PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801833

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801833

ATP Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

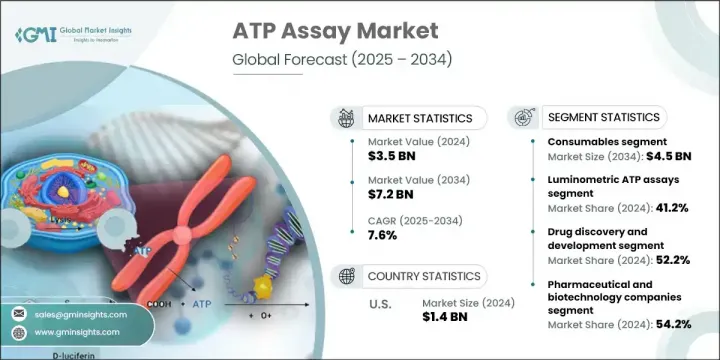

The Global ATP Assay Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 7.2 billion by 2034. Market growth is being accelerated by the rising burden of chronic diseases, the growing demand for personalized therapies, and continuous innovation in assay technology. The evolution of luminometric and enzymatic detection platforms is significantly improving throughput, precision, and sensitivity, resulting in expanded use across research, diagnostics, and pharmaceutical development. Enhanced lab instrumentation, like spectrophotometers and high-throughput luminometers, is helping streamline workflows while increasing assay efficiency.

ATP assays are essential for detecting adenosine triphosphate levels, which act as indicators of cellular viability, energy metabolism, and cytotoxic response. With the shift toward precision medicine and biologically relevant testing, demand for real-time, cell-based assays is rising. These tests enable researchers to assess cellular behavior, viability, and stress responses during early drug development, environmental monitoring, and toxicity screening. The growing emphasis on targeted drug discovery and high-throughput screening in biotechnology and pharmaceutical labs continues to elevate the role of ATP assays in delivering reliable and scalable biological data essential for next-generation therapeutics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 7.6% |

In 2024, the consumables segment generated USD 2.1 billion and will reach USD 4.5 billion by 2034 at a CAGR of 7.7%. This segment remains dominant due to the recurring need for assay kits, reagents, and specialized lab materials essential for routine procedures. These items form the backbone of most ATP testing workflows and are vital across multiple platforms, particularly in drug screening and contamination detection. As laboratories scale their operations, the continued use of these materials in research and diagnostic applications supports steady segmental growth.

The luminometric assays segment held 41.2% share in 2024. Their widespread adoption stems from high accuracy, fast results, and automation compatibility. The ability of these assays to deliver quantitative data with high sensitivity and low background noise makes them the preferred choice for large-scale screening and laboratory workflows. They are widely used in high-volume research settings for their easy integration with automated systems, real-time monitoring, and multiplexing capabilities. Their efficiency in handling large datasets with minimal manual processing significantly improves throughput while maintaining data consistency.

North America ATP Assay Market held 42.5% share in 2024. The region's advanced infrastructure for research, strong presence of pharmaceutical and biotech firms, and rapid uptake of novel diagnostic technologies continue to drive demand. A growing need for cell-based testing, drug development, and contamination detection across labs in the U.S. and Canada has strengthened the region's leadership. The surge in chronic illness cases and expanding investments in clinical trials also contribute to the rising use of ATP assays across academic and industrial sectors.

Top companies driving the Global ATP Assay Market include Danaher, 3M Company, Promega Corporation, Merck, and Thermo Fisher Scientific-together accounting for 55% of global market share. Key players in the ATP assay market are focusing on innovation-driven growth through continuous R&D in assay sensitivity, scalability, and automation compatibility. Companies are enhancing their product lines by integrating advanced luminometric technologies and microplate-based systems that support high-throughput applications. Strategic collaborations with biotech firms and research institutes help expand their End user base while strengthening brand recognition. Mergers and acquisitions are also being used to enter new geographic markets and enhance production capacity. Firms are increasingly investing in digital lab solutions and cloud-based analytics to offer better assay monitoring and data traceability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Assay type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of chronic diseases

- 3.2.1.2 Growing demand for cell-based assays

- 3.2.1.3 Growth in biopharmaceutical R&D

- 3.2.1.4 Technological advancements in assay formats

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced kits

- 3.2.2.2 Stringent regulatory guidelines

- 3.2.3 Market opportunities

- 3.2.3.1 Explosive growth in hygiene and environmental monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Reimbursement scenario

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.2.1 Luminometers

- 5.2.2 Spectrophotometers

- 5.3 Consumables

- 5.3.1 Reagents and kits

- 5.3.2 Microplates

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Luminometric ATP assays

- 6.3 Enzymatic ATP assays

- 6.4 Bioluminescence resonance energy transfer (BRET) ATP assays

- 6.5 Cell-based ATP assays

- 6.6 Other assay types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Drug discovery and development

- 7.3 Contamination testing

- 7.4 Disease detection

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M Company

- 10.2 AAT Bioquest

- 10.3 Abcam

- 10.4 Agilent Technologies

- 10.5 Berthold Technologies

- 10.6 Biotium

- 10.7 BioVision

- 10.8 Cayman Chemical

- 10.9 Cell Signaling Technology

- 10.10 Charm Sciences

- 10.11 Danaher Corporation

- 10.12 Lonza

- 10.13 Merck

- 10.14 PCE Instruments

- 10.15 Promega

- 10.16 Reddot Biotech

- 10.17 Revvity

- 10.18 Thermo Fisher Scientific