PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848124

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848124

Central And Eastern Europe Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

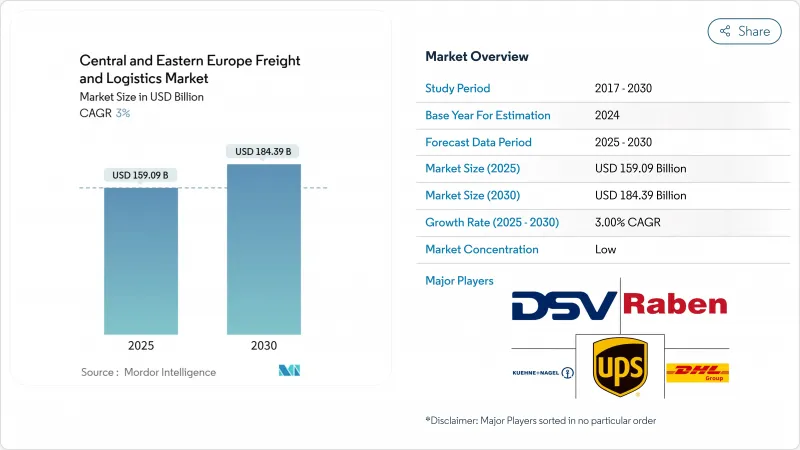

The Central and Eastern Europe freight and logistics market size is valued at USD 159.09 billion in 2025 and is projected to reach USD 184.39 billion by 2030, translating into a steady 3.00% CAGR over 2025-2030.

Nearshoring by German OEMs, accelerated TEN-T corridor upgrades, and the region's digital transformation are reinforcing sustained demand across all major logistics functions. Poland's hub status along the China-Europe rail corridor, rising 5G deployments in core logistics parks, and EU Green Deal incentives for rail and waterways further differentiate the Central and Eastern Europe freight and logistics market from Western European peers. Consolidation activity, such as DSV's purchase of DB Schenker, is elevating scale-driven efficiencies, while technology-enabled forwarders inject competitive dynamism. Key risks include a widening professional driver deficit, intermittent border congestion at EU external frontiers, and lagging cold-chain capacity that could temper growth momentum.

Central And Eastern Europe Freight And Logistics Market Trends and Insights

European Union TEN-T Corridor Upgrades Enabling Intermodal Efficiencies

The latest Trans-European transport network (TEN-T) financing round earmarked EUR 2.5 billion (USD 2.75 billion) for CEE projects in 2024, accelerating European rail traffic management system (ERTMS) deployment and cutting cross-border rail dwell times by up to 30%. Operators on the Warsaw-Berlin and Budapest-Vienna routes report 15-20% efficiency gains, underpinning new rail-road service offerings that deepen the Central and Eastern Europe freight and logistics market's multimodal capabilities. Improved connectivity allows Polish terminals to funnel higher China-Europe rail volumes into adjacent Czech and Slovak hubs, creating network effects that sustain rate stability during seasonal peaks. Revised Combined Transport Directive targets further incentivize shippers to shift medium-distance traffic from road to rail, fostering long-run carbon and cost savings.

German Auto Supply Chains Shift Closer to Home with Poland and Slovakia in Focus

Hyundai, Vitesco Technologies, and Chassix have collectively slated more than EUR 576 million (USD 635.69 million) toward new CEE plants, reinforcing the local production ecosystem for battery systems and powertrains. Hungary alone secured USD 18.8 billion in electromobility FDI, positioning the country among Europe's battery capitals. Relocated tier-1 suppliers require bonded, temperature-controlled freight and specialized warehousing, with lifting demand elasticity across road, rail, and air modes within the Central and Eastern Europe freight and logistics market. Slovakia's favorable tax framework and Poland's established automotive clusters cultivate dense distribution lanes that benefit freight forwarders specializing in time-critical deliveries to German assembly plants.

Chronic Driver Shortage Noticed in CEE Road Haulage

EU-wide driver gaps topped 233,000 positions in 2024, with Czech transport associations citing 25,000 vacancies locally. The average driver age now exceeds 50, and stricter rest-time mandates under the EU Mobility Package squeeze fleet productivity. Wage inflation of 15-20% annually elevates road freight tariffs, potentially nudging shippers toward rail and intermodal options. Several Polish carriers have introduced advanced driver assistance Systems (ADAS) and autonomous trials on controlled corridors, though full commercial roll-out remains years away. Persistent shortages weigh on the Central and Eastern Europe freight and logistics market's capacity ceiling and service reliability.

Other drivers and restraints analyzed in the detailed report include:

- China-Europe Rail Freight Growth Witnessed via New Silk Road

- European Union Green Deal Modal Shift Funding to Rail and Waterways

- Border Congestion Witnessed at EU External Frontiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wholesale and retail trade dominated with a 30.51% share in 2024 and is projected to grow at a 3.21% CAGR (2025-2030) as e-commerce gross merchandise value (GMV) hits USD 42.9 billion in 2024. Big-box and grocery chains are overhauling distribution centers to meet same-day delivery benchmarks, injecting automation spending into the Central and Eastern Europe freight and logistics market.

Manufacturing is growing significantly, largely on the back of auto and electronics clusters. Battery gigafactories in Poland and Hungary drive specialized inbound flows, including lithium-ion cells that demand ADR-compliant, temperature-controlled transport, boosting premium yields for operators.

