PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801820

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801820

MEA Less-Than-Container Load (LCL) Shipping Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

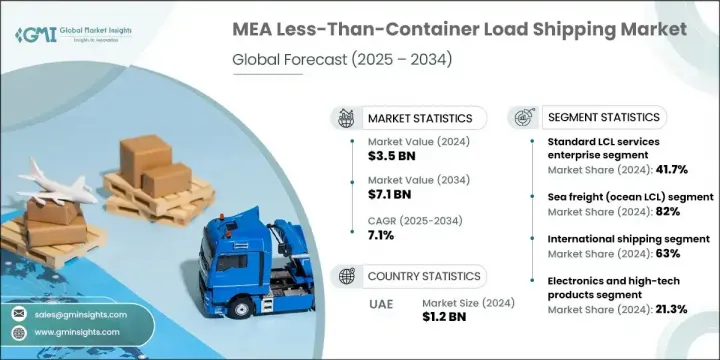

MEA Less-Than-Container Load Shipping Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 7.1 billion by 2034. The region is witnessing increasing demand for flexible, cost-effective logistics solutions due to the growth of e-commerce, expanding cross-border trade, and rising international shipments. LCL shipping is particularly beneficial for small and medium-sized enterprises and online sellers that don't require full container loads. By consolidating multiple shipments into shared containers, companies reduce costs and increase operational efficiency.

Ongoing digital transformation and e-commerce expansion across MEA are further accelerating this trend. With growing regional cooperation, trade agreements, and stronger customs frameworks, businesses are increasingly relying on smaller, more frequent shipments to access wider markets without incurring high logistics costs. As infrastructure improves and internet penetration deepens, especially in Africa and the Middle East, LCL services are becoming essential to support rising intra-regional and international trade volumes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 7.1% |

The standard LCL services held a 41.7% share in 2024 and are expected to grow at a 4.5% CAGR through 2034. With SMEs pushing for cost-efficient solutions, providers are scaling stopover LCL services connecting MEA ports to Asian and European destinations. Consolidation hubs and expanded shipping networks are being established to minimize transit delays and better accommodate small volume cargo.

The sea freight segment held 82% share and is projected to grow at a CAGR of 6.6% by 2034. Ocean-based LCL remains the most used method due to affordability, load capacity, and suitability for north-south trade between the MEA region and international markets. Ongoing upgrades in port infrastructure at major hubs such as Mombasa, Durban, and Jebel Ali are improving reliability and reducing delays. Digital freight booking solutions and direct LCL lanes are being launched to support the high shipping frequency required by SMEs.

UAE MEA Less-Than-Container Load (LCL) Shipping Market held a 33.8% share and generated USD 1.2 billion in 2024. The country's dominance is rooted in its advanced logistics capabilities, modern port infrastructure, and consolidation services that support faster and more efficient shipment handling. Ports such as Fujairah and Jebel Ali act as vital regional gateways for small consignments. Strategic overland and maritime initiatives, including new corridor projects linking UAE with Europe, reinforce the country's leadership in cross-border LCL transport. As regional connectivity improves and trade volumes climb, the UAE remains the logistical backbone of LCL operations in the MEA region.

The top companies in the Global MEA Less-Than-Container Load (LCL) Shipping Market include Maersk Logistics, Gulf Agency Company (GAC), DHL Global Forwarding, DB Schenker, CEVA Logistics, Agility Logistics, and Kuehne + Nagel. To boost their foothold, leading logistics providers are investing in regional consolidation hubs and digitized freight booking systems. They're also expanding direct LCL service lanes and improving route efficiency through AI-based logistics planning. These companies are targeting SME customers with flexible pricing models and tailored solutions for multi-origin shipments. Advanced tracking systems, end-to-end supply chain visibility, and value-added services such as customs clearance and warehousing are being used to strengthen service reliability and customer retention. Strategic partnerships with regional ports and authorities further enhance operational reach, while eco-friendly shipping practices help meet regulatory demands and sustainability goals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Mode of transport

- 2.2.4 Shipper

- 2.2.5 Destination

- 2.2.6 Commodity

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1.1 African Continental Free Trade Area (AfCFTA) Implementation

- 3.2.1.1.2 Belt and Road Initiative Infrastructure Development

- 3.2.1.1.3 Economic Diversification and Industrialization

- 3.2.1.1.4 Population Growth and Urbanization

- 3.2.1.1.5 Natural Resource Export Growth

- 3.2.1.1.6 Digital Trade and E-commerce Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1.1 Infrastructure Capacity Constraints

- 3.2.2.1.2 Political Instability and Security Concerns

- 3.2.2.1.3 Currency Volatility and Payment Risks

- 3.2.2.1.4 Regulatory Complexity and Trade Barriers

- 3.2.2.1.5 Skills Shortage and Capacity Limitations

- 3.2.3 Market Opportunities

- 3.2.3.1.1 Intra-African Trade Development

- 3.2.3.1.2 Manufacturing Hub Development

- 3.2.3.1.3 Green Shipping and Sustainability Initiatives

- 3.2.3.1.4 Digital Platform Integration

- 3.2.3.1.5 Value-Added Services Development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Middle East

- 3.4.2 North Africa

- 3.4.3 West Africa

- 3.4.4 East Africa

- 3.4.5 Southern Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Port automation and digitalization

