PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773253

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773253

Corrugated Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

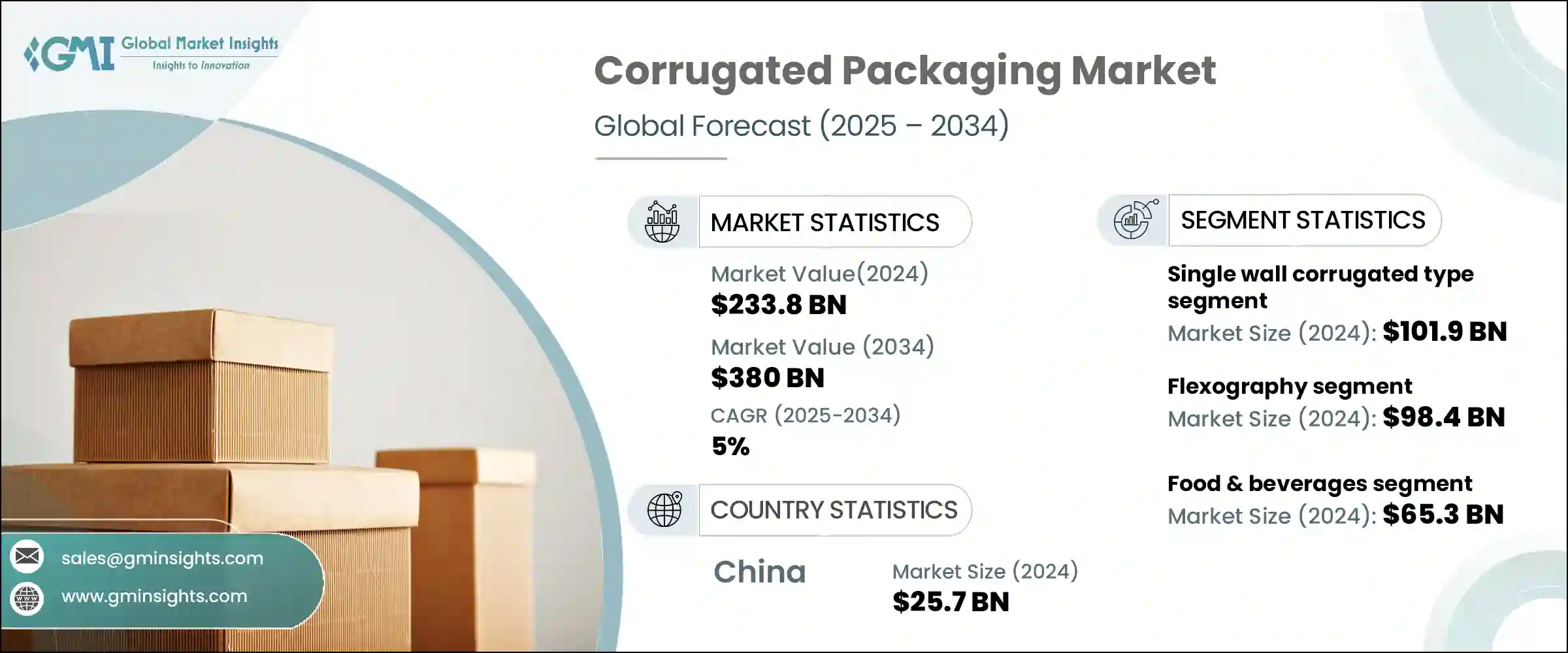

The Global Corrugated Packaging Market was valued at USD 233.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 380 billion by 2034. Much of this growth stems from rising e-commerce activity and the demand for modern packaging solutions that emphasize both functionality and sustainability. The sector continues to evolve by embracing recyclable materials and environmentally friendly practices that reduce its overall ecological footprint. Advancements in recycling processes, the development of stronger lightweight packaging, and the use of reclaimed materials are reshaping how businesses approach packaging in the digital age. With global retail increasingly shifting online, sustainable packaging that aligns with responsible consumption is becoming indispensable.

