PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773407

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773407

Hot Mix Asphalt Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

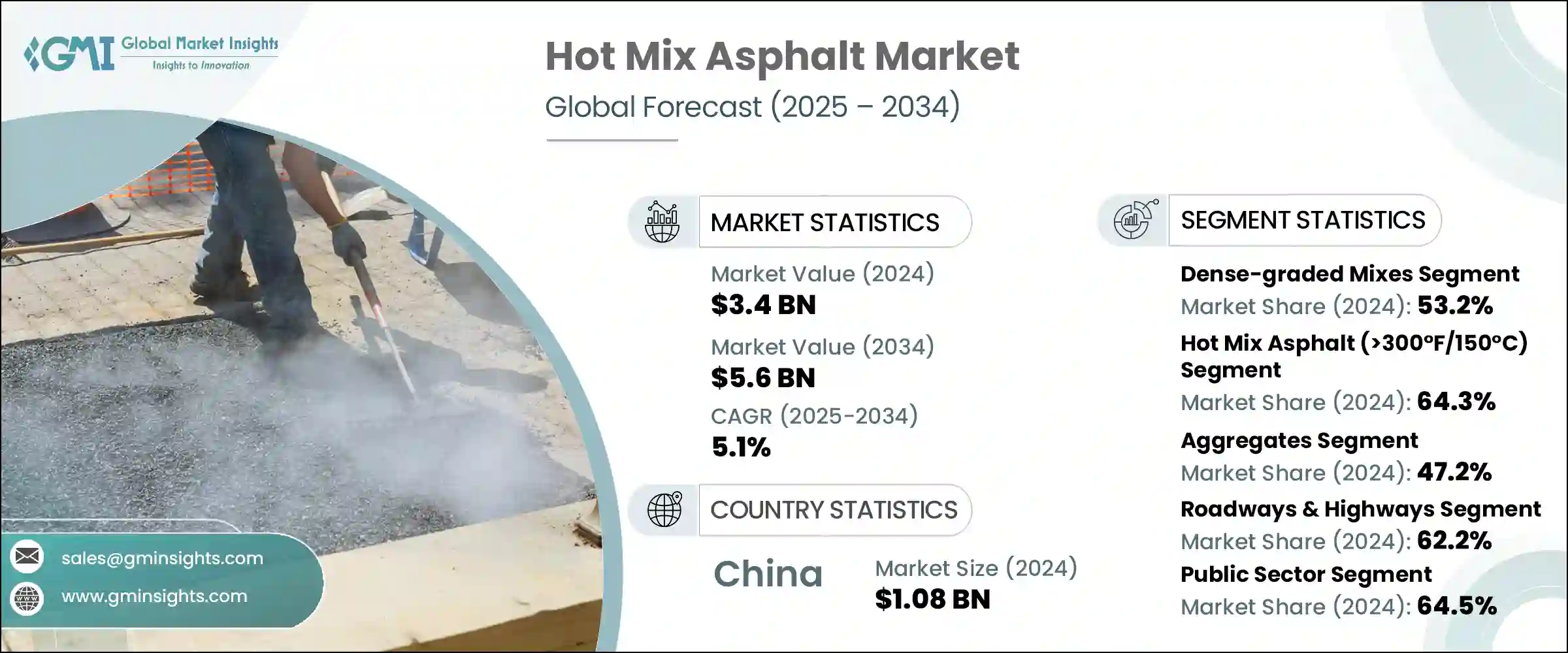

The Global Hot Mix Asphalt Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 5.6 billion by 2034. The continued migration toward urban areas and a corresponding rise in road infrastructure projects are fueling the demand for HMA materials. By 2030, around half of Asia's population will reside in urban zones, pushing local and national governments to expand transport networks. Countries experiencing rapid urbanization are developing extensive arterial and feeder road systems, which significantly boost the requirement for hot mix asphalt. This ongoing infrastructure growth, supported by heavy public investments, especially in the transportation and real estate sectors, is a key driver.

Financial commitments toward urban development and transit systems, paired with regional initiatives aimed at expanding road connectivity, are intensifying the need for high-performance asphalt. As commercial and residential construction accelerates, HMA continues to serve as a vital component in large-scale civil projects. Moreover, the use of recycled asphalt pavement (RAP) and recycled asphalt shingles (RAS) is rising, helping producers limit the extraction of virgin materials. Eco-friendly asphalt products are gaining traction among companies looking to reduce emissions and meet circular economy objectives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 5.1% |

Dense-graded mixes segment represented 53.2% share in 2024. These mixes are widely favored due to their cost-efficiency, durability, and versatility in use across main roads, secondary routes, and large parking areas. Asphalt's reliability makes it a preferred choice for both new road construction and resurfacing applications. Stone Matrix Asphalt, on the other hand, is often deployed in high-traffic environments where durability and resistance to rutting are essential, especially in regions with varying climate conditions and heavy vehicle loads.

