PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773225

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773225

Wine Cellar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

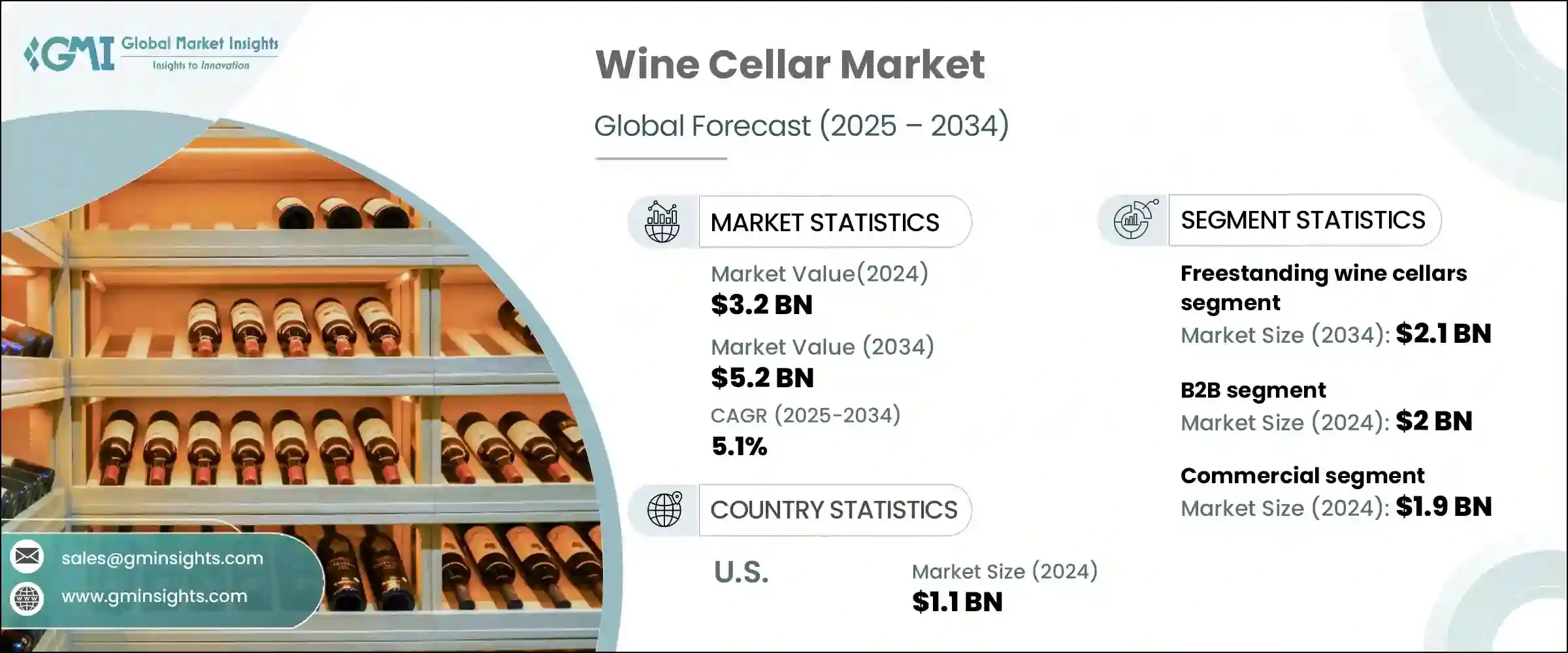

The Global Wine Cellar Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 5.2 billion by 2034. Lifestyle evolution and higher disposable incomes are steering a rise in wine consumption, which in turn is fueling demand for both residential and commercial wine cellars. Marketing campaigns and urban affluence have heightened awareness around proper wine storage, particularly among city dwellers and hospitality professionals. The expansion of wine tourism and a shift toward premium labels are encouraging manufacturers to produce design-forward, compact, and temperature-controlled cellars. As wine preservation transforms from a luxury to a household norm, consumer attitudes are shifting, supporting steady market development. The growing number of high-net-worth individuals (HNWIs) globally is another key driver. With their inclination toward bespoke storage options that reflect their collections, HNWIs are transforming wine collecting into both status symbols and investments.

