PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797713

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797713

North America Third Party Logistics (3PL) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

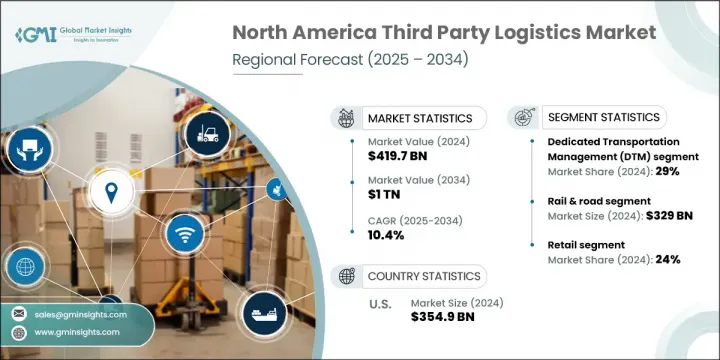

North America Third Party Logistics Market was valued at USD 419.7 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 1 trillion by 2034. The market's upward momentum is largely driven by the rapid growth of online retail, heightened consumer demand for faster deliveries, and a rising need for integrated logistics solutions. Countries such as the United States and Canada are leading the way, backed by strong digital infrastructure, mature retail and manufacturing industries, and the deployment of smart logistics technologies. The ongoing transition toward cloud-based transport management and AI-enabled supply chain tools is redefining 3PL operations across the region. From automated warehouse systems to advanced route forecasting, logistics players are embracing digital innovations that optimize movement and reduce costs.

Even though the pandemic initially disrupted supply operations, it fast-tracked the shift toward outsourced logistics as businesses looked to boost supply chain resilience. Companies now prefer flexible 3PL partnerships to navigate shifting market dynamics. Meanwhile, regulatory developments and sustainability goals are prompting 3PL providers to shift toward electric fleets, energy-conscious storage, and recyclable packaging. These environmental, social, and governance (ESG) commitments are rapidly becoming key differentiators across logistics services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $419.7 Billion |

| Forecast Value | $1 Trillion |

| CAGR | 10.4% |

The dedicated transportation management (DTM) segment held a 29% share in 2024 and is expected to grow at a CAGR of 13% through 2034. DTM's strength lies in offering dynamic route optimization, scalable logistics strategies, and transparent shipment tracking. Businesses in both Canada and the US are relying more heavily on DTM frameworks to enhance supply chain responsiveness and reduce operational expenses, driven by cloud-based systems and AI-powered logistics planning.

In 2024, the rail and road segment accounted for a 78% share, generating USD 329 billion. Its dominance stems from the reliability and reach of ground transportation networks, which support large-volume domestic freight across industries such as food & beverage, retail, and automotive. This mode enables intermodal coordination, just-in-time logistics, and cost-effective last-mile delivery for businesses across the region.

United States Third Party Logistics (3PL) Market held an 85% share, generating USD 354.9 billion in 2024. The country's leadership position is anchored in its expansive transportation grid, tech-driven logistics capabilities, and a strong presence of major service providers such as J.B. Hunt, GXO Logistics, and Amazon. The US market benefits from integrated multimodal solutions, smart warehouse adoption, and a highly skilled workforce that supports complex freight demands across a variety of verticals, including manufacturing, consumer goods, and healthcare.

Top companies shaping the North America Third Party Logistics (3PL) Market include UPS Supply Chain, Kuehne + Nagel, DB Schenker, C.H. Robinson, Amazon, GXO Logistics, and J.B. Hunt. Leading 3PL providers in North America are deploying advanced technologies such as artificial intelligence, machine learning, and predictive analytics to enhance route planning, inventory forecasting, and real-time visibility. Many firms are expanding their last-mile capabilities and regional distribution networks to handle increased e-commerce volume. Collaborations with tech startups and investments in automated fulfillment centers are helping improve operational efficiency and turnaround times. Companies are also focusing on green logistics by transitioning to electric delivery fleets and building energy-efficient warehouses. Another priority is customizing services for key verticals like healthcare and retail, offering tailored logistics solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Mode

- 2.2.4 Application

- 2.2.5 Service

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising popularity of yacht charters

- 3.2.1.2 Expanding marine tourism industry

- 3.2.1.3 Rising demand for customization and bespoke

- 3.2.1.4 Improved financing and leasing options

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Extremely high capital and operating costs

