PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773343

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773343

Vapor Recovery Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

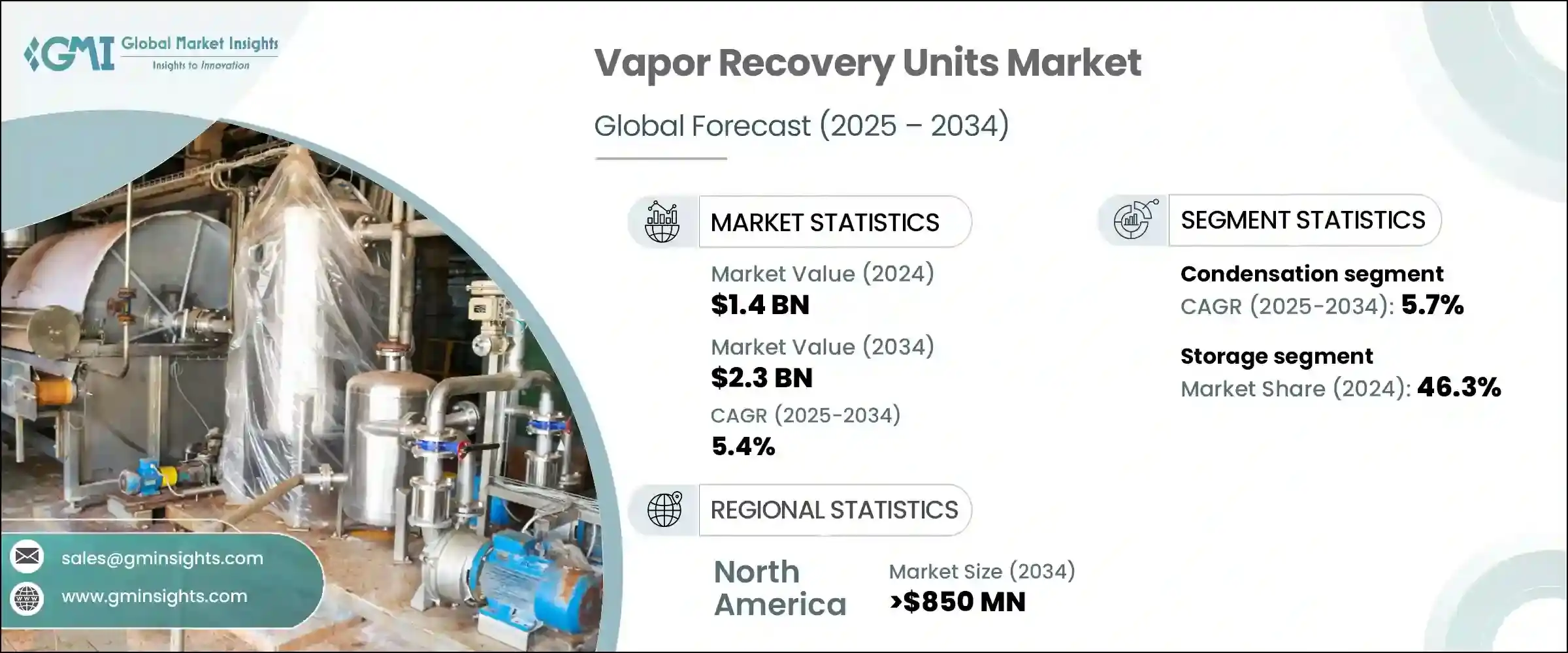

The Global Vapor Recovery Units Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 2.3 billion by 2034. Growing awareness regarding the environmental and regulatory importance of controlling volatile organic compound (VOC) emissions is playing a significant role in accelerating market momentum. Governments in several developing nations are rolling out stricter emissions norms, compelling industries to deploy vapor recovery technologies as part of their compliance strategy. These units offer a sustainable solution for capturing and recycling hydrocarbon vapors that would otherwise be released into the atmosphere. As industries seek eco-friendly and efficient alternatives to traditional emission control systems, VRUs are rapidly emerging as a viable and preferred choice.