Aggregates segment held 47.2% share in 2024. Virgin aggregates remain the top choice due to their strength, consistency, and widespread availability. However, the trend toward sustainability is pushing the increased use of recycled materials such as construction waste and demolition debris. Alternative aggregate options, including crushed glass and steel slag, are being gradually adopted, particularly in markets that have introduced green building codes and environmental compliance requirements.

China Hot Mix Asphalt Market generated USD 1.08 billion in 2024. The country maintains a strong lead thanks to its extensive infrastructure base and continual upgrades to roadways and city transportation systems. Through national development plans, substantial investments have been made in expressways and urban transit, leading to consistent consumption of asphalt-based materials. Backed by large-scale public projects and expanding industrial zones, the demand for hot-mix asphalt remains high across multiple sectors.

The Global Hot Mix Asphalt Market remains highly competitive, with key players such as Vulcan Materials Company, Eurovia (VINCI Group), Martin Marietta Materials, Colas Group, and CRH plc holding considerable market share. Leading companies in the hot mix asphalt sector are prioritizing sustainability, innovation, and supply chain integration to secure long-term growth. They are investing in advanced recycling technologies to incorporate higher percentages of RAP and RAS into their mixes without compromising quality. Strategic collaborations with government bodies and construction contractors are helping secure long-term supply contracts for infrastructure projects. Expanding manufacturing capacity and regional footprint is another major focus, allowing faster delivery and greater market responsiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development & rehabilitation projects

- 3.2.1.2 Urbanization & road network expansion

- 3.2.1.3 Government investments in transportation infrastructure

- 3.2.1.4 Growth in commercial & residential construction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Environmental concerns & regulations

- 3.2.2.3 Competition from alternative paving materials

- 3.2.2.4 High initial capital investment requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in mix designs

- 3.2.3.2 Development of sustainable & eco-friendly mixes

- 3.2.3.3 Growing demand for recycled asphalt pavement (rap)

- 3.2.3.4 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Mix Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dense-graded mixes

- 5.3 Stone matrix asphalt (SMA)

- 5.4 Open-graded friction courses

- 5.5 Porous/permeable asphalt

- 5.6 High-modulus asphalt concrete

- 5.7 Ultra-thin overlays

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Production Temperature, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hot mix asphalt (>300°F/150°C)

- 6.3 Warm mix asphalt (200-300°F/100-150°C)

- 6.3.1 Chemical additive-based WMA

- 6.3.2 Organic additive-based WMA

- 6.3.3 Foaming technology-based WMA

- 6.4 Half-warm mix asphalt (150-200°F/70-100°C)

- 6.5 Cold mix asphalt (<150°F/70°C)

Chapter 7 Market Estimates and Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aggregates

- 7.2.1 Virgin aggregates

- 7.2.2 Recycled aggregates

- 7.2.3 Alternative aggregates

- 7.3 Asphalt binders

- 7.3.1 Conventional binders

- 7.3.2 Polymer-modified binders

- 7.3.3 Bio-based binders

- 7.4 Additives & modifiers

- 7.4.1 Polymers

- 7.4.2 Fibers

- 7.4.3 Anti-stripping agents

- 7.4.4 Warm mix additives

- 7.4.5 Other additives

- 7.5 Recycled materials

- 7.5.1 Recycled asphalt pavement (RAP)

- 7.5.2 Reclaimed asphalt shingles (RAS)

- 7.5.3 Other recycled materials

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Roadways & highways

- 8.2.1 Interstate & national highways

- 8.2.2 State & provincial roads

- 8.2.3 Urban roads & streets

- 8.2.4 Rural roads

- 8.3 Airport infrastructure

- 8.3.1 Runways

- 8.3.2 Taxiways

- 8.3.3 Aprons & other airport pavements

- 8.4 Parking lots & driveways

- 8.4.1 Commercial parking areas

- 8.4.2 Residential driveways

- 8.5 Industrial & port facilities

- 8.6 Recreational surfaces

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Public sector

- 9.2.1 Federal/national government

- 9.2.2 State/provincial government

- 9.2.3 Municipal/local government

- 9.3 Private sector

- 9.3.1 Commercial developers

- 9.3.2 Industrial facilities

- 9.3.3 Residential developers

- 9.4 Public-private partnerships

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Astec Industries, Inc

- 11.2 BASF SE

- 11.3 BP p.l.c.

- 11.4 Colas Group

- 11.5 CRH plc

- 11.6 Eurovia (VINCI Group)

- 11.7 Exxon Mobil Corporation

- 11.8 Granite Construction Incorporated

- 11.9 Heidelberg Materials (formerly HeidelbergCement AG)

- 11.10 Holcim Ltd

- 11.11 Ingevity Corporation

- 11.12 Kraton Corporation (DL Chemical)

- 11.13 Martin Marietta Materials, Inc

- 11.14 Owens Corning

- 11.15 Shell plc

- 11.16 TotalEnergies SE

- 11.17 Vulcan Materials Company

- 11.18 Wirtgen Group (John Deere)