Digitally printed packaging is playing a key role in product differentiation and efficiency. With technologies enabling high-resolution graphics and on-demand production, operational costs are streamlined while enhancing consumer appeal. Smart packaging, incorporating elements like QR codes and sensors, is also gaining ground by improving transparency, traceability, and product safety. As e-commerce continues expanding-particularly in digital-first markets-the shift in packaging functionality and innovation is becoming more rapid and essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $233.8 Billion |

| Forecast Value | $380 Billion |

| CAGR | 5% |

The single-wall corrugated board segment was valued at USD 101.9 billion in 2024 and is forecasted to grow at 5.4% CAGR through 2034. Its appeal lies in its lightweight structure, flexibility, and affordability, making it a preferred option across sectors like consumer electronics, retail, food, and beverage. Made with a single fluted layer between two liners, it delivers cost-efficient protection and is widely used in transit packaging where performance and price matter equally.

In terms of printing, the flexography segment was valued at USD 98.4 billion in 2024 and is expected to grow at a 5.2% CAGR through the forecast period. This printing technique, known for high-speed production and cost efficiency, remains the go-to option for large-scale packaging applications. Its compatibility with eco-conscious inks enhances its role in green packaging strategies. Flexography supports fast-drying processes and performs well on varied materials, reinforcing its utility in producing visually appealing, sustainable packaging solutions.

China Corrugated Packaging Market generated USD 25.7 billion in 2024 and is projected to grow at a CAGR of 5.6% through 2034. The country's dominance is fueled by its massive e-commerce ecosystem and advanced manufacturing capabilities. Continued investment in packaging R&D and a clear shift toward eco-friendly materials and smarter designs position China as a driving force in the Asia-Pacific region. Manufacturers are now aligning with shifting consumer behavior and regulatory standards by offering more sustainable and visually engaging solutions.

Notable companies in the Corrugated Packaging Market include Danhil, Rengo, Evergreen Packaging, Montebello Container, Cascades, Smurfit Kappa Group, Mondi Group, Georgia-Pacific, Packaging Corporation of America, CESCO, Sultana Packaging, DS Smith, Lee & Man Paper Manufacturing, WestRock, and International Paper. Leading companies in the corrugated packaging space are reinforcing their market presence through several focused strategies. Key initiatives include expanding production capacity to meet growing e-commerce demands and investing in sustainable material development to meet stricter environmental regulations. Many firms are integrating digital printing and automation technologies to reduce turnaround time and improve design flexibility. Strategic partnerships with logistics and retail companies are also being leveraged to improve service delivery and optimize supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Wall type

- 2.2.3 Boxes styles

- 2.2.4 Flutes

- 2.2.5 Printing technology

- 2.2.6 End Use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Wall Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single wall corrugated

- 5.3 Double wall corrugated

- 5.4 Triple-wall corrugated

Chapter 6 Market Estimates & Forecast, By Boxes Style, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Slotted boxes

- 6.3 Telescope boxes

- 6.4 Rigid (bliss) boxes

- 6.5 Self-erecting boxes

- 6.6 Others (interior forms, die cut)

Chapter 7 Market Estimates & Forecast, By Flutes, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Type A flute

- 7.3 Type B flute

- 7.4 Type C flute

- 7.5 Type E flute

- 7.6 Type F flute

Chapter 8 Market Estimates & Forecast, By Printing Technology, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lithography

- 8.3 Flexography

- 8.4 Digital printing

- 8.5 Others (rotogravure, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 9.1 Key Trends

- 9.2 Food & beverages

- 9.3 Personal care & home care

- 9.4 Medical

- 9.5 Home appliances & electronics

- 9.6 Agriculture

- 9.7 Industrial

- 9.8 Chemical & plastics

- 9.9 Paper & Carton

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Cascades

- 12.2 CESCO

- 12.3 Danhil of Mexico

- 12.4 DS Smith

- 12.5 Evergreen Packaging

- 12.6 Georgia-Pacific

- 12.7 International Paper

- 12.8 Lee & Man Paper Manufacturing

- 12.9 Mondi Group

- 12.10 Montebello Container

- 12.11 Packaging Corporation of America

- 12.12 Rengo

- 12.13 Smurfit Kappa Group

- 12.14 Sultana Packaging

- 12.15 WestRock