This growing trend is fueling a surge in demand for high-end, precision-engineered wine cellar systems that not only offer climate control but also integrate seamlessly into luxury home aesthetics. Homeowners are increasingly seeking customized solutions that merge functionality with architectural elegance, driving innovation in finishes, smart temperature regulation, and humidity control. As a result, manufacturers are competing to deliver state-of-the-art cellar designs equipped with digital monitoring, modular racking, and enhanced energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.1% |

The freestanding wine cellars segment generated USD 1.2 billion in 2024 and is projected to grow to USD 2.1 billion by 2034. Their appeal lies in their portability and ease of use without requiring professional installation. Both homeowners and commercial venues are drawn to models featuring durable, rust-resistant materials, better insulation, and additional storage for accessories, making them ideal for versatile placement and functionality.

The commercial segment led the market at USD 1.9 billion in 2024 and is expected to grow at a CAGR of 5.2%. Restaurants, hotels, and wine bars are investing in advanced storage systems to maintain collection quality and enhance guest experience. Cellars equipped with IoT-based temperature and humidity monitoring-and even AI-controlled climate systems-ensure precise conditions for aging and serving wines. This technology-driven approach, combined with the popularity of wine-pairing experiences, consolidates the dominance of the commercial sector.

U.S. Wine Cellar Market generated USD 1.1 billion in 2024 and is forecast to grow at a CAGR of 5% through 2034. This growth is anchored by increasing wine appreciation, home entertainment trends, and the adoption of smart storage technologies. Affluent homeowners are investing in stylish and customized wine cellars, favoring smart systems that monitor temperature, humidity, and inventory. The blend of aesthetic appeal and functionality is establishing these installations as standard additions in upscale residences.

Well-known players in the Wine Cellar Industry include Miele, Vinotech, Whirlpool, Avanti, Sub-Zero, Gaggenau, EuroCave, U-line, Liebherr, Rocco, Avallon, Wine Enthusiast, Perlick, Thermador, NewAir, Electrolux, Haier, Viking, Groupe Farious (Climadiff, La Sommeliere, Avintage, Temtech, Le Cellier, Viteplus), Danby, and Honeywell. Key strategies driving success in the wine cellar market include leveraging design innovation, customization, and smart integration. Companies are investing in R&D to create energy-efficient cooling systems, smart inventory tracking, and sleek aesthetics. Partnerships with real estate developers and luxury home builders are helping reach upscale homeowners, while collaborations with restaurants, hotels, and wine tourism venues expand their commercial footprint. Brands also emphasize eco-friendly materials and insulation to align with sustainable consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Capacity

- 2.2.4 Price range

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Freestanding wine cellars

- 5.3 Built-in wine cellars

- 5.4 Walk-in wine cellars

- 5.5 Wine walls

- 5.6 Wine cabinets

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Small (under 50 bottles)

- 6.3 Medium (50–100 bottles)

- 6.4 Large (100–200 bottles)

- 6.5 Extra-large (over 200 bottles)

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Low cost

- 7.3 Mass

- 7.4 Premium

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Restaurants and bars

- 8.3.2 Hotels and resorts

- 8.3.3 Wine shops and tasting rooms

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key Trends

- 9.2 B2B

- 9.3 B2C

- 9.3.1 Specialty stores

- 9.3.2 Home improvement stores

- 9.3.3 Online retail

- 9.3.4 Department stores

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 The U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Avallon

- 11.2 Avanti

- 11.3 Danby

- 11.4 Electrolux

- 11.5 EuroCave

- 11.6 Gaggenau

- 11.7 Groupe Frio (Climadiff, La Sommeliere, Avintage, Temtech, Le Cellier, Vitempus)

- 11.8 Haier

- 11.9 Honeywell

- 11.10 Liebherr

- 11.11 Miele

- 11.12 NewAir

- 11.13 Perlick

- 11.14 Rocco

- 11.15 Sub-Zero

- 11.16 Thermador

- 11.17 U-line

- 11.18 Viking

- 11.19 Vinotemp

- 11.20 Vintech

- 11.21 Whirlpool

- 11.22 Wine Enthusiast