PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801881

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801881

North America ATP Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

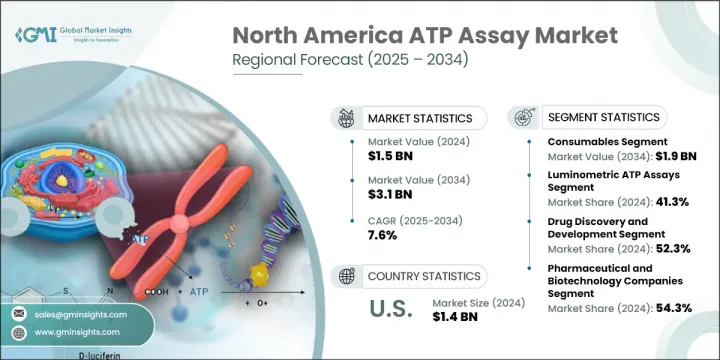

The North America ATP Assay Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 3.1 billion by 2034. Rising incidences of long-term health conditions, including cardiovascular, neurological, and oncological disorders, are accelerating the demand for precise and fast cellular testing tools across the region. This shift is positioning ATP assays as critical solutions in both clinical settings and scientific research. The growing use of ATP-based methods for early disease detection, cellular viability analysis, and metabolic monitoring is fueling this upward trend. With increasing funding toward biomedical research and personalized medicine in North America, the adoption of ATP assay technologies is expanding rapidly.

Laboratories are turning to ATP analysis for its accuracy, sensitivity, and adaptability to high-throughput workflows. The advanced infrastructure for life sciences in the U.S. and Canada, backed by solid investments from both public and private sectors, is significantly influencing the adoption of cutting-edge cellular testing technologies. This growing emphasis on energy metabolism in cellular biology is making ATP assays indispensable tools in the modern research and clinical environment, driving steady growth across the North American landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.6% |

The consumables segment generated USD 910.7 million in 2024 and is expected to reach USD 1.9 billion by 2034, growing at a CAGR of 7.7%. Consumables are an essential component of testing workflows for contamination detection, cell viability, and drug efficacy studies. In North America, demand is rising as laboratories move toward automation and rely heavily on standardized assay kits and pre-formulated reagents. The integration of robotic handling systems and modular assay instruments is pushing the need for high-quality, consistent, and validated consumables that streamline operations, reduce human error, and support regulatory frameworks in the U.S. and Canada.

The drug discovery and development segment held 52.3% share in 2024. Pharmaceutical and biotechnology companies are increasingly relying on ATP-based tests to screen new compounds, evaluate cytotoxicity, and monitor cellular metabolic activity during early-stage drug pipeline development. ATP assays provide the quantitative insights needed for rapid decision-making and are highly compatible with automated systems used in large-scale compound screening. The segment's growth is being propelled by North America's robust pharmaceutical infrastructure and its continued investment in early-phase research and precision therapy development.

U.S ATP Assay Market generated USD 1.4 billion in 2024. The country's growing burden of chronic health issues, which consume the bulk of the nation's USD 4.1 trillion annual healthcare spending, is creating a strong demand for advanced cellular monitoring tools. ATP assays are becoming essential in evaluating how cells respond to therapy and changes in metabolic behavior. With the U.S. maintaining leadership in biotech funding, regulatory flexibility, and automation initiatives, ATP technologies have gained widespread use across drug development labs, clinical diagnostics, and academic research institutions. The rising need for real-time, data-rich analysis and high-throughput cell-based testing is keeping momentum strong for ATP assay adoption.

Key players shaping the North America ATP Assay Market include Merck, Biotium, Lonza, Agilent Technologies, Reddot Biotech, Revvity, Danaher, Charm Sciences, AAT Bioquest, Cell Signaling Technology, Promega, 3M Company, Cayman Chemical, Abcam, Berthold Technologies, E-Pak Machinery, and Thermo Fisher Scientific. Leading companies in the North America ATP assay market are focusing heavily on product innovation, including the development of ultra-sensitive reagents, multiplexed assay kits, and next-generation detection systems to enhance performance in high-throughput screening. Strategic alliances with pharmaceutical firms and academic research centers help expand their reach and validate new assay applications. Many players are investing in workflow automation by integrating ATP technologies with robotic platforms, improving consistency and scaling efficiency. Additionally, companies are expanding their distribution networks and strengthening regulatory compliance to gain trust in clinical diagnostics. Emphasis on customized assay kits and support services for drug developers is also driving market share. These strategies ensure market leaders maintain strong competitive positions across research, clinical, and pharmaceutical environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product type trends

- 2.2.3 Assay type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of chronic diseases

- 3.2.1.2 Growing demand for cell-based assays

- 3.2.1.3 Growth in biopharmaceutical R&D

- 3.2.1.4 Regulatory support and quality standards

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced kits

- 3.2.2.2 Survival challenges for small and new entrants

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into point-of-care and field testing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Pipeline and R&D investment analysis

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.2.1 Luminometers

- 5.2.2 Spectrophotometers

- 5.3 Consumables

- 5.3.1 Reagents and kits

- 5.3.2 Microplates

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Luminometric ATP assays

- 6.3 Enzymatic ATP assays

- 6.4 Bioluminescence resonance energy transfer (BRET) ATP assays

- 6.5 Cell-based ATP assays

- 6.6 Other assay types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Drug discovery and development

- 7.3 Contamination testing

- 7.4 Disease detection

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 3M Company

- 10.2 AAT Bioquest

- 10.3 Abcam

- 10.4 Agilent Technologies

- 10.5 Berthold Technologies

- 10.6 Biotium

- 10.7 Cayman Chemical

- 10.8 Cell Signaling Technology

- 10.9 Charm Sciences

- 10.10 Danaher

- 10.11 Lonza

- 10.12 Merck

- 10.13 Promega

- 10.14 Reddot Biotech

- 10.15 Revvity

- 10.16 Thermo Fisher Scientific