Freight transport captured 65.13% of 2024 revenue, underscoring its foundational role in meeting manufacturing and distribution needs across the Central and Eastern Europe Freight and Logistics market. Road, rail, and intermodal carriers benefit from robust cross-border trade, particularly along Poland-Germany lanes. The Central and Eastern Europe freight and logistics market size is projected to grow, supported by automotive nearshoring and Eurasian rail flows. CEP, although smaller, is rising fastest; automation in parcel hubs and expansion of pick-up point networks shorten delivery cycles and fuel a 3.44% CAGR (2025-2030). Digital platforms enable real-time price discovery and capacity matching, allowing forwarders to integrate Freight Transport and CEP services under unified dashboards. The interplay of these services underpins flexible, end-to-end solutions that attract multinational shippers seeking resilience.

Historical resilience is evident: sovereignty-related challenges and pandemic shocks slowed activity in 2020, yet e-commerce growth spurred the CEP segment's share in 2024. Warehousing and storage posted stable, mid-single-digit growth as omnichannel retailers demanded higher inventory buffers. Freight Forwarding added value through trade route diversification, with digital brokers exploiting API connectivity to airlines and rail operators, an emerging differentiator in the Central and Eastern Europe freight and logistics industry.

The Central and Eastern Europe Freight and Logistics Market Report is Segmented by End User Industry (Construction, Manufacturing, Wholesale and Retail Trade, and More), by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and More) and by Geography (Albania, Bulgaria, Croatia, Czech Republic, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargus

- CMA CGM Group (Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International

- FedEx

- Gebruder Weiss

- GEODIS

- Hamburger Hafen und Logistik AG (Including METRANS)

- Kuehne+Nagel

- La Poste Group (Including GeoPost)

- Magyar Posta Zrt

- NYK (Nippon Yusen Kaisha) Line

- OBB-Holding AG (Including Rail Cargo Group)

- PKP CARGO SA

- Raben Group

- Rhenus Group

- ROHLIG SUUS Logistics SA

- United Parcel Service of America, Inc. (UPS)

- Waberer's International Nyrt.

- Walter Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Modal Share

- 4.13 Freight Pricing Trends

- 4.14 Freight Tonnage Trends

- 4.15 Infrastructure

- 4.16 Regulatory Framework (Road and Rail)

- 4.17 Regulatory Framework (Sea and Air)

- 4.18 Value Chain and Distribution Channel Analysis

- 4.19 Market Drivers

- 4.19.1 European Union TEN-T Corridor Upgrades Enabling Intermodal Efficiencies

- 4.19.2 German Auto Supply Chains Shift Closer to Home with Poland and Slovakia in Focus

- 4.19.3 European Union Green Deal Modal Shift Funding to Rail and Waterways

- 4.19.4 Energy Security Initiatives and Supply Route Diversification

- 4.19.5 China-Europe Rail Freight Growth Witnessed via New Silk Road

- 4.19.6 5G / ITS Roll-Out Witnessed in Key Logistics Hubs

- 4.20 Market Restraints

- 4.20.1 Chronic Driver Shortage Noticed in CEE Road Haulage

- 4.20.2 Border Congestion Witnessed at EU External Frontiers

- 4.20.3 Under-Developed Cold-Chain Infrastructure Curtailing Growth

- 4.20.4 Fragmented Grade-A Warehousing Supply in the Region

- 4.21 Technology Innovations in the Market

- 4.22 Porter's Five Forces Analysis

- 4.22.1 Threat of New Entrants

- 4.22.2 Bargaining Power of Suppliers

- 4.22.3 Bargaining Power of Buyers

- 4.22.4 Threat of Substitutes

- 4.22.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Geography

- 5.3.1 Albania

- 5.3.2 Bulgaria

- 5.3.3 Croatia

- 5.3.4 Czech Republic

- 5.3.5 Estonia

- 5.3.6 Hungary

- 5.3.7 Latvia

- 5.3.8 Lithuania

- 5.3.9 Poland

- 5.3.10 Romania

- 5.3.11 Slovak Republic

- 5.3.12 Slovenia

- 5.3.13 Rest of CEE

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Cargus

- 6.4.2 CMA CGM Group (Including CEVA Logistics)

- 6.4.3 DACHSER

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (Including DB Schenker)

- 6.4.6 Expeditors International

- 6.4.7 FedEx

- 6.4.8 Gebruder Weiss

- 6.4.9 GEODIS

- 6.4.10 Hamburger Hafen und Logistik AG (Including METRANS)

- 6.4.11 Kuehne+Nagel

- 6.4.12 La Poste Group (Including GeoPost)

- 6.4.13 Magyar Posta Zrt

- 6.4.14 NYK (Nippon Yusen Kaisha) Line

- 6.4.15 OBB-Holding AG (Including Rail Cargo Group)

- 6.4.16 PKP CARGO SA

- 6.4.17 Raben Group

- 6.4.18 Rhenus Group

- 6.4.19 ROHLIG SUUS Logistics SA

- 6.4.20 United Parcel Service of America, Inc. (UPS)

- 6.4.21 Waberer's International Nyrt.

- 6.4.22 Walter Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment