PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773236

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773236

North America Hydrogen Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

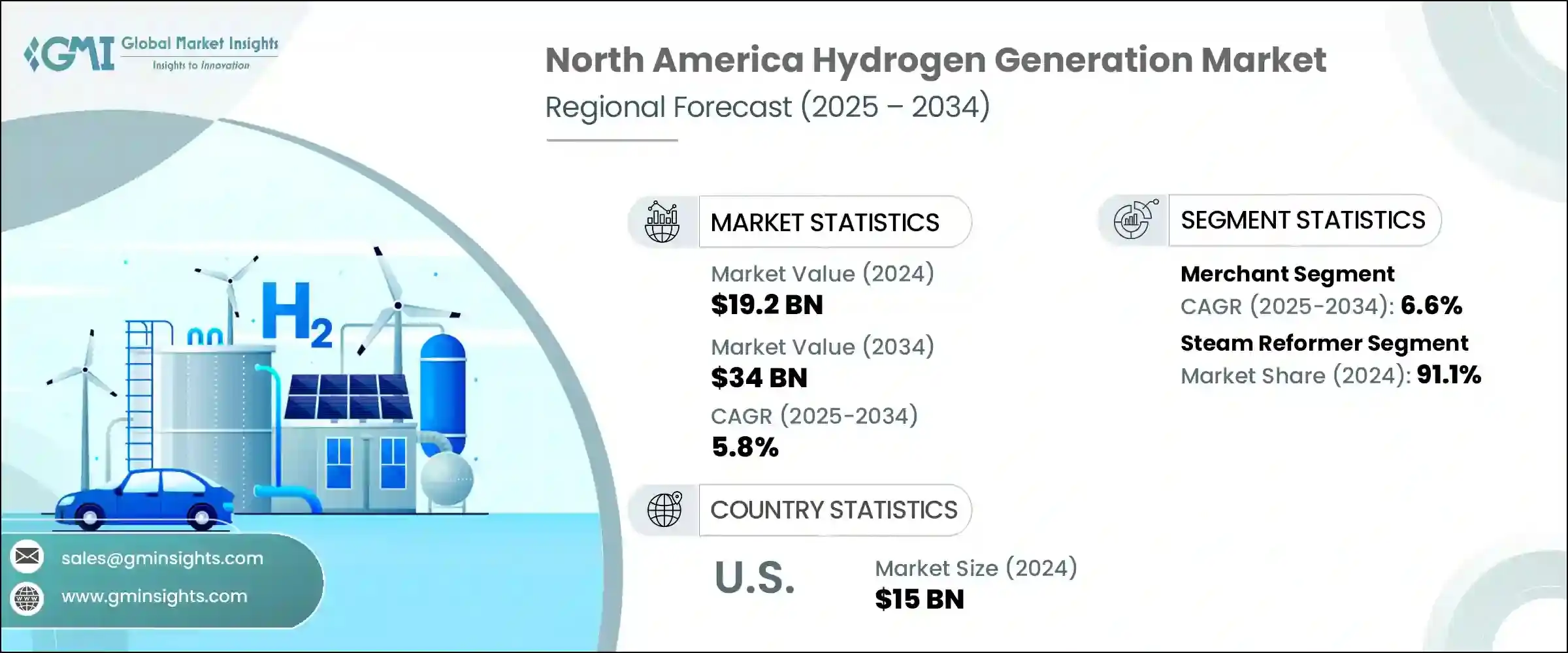

North America Hydrogen Generation Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 34 billion by 2034. This expansion is being fueled by substantial investments in clean energy infrastructure, supportive policies, and increasing demand from industrial sectors. Efforts to decarbonize key industries-such as transportation, refining, and power generation, are driving the adoption of hydrogen technologies. As the region advances toward energy diversification, hydrogen is playing a critical role in facilitating this transition. The implementation of advanced electrolysis systems and carbon capture solutions, supported by tax incentives and public funding, is boosting production capacity. Interest in green hydrogen, especially for transport and heavy industry, is rising, and is further backed by a surge in renewables-linked electrolysis projects using wind and solar power.

