PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911463

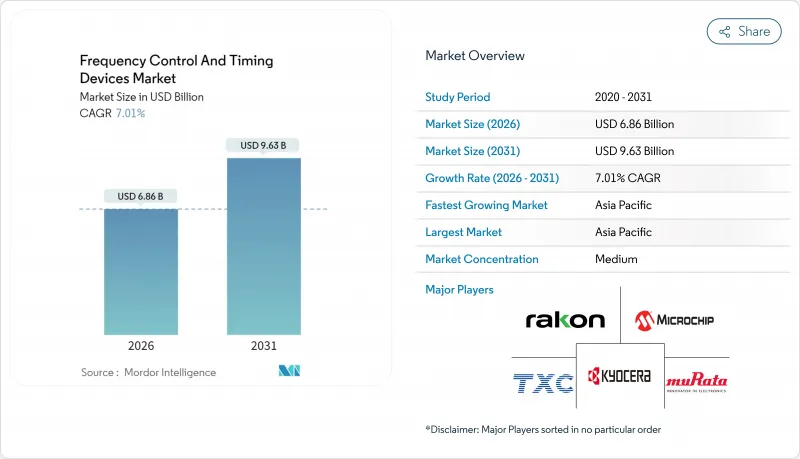

Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The frequency control and timing devices market is expected to grow from USD 6.41 billion in 2025 to USD 6.86 billion in 2026 and is forecast to reach USD 9.63 billion by 2031 at 7.01% CAGR over 2026-2031.

This market size trajectory reflects the pivotal role that precision synchronization now plays in 5G radio access networks, AI-enhanced hyperscale data centers, and safety-critical automotive electronics . Network operators, cloud providers, and electric-vehicle OEMs increasingly specify sub-microsecond accuracy, turning timing components from low-value commodities into strategic enablers of system performance. Oscillators, especially temperature-compensated and oven-controlled variants, lead demand because they deliver the ultra-stable references required in stand-alone 5G Time Division Duplex cells. Quartz remains the dominant technology, yet fast-rising MEMS oscillators gain ground as designers pursue smaller footprints, wider temperature tolerance, and lower power budgets in IoT nodes and automotive control units. Asia Pacific secures the largest regional footprint owing to its integrated electronics supply chain and accelerating domestic consumption of 5G handsets, EVs, and industrial automation equipment.

Global Frequency Control And Timing Devices Market Trends and Insights

5G Infrastructure Build-out Momentum

Standalone 5G architecture pushes synchronization accuracy to within 1.5 microseconds to prevent inter-cell interference, turning TCXOs and OCXOs into mandatory radio components . Small-cell densification compounds latency-driven timing budgets because each node requires individual delay compensation. Equipment vendors now issue tighter frequency-stability specifications that cannot be met with generic crystals. MEMS-based Super-TCXOs enter macro base stations as vendors trade quartz for higher vibration resilience at rooftop locations . The planned 5G-Advanced upgrade path introduces time-sensitive networking, network slicing, and URLLC, each escalating accuracy thresholds through 2030.

Electrification and ADAS Penetration in Automotive Industry

Electric powertrains depend on precise inverter switching, while ADAS radar, LiDAR, and camera fusion require microsecond-aligned time stamps to maintain spatial coherence. Centralized vehicle computers now distribute a master clock to dozens of ECUs, elevating MEMS oscillators because they endure under-hood vibration and -40 °C to +125 °C temperature swings. Automotive OEMs enforce AEC-Q200 certification, lengthening qualification cycles but ensuring 15-year field reliability. As Level-3 and Level-4 autonomy expand after 2026, nanosecond-grade synchronization will become a design baseline for sensor fusion algorithms.

Fab Capacity Constraints for High-Precision Quartz Blanks

Ultra-pure silica from the Spruce Pine mine feeds the highest-Q resonator supply chain; Hurricane Helene's 2024 disruption exposed single-source vulnerability . Only a handful of fabs worldwide can etch and lap blanks to sub-ppm frequency tolerance, generating allocation policies that lengthen oscillator lead times beyond 26 weeks. Investments in synthetic quartz growth and laser-annealing aim to unlock new capacity, yet commercial output is unlikely before 2027. MEMS vendors market silicon-based alternatives as risk-mitigation options, although quartz still outperforms in OCXO class stability.

Other drivers and restraints analyzed in the detailed report include:

- Cloud and AI Workloads Fuelling Hyperscale Data Centers

- Edge-Computing IoT Node Proliferation

- Price Erosion from Commoditization in Consumer Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oscillators commanded 56.12% of the frequency control and timing devices market share in 2025 and are projected to expand at an 8.44% CAGR to 2031, underscoring their role as complete clock solutions across telecom, automotive, and industrial platforms. Within this cohort, temperature-compensated crystal oscillators gained momentum because they maintain +-0.1 ppm stability across -40 °C to +85 °C ranges essential for small-cell radios. Voltage-controlled crystal oscillators rose in popularity among 5G massive-MIMO arrays, where phase-locked-loop trimming curbs Doppler-induced offsets.

MEMS oscillators account for the fastest-growing slice inside the oscillator category due to their 20X better vibration immunity and 50% lower power draw compared with legacy quartz solutions. Their digital programmability enables last-minute frequency configuration, shortening customer supply-chain cycles by several weeks. Crystals remain the foundational building block at lower frequencies, while resonators retain niche adoption in RF filters and duplexers where surface-acoustic-wave propagation offers steep skirt selectivity.