- 3.7.1.2 Logistics technology implementation

- 3.7.1.3 Skills development and training

- 3.7.1.4 Research and development collaboration

- 3.7.2 Emerging technologies

- 3.7.2.1 Internet of Things (IoT) and sensor networks

- 3.7.2.2 Artificial Intelligence and Machine Learning

- 3.7.2.3 Blockchain and distributed ledger technology

- 3.7.2.4 Autonomous vehicles and robotics

- 3.7.1 Current technological trends

- 3.8 LCL vs FCL comparative analysis

- 3.8.1 Cost benefit

- 3.8.2 Customer preference

- 3.8.3 Transit time

- 3.8.4 Container size

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By mode of transport

- 3.10 Shipping logistics statistics

- 3.10.1 Major ports and corridors

- 3.10.2 Top exporting and importing countries

- 3.10.3 Major commodities

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Regional Trade Integration and AfCFTA Impact

- 3.13.1 African Continental Free Trade Area (AfCFTA) Analysis

- 3.13.2 Gulf Cooperation Council (GCC) Integration

- 3.13.3 Regional Economic Communities (RECs)

- 3.13.4 Intra-Regional Trade Development

- 3.13.5 Trade Agreement Impact on LCL Services

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Middle East

- 4.2.2 North Africa

- 4.2.3 West Africa

- 4.2.4 East Africa

- 4.2.5 Southern Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Standard LCL Services

- 5.3 Express LCL Services

- 5.4 Temperature-Controlled LCL

- 5.5 Hazardous Cargo LCL

- 5.6 Project and Break-Bulk LCL

- 5.7 Door-to-Door LCL Services

Chapter 6 Market Estimates & Forecast, By Mode of Transport, 2021 - 2034 ($Bn, TEU)

- 6.1 Key trends

- 6.2 Sea Freight (Ocean LCL)

- 6.3 Air Freight (Air LCL)

- 6.4 Land Freight (Road/Rail LCL)

Chapter 7 Market Estimates & Forecast, By Shipper, 2021 - 2034 ($Bn, TEU)

- 7.1 Key trends

- 7.2 Small and Medium Enterprises (SMEs)

- 7.3 Large Enterprises

Chapter 8 Market Estimates & Forecast, By Destination, 2021 - 2034 ($Bn, TEU)

- 8.1 Key trends

- 8.2 Domestic LCL Shipping

- 8.3 International LCL Shipping

Chapter 9 Market Estimates & Forecast, By Commodity, 2021 - 2034 ($Bn, TEU)

- 9.1 Key trends

- 9.2 Electronics and High-Tech Products

- 9.3 Textiles and Apparel

- 9.4 Machinery and Industrial Equipment

- 9.5 Automotive Parts and Components

- 9.6 Consumer Goods and Retail Products

- 9.7 Food and Beverages

- 9.8 Medical Equipment and Pharmaceuticals

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, TEU)

- 10.1 Key trends

- 10.2 Middle East

- 10.2.1 Bahrain

- 10.2.2 Kuwait

- 10.2.3 Oman

- 10.2.4 Qatar

- 10.2.5 Saudi Arabia

- 10.2.6 United Arab Emirates

- 10.3 North Africa

- 10.3.1 Algeria

- 10.3.2 Egypt

- 10.3.3 Libya

- 10.3.4 Morocco

- 10.3.5 Tunisia

- 10.4 West Africa

- 10.4.1 Ghana

- 10.4.2 Guinea

- 10.4.3 Liberia

- 10.4.4 Nigeria

- 10.4.5 Senegal

- 10.4.6 Togo

- 10.5 East Africa

- 10.5.1 Ethiopia

- 10.5.2 Kenya

- 10.5.3 Somalia

- 10.5.4 Tanzania

- 10.5.5 Uganda

- 10.6 Southern Africa

- 10.6.1 Angola

- 10.6.2 Mozambique

- 10.6.3 South Africa

- 10.6.4 Zambia

- 10.6.5 Zimbabwe

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 A.P. Moller-Maersk

- 11.1.2 Agility Public Warehousing Company

- 11.1.3 CMA CGM Group

- 11.1.4 COSCO SHIPPING Lines

- 11.1.5 DB Schenker

- 11.1.6 DHL Global Forwarding

- 11.1.7 Evergreen Marine

- 11.1.8 Hapag-Lloyd

- 11.1.9 Kuehne + Nagel

- 11.1.10 Mediterranean Shipping Company (MSC)

- 11.2 Regional players

- 11.2.1 Aramex International

- 11.2.2 Bollore Logistics Africa

- 11.2.3 CEVA Logistics

- 11.2.4 Emirates Shipping Line (ESL)

- 11.2.5 Grimaldi Lines

- 11.2.6 Imperial Logistics

- 11.2.7 National Shipping Company of Saudi Arabia

- 11.2.8 Ocean Network Express (ONE)

- 11.2.9 Safmarine (Maersk Group)

- 11.2.10 Yang Ming Marine Transport

- 11.3 Local leaders and emerging players

- 11.3.1 Cargo Services Far East (CSFE)

- 11.3.2 Freight in Time (FIT)

- 11.3.3 GAC Group

- 11.3.4 Kobo360

- 11.3.5 Lori Systems

- 11.3.6 Seaboard Marine

- 11.3.7 Sendy

- 11.3.8 Tristar Group