Public-private partnerships are also accelerating the build-out of infrastructure, reinforcing North America's position in the clean hydrogen landscape. These collaborations are driving large-scale investment in production facilities, storage hubs, and distribution networks, ensuring faster deployment and integration of hydrogen across critical sectors. By combining the innovation capacity of private firms with the financial and regulatory support of government agencies, such alliances are addressing key bottlenecks in the supply chain. Regional hydrogen hubs, joint research initiatives, and co-funded demonstration projects are further fueling innovation and reducing project risk.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $34 Billion |

| CAGR | 5.8% |

The captive hydrogen segment is expected to reach USD 21 billion by 2034. Industries such as refining, chemical production, and heavy manufacturing are increasingly shifting toward in-house hydrogen systems to gain greater control over fuel supply and streamline operations. These systems offer key advantages-minimized transportation costs, consistent purity levels, and the ability to scale production based on real-time facility requirements. As energy-intensive sectors strive to enhance efficiency while meeting decarbonization targets, the demand for captive hydrogen infrastructure continues to rise.

The alternative hydrogen segment is expected to grow at a CAGR of 4.3% between 2025 and 2034. Methods such as biomass gasification and methane pyrolysis are gaining ground as viable options for regions with abundant bio-resources or natural gas. These technologies are particularly attractive due to their potential for significantly reduced carbon emissions and improved feedstock versatility. With growing support from public research programs and demonstration-scale deployments, these non-traditional hydrogen routes are building momentum. Continued innovation and supportive funding mechanisms are expected to elevate their role in the evolving hydrogen economy.

Canada Hydrogen Generation Industry is poised to grow at a CAGR of 6% through 2034. The country's national framework prioritizes hydrogen use in heavy-duty transportation, industrial applications, and as an export commodity. Canada's leadership is further reinforced by regional policy instruments, including provincial-level incentives and federal funding for pilot projects and infrastructure development. These measures are accelerating the commercialization of hydrogen technologies while expanding the market's foundation. A clear focus on building a sustainable and export-ready hydrogen economy is placing Canada on the global map as a key player in the clean fuel transition.

Key North American players in the North America Hydrogen Generation Market include Siemens Energy, Ballard Power Systems, Plug Power, Messer, CALORIC, Iwatani Corporation, Hexagon Composites, Nuvera Fuel Cells, Linde, Chart Industries, CF Industries, Air Products and Chemicals, Cummins, ITM Power, Resonac Holdings Corporation, and Nel. Leading companies are adopting multi-pronged approaches to reinforce their dominance in the North America hydrogen generation market. These include forming collaborative partnerships with government agencies and OEMs to develop large-scale electrolysis and carbon capture projects. Significant investment in R&D is boosting electrolyzer efficiency while integrating renewables and smart grid compatibility enhances sustainability. Expansion strategies include establishing regional production hubs and forging off-take agreements with industrial consumers to anchor demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Company market share

- 3.3 Strategic dashboard

- 3.4 Strategic initiative

- 3.5 Competitive benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Delivery Mode, 2021-2034 (USD Billion)

- 4.1 Key trends

- 4.2 Captive

- 4.3 Merchant

Chapter 5 Market Size and Forecast, By Process, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam reformer

- 5.3 Electrolysis

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Petroleum refinery

- 6.3 Chemical

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Country, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

- 7.4 Mexico

Chapter 8 Company Profiles

- 8.1 Air Products and Chemicals

- 8.2 Ballard Power Systems

- 8.3 CALORIC

- 8.4 CF Industries

- 8.5 Cummins

- 8.6 Hexagon Composites

- 8.7 Iwatani Corporation

- 8.8 ITM Power

- 8.9 Linde

- 8.10 Messer

- 8.11 Nuvera Fuel Cells

- 8.12 Nel

- 8.13 Plug Power

- 8.14 Resonac Holdings Corporation

- 8.15 Siemens Energy