- 3.2.2.2 Strict environmental and emissions regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of the refit and refurbishment market

- 3.2.3.2 Integration of smart & connected features

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 US

- 3.4.2 Canada

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By Product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Value chain analysis

- 3.11.1 Technology providers and system integrators

- 3.11.2 3PL service providers

- 3.11.3 Shippers and manufacturers

- 3.11.4 End consumers and retailers

- 3.11.5 Government and regulatory bodies

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 US

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Dedicated Contract Carriage (DCC)

- 5.3 Dedicated Transportation Management (DTM)

- 5.4 International Transportation Management (ITM)

- 5.5 Warehousing & distribution

- 5.6 Logistics software

Chapter 6 Market Estimates & Forecast, By Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Air

- 6.3 Sea

- 6.4 Rail & road

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Healthcare

- 7.4 Retail

- 7.5 Automotive

- 7.6 Manufacturing

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Transportation services

- 8.3 Warehousing and distribution services

- 8.4 Freight forwarding services

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 Small and Medium Enterprises (SME)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 US

- 10.2.1 Alabama

- 10.2.2 Alaska

- 10.2.3 Arizona

- 10.2.4 Arkansas

- 10.2.5 California

- 10.2.6 Colorado

- 10.2.7 Connecticut

- 10.2.8 Delaware

- 10.2.9 Florida

- 10.2.10 Georgia

- 10.2.11 Hawaii

- 10.2.12 Idaho

- 10.2.13 Illinois

- 10.2.14 Indiana

- 10.2.15 Iowa

- 10.2.16 Kansas

- 10.2.17 Kentucky

- 10.2.18 Louisiana

- 10.2.19 Maine

- 10.2.20 Maryland

- 10.2.21 Massachusetts

- 10.2.22 Michigan

- 10.2.23 Minnesota

- 10.2.24 Mississippi

- 10.2.25 Missouri

- 10.2.26 Montana

- 10.2.27 Nebraska

- 10.2.28 Nevada

- 10.2.29 New Hampshire

- 10.2.30 New Jersey

- 10.2.31 New Mexico

- 10.2.32 New York

- 10.2.33 North Carolina

- 10.2.34 North Dakota

- 10.2.35 Ohio

- 10.2.36 Oklahoma

- 10.2.37 Oregon

- 10.2.38 Pennsylvania

- 10.2.39 Rhode Island

- 10.2.40 South Carolina

- 10.2.41 South Dakota

- 10.2.42 Tennessee

- 10.2.43 Texas

- 10.2.44 Utah

- 10.2.45 Vermont

- 10.2.46 Virginia

- 10.2.47 Washington

- 10.2.48 West Virginia

- 10.2.49 Wisconsin

- 10.2.50 Wyoming

- 10.3 Canada

- 10.3.1 Alberta

- 10.3.2 British Columbia

- 10.3.3 Manitoba

- 10.3.4 New Brunswick

- 10.3.5 Newfoundland and Labrador

- 10.3.6 Nova Scotia

- 10.3.7 Ontario

- 10.3.8 Prince Edward Island

- 10.3.9 Quebec

- 10.3.10 Saskatchewan

- 10.3.11 Northwest Territories

- 10.3.12 Nunavut

- 10.3.13 Yukon

Chapter 11 Company Profiles

- 11.1 Tier 1 Players

- 11.1.1 Amazon

- 11.1.2 C.H. Robinson

- 11.1.3 DB Schenker

- 11.1.4 FedEx Supply Chain

- 11.1.5 GXO Logistics

- 11.1.6 J.B. Hunt

- 11.1.7 Kuehne + Nagel

- 11.1.8 Ryder System

- 11.1.9 UPS Supply Chain

- 11.1.10 XPO Logistics

- 11.2 Tier 2 Players

- 11.2.1 DSV

- 11.2.2 GEODIS

- 11.2.3 Hub Group

- 11.2.4 Lineage Logistics

- 11.2.5 Maersk Logistics

- 11.2.6 NFI Industries

- 11.2.7 Penske Logistics

- 11.2.8 Schneider National

- 11.2.9 Transplace

- 11.2.10 Werner Enterprises

- 11.3 Tier 3 Players

- 11.3.1 A. Duie Pyle

- 11.3.2 R+L Carriers

- 11.3.3 Radial

- 11.3.4 Saddle Creek

- 11.3.5 SEKO Logistics