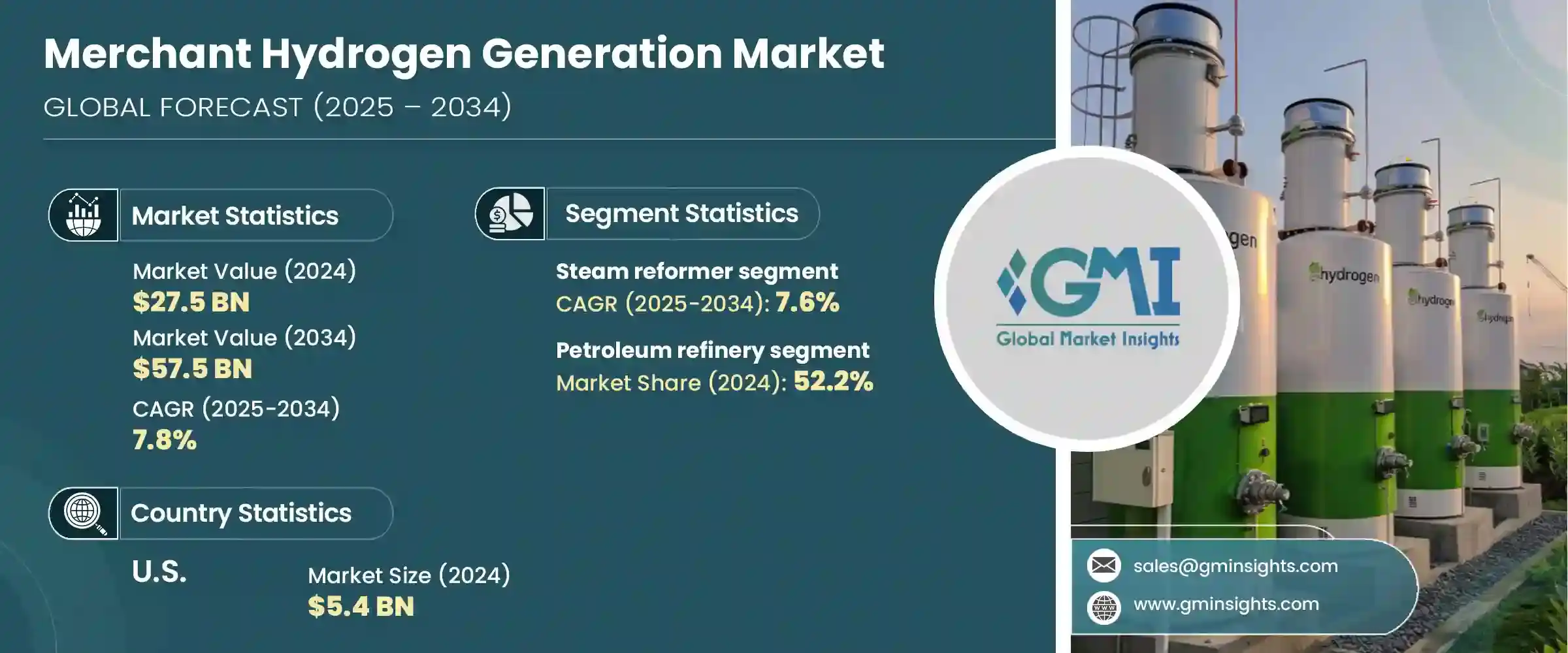

The Global Merchant Hydrogen Generation Market was valued at USD 27.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 57.5 billion by 2034. The market is experiencing steady momentum as governments and industries worldwide place greater emphasis on reducing carbon emissions. This shift is driving demand for clean energy sources, including hydrogen, which has emerged as a key player in the global decarbonization agenda. Policies aimed at achieving net-zero goals, along with rising climate awareness across sectors, are creating favorable conditions for the expansion of merchant hydrogen generation.

One of the major growth enablers is the increasing scale of renewable energy deployment, which creates synergies with hydrogen production through surplus power utilization. As energy systems become more diversified and decentralized, hydrogen is becoming an important tool for energy storage and grid balancing. In this landscape, new-generation electrolysis technologies, such as proton exchange membrane and solid oxide electrolysis, are gaining traction. These innovations offer high efficiency and cost advantages, making hydrogen generation more viable at commercial scales. Industries are actively aligning their operations with sustainability targets, particularly in energy-intensive sectors like steel, refining, and chemicals. This transition is encouraging a gradual shift toward hydrogen-based processes that can lower emissions without compromising productivity. As these trends converge, the merchant hydrogen generation market is positioned for structural transformation over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.5 Billion |

| Forecast Value | $57.5 Billion |

| CAGR | 7.8% |

Based on process type, the steam reformer category is projected to expand at a CAGR of 7.6% through 2034. Its continued relevance lies in its cost efficiency and compatibility with existing natural gas infrastructure. While newer methods are gaining prominence, steam reforming remains widely adopted due to its scalability and reliability for industrial hydrogen needs. Its seamless integration with pipeline networks further strengthens its role in supporting merchant hydrogen distribution across various application zones.

On the basis of application, the market is categorized into petroleum refinery, chemical, metal, and other segments. The petroleum refinery segment accounted for the largest revenue share in 2024, holding 52.2% of the market. Refineries are increasingly adopting hydrogen to meet tightening emission regulations and reduce the environmental footprint of downstream operations. The rising push for green feedstocks and cleaner fuel outputs is prompting refiners to upgrade processes and integrate hydrogen into desulfurization and hydrocracking units. This ongoing transformation within the refining landscape is creating substantial opportunities for hydrogen suppliers offering reliable, on-demand merchant hydrogen services.

Regionally, the North American merchant hydrogen generation market accounted for 24.3% of global revenue in 2024. Within this region, the United States has shown consistent growth, with market values rising from USD 4.9 billion in 2022 to USD 5.4 billion in 2024. A strong policy framework, combined with growing collaboration between federal agencies and private enterprises, is catalyzing the hydrogen ecosystem across the country. Government-backed funding programs and clean energy incentives are encouraging infrastructure buildout, particularly around hydrogen hubs and refueling corridors. The expansion of transportation and logistics capabilities is playing a key role in accelerating industrial-scale adoption of merchant hydrogen solutions.

Market leaders are investing heavily in optimizing project economics and scaling production volumes while complying with low-carbon certification standards. There is a strategic focus on placing merchant hydrogen hubs near high-demand centers like industrial clusters and mobility zones to minimize delivery costs and enhance supply responsiveness. These firms are also exploring digital technologies to streamline operations, improve delivery timelines, and maintain real-time visibility across hydrogen supply chains. Integrated business models that combine on-site generation, networked infrastructure, and smart delivery management systems are becoming standard practice among major players.

To gain a competitive edge, companies are strengthening their regional presence through strategic partnerships, aligning with regulatory roadmaps, and securing funding support for large-scale deployment. By leveraging these efforts, industry participants are well-positioned to meet the growing demand for low-carbon hydrogen across a broad spectrum of end-use sectors, thereby shaping the future of the global energy transition.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam reformer

- 5.3 Electrolysis

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Petroleum refinery

- 6.3 Chemical

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Netherlands

- 7.3.4 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 Iran

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Axpo Holding

- 8.3 Air Products and Chemicals

- 8.4 Cummins

- 8.5 Coregas

- 8.6 Linde

- 8.7 Messer Group

- 8.8 Nel Hydrogen

- 8.9 Plug Power

- 8.10 Sumitomo Corporation

- 8.11 TotalEnergies

- 8.12 Uniper