PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797701

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797701

Silicon Based Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

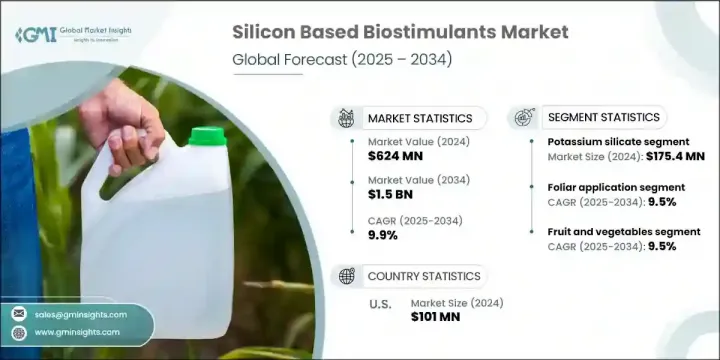

The Global Silicon Based Biostimulants Market was valued at USD 624 million in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 1.5 billion by 2034. This market is gaining traction as agriculture continues to prioritize sustainable and resilient farming methods. The ongoing shift toward eco-conscious and efficient cultivation practices is driving the demand for silicon-based inputs across various farming systems. With agriculture's increasing focus on mitigating the effects of biotic and abiotic stress, these biostimulants are being adopted for their ability to support plant health, yield stability, and resistance to environmental pressures.

The expansion of the industry is backed by rising research, product innovation, and growing interest in smart agriculture technologies. As farms transition to methods that reduce chemical reliance and improve crop outcomes, silicon-enhanced formulations are finding favor among producers globally. The dynamic nature of the market is further propelled by strong product performance, particularly in improving crop resilience and optimizing plant metabolism under stress. Sophisticated agricultural practices in several parts of the world are creating favorable conditions for the rise of specialized products in this category, reflecting a wider commitment to regenerative and sustainable farming.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $624 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 9.9% |

A notable development in the market is the emergence of nano-silicon biostimulants. These advanced formulations use silicon nanoparticles to enhance bioavailability and deliver targeted benefits, such as improved plant uptake and increased resistance to stress. Such innovations are becoming increasingly attractive for high-value crops and precision agriculture. As research deepens and commercialization gains speed, new opportunities are surfacing, driven by a rise in scientific findings that support the advantages of nano-silicon across complex farming systems. This trend is expected to open fresh pathways for growth in technologically advanced agricultural regions.

Amid global concerns about climate shifts and deteriorating soil health, both farmers and agribusinesses are exploring smarter solutions. Silicon-based biostimulants are proving instrumental in boosting agricultural resilience to environmental challenges, including heavy metal exposure, drought, and soil salinity. These solutions align with the global momentum toward sustainable agricultural inputs, which are becoming an essential part of climate-conscious food production systems. The adoption of these products is increasing across the farming spectrum as growers seek effective ways to enhance plant health without compromising ecological balance.

In terms of product type, the potassium silicate segment generated USD 175.4 million and held 28.1% share in 2024 due to its proven effectiveness in boosting plant strength and stress response across multiple crop types. Its consistent performance in diverse agricultural environments continues to make it a top choice among growers looking for reliable biostimulant options.

The foliar segment held a 34.1% share in 2024 and will grow at a 9.5% CAGR through 2034. This technique is popular because it enables rapid absorption of silicon through plant foliage and delivers immediate benefits. Visible improvements in plant condition, stress resistance, and yield quality are key reasons for its widespread adoption among growers and horticulturists aiming for fast, measurable outcomes.

United States Silicon Based Biostimulants Market generated USD 101 million in 2024 and held an 80.1% share. The country's leadership in the sector is supported by a strong regulatory framework, rapid advancements in agri-tech, and widespread emphasis on environmental stewardship. Silicon-based biostimulants have become integral in crop production strategies, particularly in grain and produce farming, where enhancing yield and stress tolerance are top priorities. The integration of these products into crop management programs is steadily expanding as farmers respond to increasingly unpredictable climate conditions.

Key players shaping the Silicon Based Biostimulants Market include Syngenta AG, UPL Limited, Corteva Inc., Bayer AG, and BASF SE. Leading firms in the silicon-based biostimulants sector are reinforcing their market positions through a combination of innovation, partnerships, and global expansion. Companies are heavily investing in R&D to create advanced formulations, particularly nano-silicon technologies that offer precision delivery and improved efficacy. Strategic collaborations with agricultural research institutions and tech providers are accelerating product development and commercialization. Many players are also entering emerging markets through acquisitions and joint ventures to expand their geographic footprint. Customization of product offerings to meet regional crop requirements and regulatory standards has become a critical focus.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable agriculture

- 3.2.1.2 Enhanced crop stress tolerance and yield

- 3.2.1.3 Regulatory support for biostimulants use

- 3.2.1.4 Advancements in product formulations and nanotechnology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and education

- 3.2.2.2 Higher cost compared to conventional inputs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with precision and digital agriculture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million, Tons)

- 5.1 Key trends

- 5.2 Potassium silicate

- 5.3 Sodium silicate

- 5.4 Stabilized silicic acid

- 5.5 Silicon nanoparticles

- 5.6 Other silicon compounds

Chapter 6 Market Estimates & Forecast, By Application Method, 2021 - 2034 (USD Million, Tons)

- 6.1 Key trends

- 6.2 Foliar application

- 6.3 Soil application

- 6.4 Seed treatment

- 6.5 Fertigation and hydroponic

Chapter 7 Market Estimates & Forecast, By Crop Type, 2021 - 2034 (USD Million, Tons)

- 7.1 Key trends

- 7.2 Cereals and grains

- 7.3 Fruits and vegetables

- 7.4 Industrial crops

- 7.5 Turf and ornamentals

- 7.6 Other specialty crops

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Italy

- 8.3.4 Spain

- 8.3.5 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Eutrema

- 9.3 Haifa Group

- 9.4 Intermag

- 9.5 Nuvia Technologies

- 9.6 Orion Future Technology Ltd

- 9.7 Plant Food Company Inc

- 9.8 PlantoSys Nederland B.V.

- 9.9 Roam Technology

- 9.10 Shield Lifesciences and Resins Pvt Ltd

- 9.11 Sustainable Agro Solutions S.A

- 9.12 Syngenta AG