PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801846

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801846

North America Point-of-Care CT Imaging Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

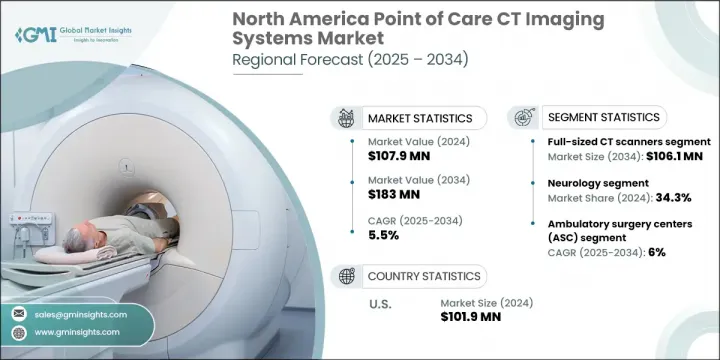

North America Point-of-Care CT Imaging Systems Market was valued at USD 107.9 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 183 million by 2034. The consistent upward trajectory is primarily driven by the surge in chronic health conditions and a rapidly growing elderly population. These factors are accelerating the need for fast and accessible diagnostic imaging solutions. Point-of-care CT imaging systems, known for their mobility and compact design, have become crucial in emergency and outpatient settings where quick and accurate diagnostic scans are required. The demand is particularly strong in critical and acute care units, as these platforms support prompt diagnosis of life-threatening conditions, including cardiovascular, neurological, and respiratory disorders.

With chronic diseases becoming increasingly common, early detection remains vital for improving patient outcomes, prompting healthcare providers to invest in these advanced imaging solutions. Supportive policies and government initiatives aimed at promoting early diagnosis also play a major role in market expansion across Canada. Furthermore, North America's aging population continues to fuel market growth, creating a sustained need for efficient, high-quality diagnostic equipment that can be operated bedside. A growing emphasis on clinical efficiency and shorter diagnostic timelines has made these systems indispensable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $107.9 Million |

| Forecast Value | $183 Million |

| CAGR | 5.5% |

The full-sized point-of-care CT systems segment was valued at USD 63.3 million in 2024 and is forecast to reach USD 106.1 million by 2034, growing at a CAGR of 5.4%. These systems are valued for their superior imaging quality and comprehensive anatomical coverage, especially in trauma and surgical planning scenarios. Their continued dominance can be attributed to their integration into hospital operations and their essential role in environments that demand quick, precise diagnostic data. These scanners are primarily installed in emergency departments and operating rooms, where rapid clinical decision-making is necessary. Their high resolution and versatility make them the preferred choice for physicians needing immediate full-body imaging. The segment's growth reflects hospitals' ongoing investment in infrastructure that supports time-sensitive diagnostics.

Among application segments, the neurology segment held the largest share at 34.3% in 2024 fueled by the growing incidence of neurological conditions throughout North America. The rise in stroke, traumatic brain injuries, and neurodegenerative diseases has led to increased deployment of point-of-care CT solutions that offer instant, high-definition brain imaging near the patient. These systems are crucial in emergency care and intensive monitoring units, where rapid evaluation can be life-saving. Their real-time imaging capabilities streamline diagnosis and assist physicians in making faster clinical interventions, especially in time-critical scenarios. The increased neurological disease burden, particularly within aging communities, continues to amplify demand for these mobile systems.

United States Point-of-Care CT Imaging Systems Market reached USD 101.9 million in 2024. The country benefits from a highly advanced healthcare framework and swift adoption of breakthrough medical technologies. The prevalence of chronic health issues across the US population remains a key growth factor. The supportive ecosystem for innovation-including strong investments in R&D, streamlined regulatory processes, and increased public health awareness-provides a favorable landscape for point-of-care CT system manufacturers. These elements collectively ensure a robust environment for both new entrants and established players to grow their market presence.

Key players driving the North America Point-of-Care CT Imaging Systems Market include Xoran Technologies, CurveBeam, Carestream Dental, Siemens Healthineers, Epica International, NeuroLogica, Stryker, and SOREDEX. These companies are continually evolving their product lines and investing in innovation to stay competitive in a rapidly growing segment. To strengthen their position in the North America point-of-care CT imaging systems market, major companies are prioritizing technological advancement and product innovation. They are focusing on developing compact, user-friendly, and AI-integrated systems to meet the demand for rapid diagnostics. Strategic collaborations with hospitals and emergency care units allow companies to integrate their solutions directly into clinical workflows. Many firms are expanding their regional distribution networks and enhancing after-sales support to boost customer satisfaction and brand loyalty. Investment in R&D remains a top priority, ensuring products meet evolving clinical needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disorders

- 3.2.1.2 Growing aging population

- 3.2.1.3 Rising emphasis on early diagnosis and treatment

- 3.2.1.4 Technological advancements in imaging system

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging systems

- 3.2.2.2 Regulatory and reimbursement barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into rural and remote areas

- 3.2.3.2 Integration with AI and telemedicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Compact CT scanners

- 5.3 Full-sized CT scanners

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Neurology

- 6.3 Respiratory

- 6.4 Musculoskeletal

- 6.5 ENT

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgery centers

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Carestream Dental

- 9.2 CurveBeam

- 9.3 Epica International

- 9.4 NeuroLogica

- 9.5 Siemens Healthineers

- 9.6 SOREDEX

- 9.7 Stryker

- 9.8 Xoran Technologies