PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801819

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801819

Point-of-care CT Imaging Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

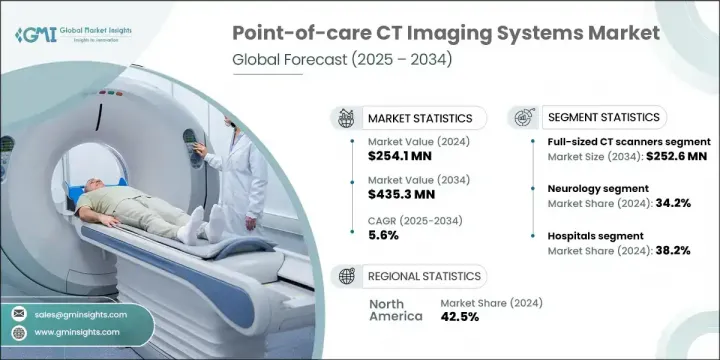

The Global Point-of-care CT Imaging Systems Market was valued at USD 254.1 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 435.3 million by 2034. Growth in this market is primarily fueled by the increasing rates of chronic health conditions and a rapidly aging global population. These factors are driving higher demand for immediate and convenient diagnostic solutions. Point-of-care CT systems are compact, mobile platforms that offer fast and accessible imaging, making them essential in emergency care, outpatient centers, and intensive care environments. As healthcare models shift toward patient-centric diagnostics, portable CT technologies are gaining traction for their ability to support respiratory evaluations and deliver real-time imaging without depending on centralized hospital systems.

Rising cases of respiratory conditions are further strengthening the market, as early and accurate diagnosis remains critical in managing outcomes. One of the major contributors to this trend is the seasonal spike in viral infections, which significantly adds to the burden on respiratory health systems. As a result, there's growing adoption of point-of-care CT systems across clinical settings where fast assessments are needed to inform immediate treatment decisions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $254.1 Million |

| Forecast Value | $435.3 Million |

| CAGR | 5.6% |

In 2024, the full-sized CT scanners segment generated USD 149.3 million. This segment is projected to grow to USD 252.6 million by 2034, advancing at a CAGR of 5.5%. These systems are favored for their high-resolution output and comprehensive diagnostic capabilities, making them the preferred option for critical and emergency care. Full-sized models are commonly used in surgical theaters, trauma units, and intensive care departments where speed and detail in imaging play a vital role in patient outcomes. Their ability to support a wide range of clinical needs makes them indispensable in hospital workflows.

The hospitals segment held a 38.2% share in 2024, remaining the largest End user group in this segment. The dominance of hospitals is attributed to their established diagnostic infrastructure and the availability of trained radiology staff. These institutions routinely handle complex cases in neurology, trauma, and pulmonary care, all of which benefit from rapid point-of-care imaging solutions. As hospitals continue to enhance their diagnostic speed and service delivery, the demand for mobile CT systems grows stronger.

U.S. Point-of-care CT Imaging Systems Market generated USD 101.9 million in 2024, maintaining its leadership in the global space. The country's high incidence of chronic illnesses and cancer, paired with its robust healthcare delivery systems, drives ongoing adoption. Furthermore, a favorable regulatory landscape, increasing awareness of early diagnostics, and substantial investments in advanced medical imaging technologies support sustained market expansion.

Key players actively shaping the Point-of-care CT Imaging Systems Market include Carestream Dental, Planmed, Xoran Technologies, CurveBeam, Siemens Healthineers, NeuroLogica, Epica International, SOREDEX, Stryker, and Arineta. Leading companies in the point-of-care CT imaging systems market are investing heavily in innovation to improve image quality, portability, and system usability. To differentiate themselves, many are focusing on the development of AI-integrated platforms that enhance diagnostic speed and accuracy. Strategic collaborations with hospitals, diagnostic centers, and telehealth providers help boost adoption, particularly in decentralized care settings. Several manufacturers are expanding their product portfolios with compact, wireless systems tailored for outpatient, ICU, and rural care environments. Companies are also leveraging regulatory approvals and fast-track clearances to bring advanced models to market faster.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disorders

- 3.2.1.2 Growing aging population

- 3.2.1.3 Rising emphasis on early diagnosis and treatment

- 3.2.1.4 Technological advancements in imaging system

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging systems

- 3.2.2.2 Regulatory and reimbursement barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into rural and remote areas

- 3.2.3.2 Integration with AI and telemedicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Compact CT scanners

- 5.3 Full-sized CT scanners

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Neurology

- 6.3 Respiratory

- 6.4 Musculoskeletal

- 6.5 ENT

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgery centers

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arineta

- 9.2 Carestream Dental

- 9.3 CurveBeam

- 9.4 Epica International

- 9.5 NeuroLogica

- 9.6 Planmed

- 9.7 Siemens Healthineers

- 9.8 SOREDEX

- 9.9 Stryker

- 9.10 Xoran Technologies