The increasing preference for cleaner technologies that not only minimize environmental impact but also offer operational cost benefits is fueling VRU adoption across multiple sectors. One of the primary drivers for market expansion is the growing number of fuel storage facilities and crude oil terminals, especially in rapidly industrializing regions. Operators in these areas are investing in vapor recovery systems to align with tightening pollution norms and to improve overall process efficiency. The ability of VRUs to recover valuable fuel vapors translates into added cost savings, making them a strategic investment for operators. Moreover, the market is witnessing rising demand for compact, skid-mounted vapor recovery systems designed for space-constrained setups or mobile applications. These modern systems are being equipped with advanced features such as improved filtration, corrosion-resistant materials, integrated condensers, and self-cleaning mechanisms, which help minimize maintenance intervals and enhance operational reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.4% |

Additionally, the resale value of recovered fuel, combined with reduced labor requirements for compliance and inspection, is further encouraging the uptake of VRU systems. As the market becomes more performance-driven, the emphasis is shifting toward high-efficiency systems that deliver consistent output while reducing operational disruptions. The demand for such units continues to rise in line with expanding energy infrastructure and increasing fuel throughput across global storage networks.

Technologically, the vapor recovery units market is segmented into condensation, adsorption, absorption, and compression systems. Among these, the condensation segment is expected to expand at a CAGR of 5.7% through 2034. This growth is largely supported by growing interest in closed-loop cooling systems, which allow operators to limit water consumption and enhance the sustainability profile of their operations. The shift toward eco-conscious designs that reduce resource use without compromising recovery rates is giving a considerable push to the condensation VRU segment. These systems are gaining traction for their ability to recover a wide range of hydrocarbons efficiently while aligning with environmental goals.

By application, the market is classified into processing, storage, and transportation. In 2024, the storage application segment held the largest share at 46.3%, and it is expected to maintain dominance throughout the forecast period. This is largely due to the regulatory emphasis on minimizing emissions from storage tanks, particularly emissions stemming from tank breathing and working losses. As emissions standards tighten, facility operators are increasingly compelled to integrate VRUs into their terminal infrastructure to stay in compliance and avoid penalties. The storage sector remains the primary area of application for these systems, with demand showing strong momentum across both large and mid-sized facilities.

In terms of regional analysis, the vapor recovery units market in the United States stood at USD 373.6 million in 2022, rose to USD 389.8 million in 2023, and reached USD 407.2 million in 2024. The country continues to witness strong adoption of VRUs, particularly across upstream oil operations and shale basins. As shale exploration activities grow, there is heightened demand for emissions control technologies capable of managing tank battery releases and complying with the Clean Air Act. Additionally, refineries and fuel distribution terminals are increasing their investment in VRUs to meet strict air quality mandates and reduce their environmental footprint. These efforts are creating new business opportunities for suppliers and driving consistent market growth in the region.

The competitive landscape of the vapor recovery units market is moderately fragmented, with a mix of large-scale industrial manufacturers and specialized system integrators. The top five players, which include Ingersoll Rand, PSG, Cimarron Energy, Kilburn, and Zeeco, collectively account for around 40% of the market share. These companies are focusing on strategic product innovation, technical service expansion, and enhanced system integration capabilities to strengthen their position. As competition intensifies, players are also investing in localized manufacturing, automation, and modular system development to cater to evolving end-user needs across diverse sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Condensation

- 5.3 Adsorption

- 5.4 Absorption

- 5.5 Compression

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Processing

- 6.3 Storage

- 6.4 Transportation

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Chemical & petrochemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Norway

- 8.3.8 Poland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 Oman

- 8.5.6 South Africa

- 8.5.7 Nigeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ALMA Group

- 9.2 BORSIG

- 9.3 Cimarron Energy

- 9.4 Cool Sorption

- 9.5 Flogistix

- 9.6 Ingersoll Rand

- 9.7 KAPPA GI

- 9.8 Kilburn

- 9.9 Koch Engineered Solutions

- 9.10 PSG

- 9.11 Reynold India

- 9.12 S&S Technical

- 9.13 SCS Technologies

- 9.14 SYMEX Technologies

- 9.15 Tecam

- 9.16 VOCZero

- 9.17 Zeeco