Quartz devices represented 71.25% of the frequency control and timing devices market in 2025, safeguarded by decades-long reliability records and mature global fabs. However, MEMS solutions are forecast to capture incremental share through a 7.48% CAGR as OEMs prioritize smaller footprints and high temperature shock resistance. Recent silicon-die thinning and hermetic wafer-level packaging cut MEMS oscillator Z-height below 0.35 mm, unlocking adoption in ultra-slim 5G handsets.

Surface-acoustic-wave components keep a specialized role in RF filtering, where they can handle up-converter steps above 3 GHz. Hybrid topologies that marry a quartz resonator with MEMS-based temperature control circuits illustrate the path toward coexistence rather than outright substitution. Continuous improvements in precision laser-trimming push quartz aging below +-1 ppm per year, ensuring its viability in OCXO-class timing for satellite payloads and metrology instrumentation.

The Frequency Control and Timing Devices Market Report is Segmented by Product Type (Crystals, Oscillators, Resonators), Technology (Quartz, MEMS, Surface-Acoustic-Wave, Others), Packaging (Surface-Mount Device, Through-Hole/DIP), End-User (Telecommunications and Data Centres, Automotive and Transportation, Consumer Electronics, Industrial and IoT, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 45.78% share of the frequency control and timing devices market in 2025 underscores its dual identity as a manufacturing powerhouse and a high-volume consumer base. China intensifies upstream demand as it scales 5G macro sites and accelerates EV adoption, while Japan's quartz heritage anchors global supply of ultra-stable blanks. South Korea channels timing purchases into memory fabs and nationwide 5G mid-band coverage, and Taiwan's foundries supply back-end assembly services. Export-control headwinds prompt APAC OEMs to localize MEMS tooling and crystal-blank finishing within regional trade blocs.

North America holds the second-largest position, propelled by hyperscale data-center campuses that collectively add more than 1 GW of new compute power annually. The CHIPS Act's incentives catalyze domestic fabs for both silicon MEMS and synthetic quartz, cushioning the region from single-country disruption risk. Defense modernization budgets sustain OCXO and CSAC requirements for protected satcom and position-navigation-timing programs.

Europe's outlook is tethered to its automotive and industrial automation franchise; German OEMs mandate AEC-Q200 devices for centralized vehicle computers, and French and Italian aerospace primes stipulate radiation-tolerant OCXOs. The EU's digital sovereignty initiative channels grants into MEMS R&D clusters, while sustainability directives favor lower-power silicon timing over legacy quartz in high-volume consumer appliances. Emerging regions in the Middle East, Africa, and South America invest in 4G-to-5G upgrades and smart-grid projects, representing nascent yet rising demand for cost-effective SMD crystals.

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Seiko Epson Corporation

- TXC Corporation

- Nihon Dempa Kogyo Co., Ltd.

- Daishinku Corporation

- Microchip Technology Inc.

- SiTime Corporation

- Rakon Limited

- Siward Crystal Technology Co., Ltd.

- Hosonic Technology Co., Ltd.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Abracon LLC

- ECS Inc. International

- Vectron International, Inc.

- IQD Frequency Products Ltd.

- Pletronics, Inc.

- CTS Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G infrastructure build-out momentum

- 4.2.2 Electrification and ADAS penetration in the automotive industry

- 4.2.3 Cloud and AI workloads fuelling hyperscale data centres

- 4.2.4 Edge-computing IoT node proliferation

- 4.2.5 Satellite mega-constellations requiring precision timing

- 4.2.6 Chip-scale atomic clock (CSAC) cost curve breakthroughs

- 4.3 Market Restraints

- 4.3.1 Fab capacity constraints for high-precision quartz blanks

- 4.3.2 Price erosion from commoditisation in consumer devices

- 4.3.3 Export-control risks on the strategic timing of IP

- 4.3.4 Long qualification cycles in safety-critical verticals

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Crystals

- 5.1.2 Oscillators

- 5.1.2.1 Temperature-Compensated Crystal Oscillator (TCXO)

- 5.1.2.2 Voltage-Controlled Crystal Oscillator (VCXO)

- 5.1.2.3 Oven-Controlled Crystal Oscillator (OCXO)

- 5.1.2.4 MEMS Oscillator

- 5.1.2.5 Other Oscillators

- 5.1.3 Resonators

- 5.2 By Technology

- 5.2.1 Quartz

- 5.2.2 MEMS

- 5.2.3 Surface-Acoustic-Wave (SAW)

- 5.2.4 Others

- 5.3 By Packaging

- 5.3.1 Surface-Mount Device (SMD)

- 5.3.2 Through-Hole / DIP

- 5.4 By End-User

- 5.4.1 Telecommunications and Data Centres

- 5.4.2 Automotive and Transportation

- 5.4.3 Consumer Electronics

- 5.4.4 Industrial and IoT

- 5.4.5 Aerospace and Defence

- 5.4.6 Healthcare and Medical Devices

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 UAE

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Vendor Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co., Ltd.

- 6.4.2 Kyocera Corporation

- 6.4.3 Seiko Epson Corporation

- 6.4.4 TXC Corporation

- 6.4.5 Nihon Dempa Kogyo Co., Ltd.

- 6.4.6 Daishinku Corporation

- 6.4.7 Microchip Technology Inc.

- 6.4.8 SiTime Corporation

- 6.4.9 Rakon Limited

- 6.4.10 Siward Crystal Technology Co., Ltd.

- 6.4.11 Hosonic Technology Co., Ltd.

- 6.4.12 Texas Instruments Incorporated

- 6.4.13 NXP Semiconductors N.V.

- 6.4.14 Abracon LLC

- 6.4.15 ECS Inc. International

- 6.4.16 Vectron International, Inc.

- 6.4.17 IQD Frequency Products Ltd.

- 6.4.18 Pletronics, Inc.

- 6.4.19 CTS Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment