PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773223

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773223

Gas Fired Real Estate Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

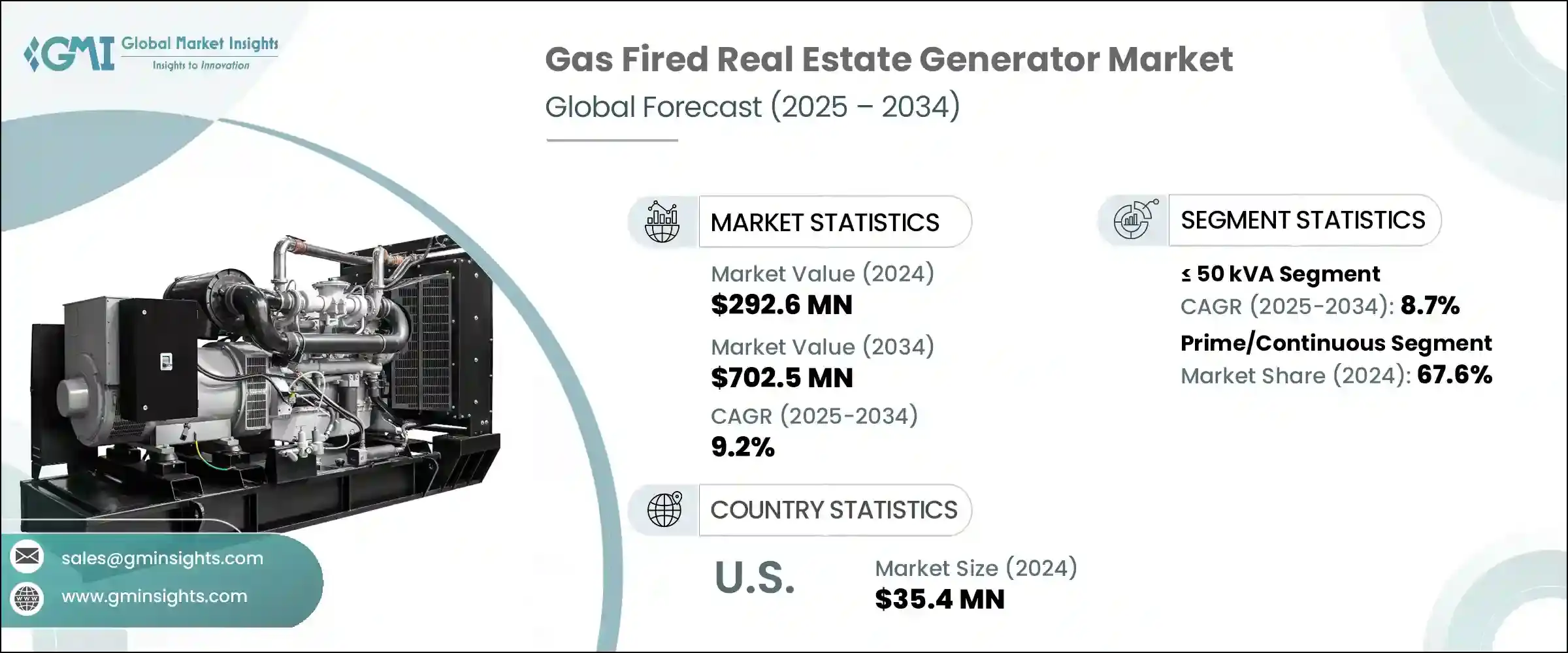

The Global Gas Fired Real Estate Generator Market was valued at USD 292.6 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 702.5 million by 2034. The increasing pace of urban development, combined with expanding infrastructure projects across emerging economies, is boosting demand across the sector. Frequent power interruptions and unstable grid performance in residential and commercial zones are prompting developers to deploy gas-fired gensets to guarantee continuous electricity. These units are being integrated into hybrid microgrids for better reliability in regions lacking consistent utility coverage. Real estate developments benefit from these gensets not only during construction phases but also post-completion as reliable backup systems, thereby enhancing overall property value and operational stability.

With stricter regulations phasing out high-emission diesel gensets, interest is shifting toward cleaner gas-powered alternatives. Backed by regulatory incentives promoting sustainable infrastructure and growing interest in eco-friendly buildings, these generators are gaining rapid traction. Their deployment in modern real estate-from residential high-rises to commercial complexes-is being driven by demands for reliable, low-emission power. Government mandates, coupled with enhanced features such as reduced noise, better fuel economy, and automated load management, are accelerating adoption across both developing and developed regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $292.6 Million |

| Forecast Value | $702.5 Million |

| CAGR | 9.2% |

In 2024, the > 50 kVA - 125 kVA generator segment accounted for USD 70.9 million. These systems are preferred for their ability to deliver reliable power in areas with grid instability while meeting updated environmental standards. Ongoing enhancements in design, such as quieter operations and improved fuel performance, are expected to continue drawing investment.

The standby segment within the gas-fired real estate generator market is forecast to grow at a CAGR of 9% through 2034. This growth is underpinned by evolving regulatory standards focused on cutting emissions and an increased emphasis on energy efficiency through smart features like automatic load optimization.

Asia Pacific Gas Fired Real Estate Generator Market is expected to reach USD 260 million by 2034, supported by fast-paced urban expansion and significant improvements in regional gas distribution infrastructure. A marked shift toward clean, stable energy for urban development projects is reinforcing the need for gas-based generators across the region's growing construction sector.

Major players operating in the Gas Fired Real Estate Generator Market include Mitsubishi Heavy Industries, Atlas Copco, Caterpillar, Rolls-Royce, Aggreko, Ashok Leyland, Cummins, HIMOINSA, Generac Power Systems, Mahindra Powerol, J.C. Bamford Excavators, PR Industrial, Rehlko, Kirloskar, and Yanmar Holdings. Leading companies are focusing on expanding their portfolios with eco-friendly and high-efficiency generator models to address the growing demand for low-emission backup solutions. Manufacturers are integrating smart technologies such as automated load balancing, real-time monitoring, and noise-reduction systems to enhance user experience and compliance with environmental norms. Many firms are strengthening their supply chain and distribution networks to ensure timely product availability across urbanizing regions. Partnerships with real estate developers and government-backed infrastructure initiatives are becoming a core strategy to secure long-term contracts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 350 kVA

- 5.6 > 350 kVA - 500 kVA

- 5.7 > 500 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Ashok Leyland

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Generac Power Systems

- 8.7 HIMOINSA

- 8.8 J.C. Bamford Excavators

- 8.9 Kirloskar

- 8.10 Rehlko

- 8.11 Mahindra Powerol

- 8.12 Mitsubishi Heavy Industries

- 8.13 PR Industrial

- 8.14 Rolls-Royce

- 8.15 Yanmar Holdings