PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801834

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801834

Europe Class 7 Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

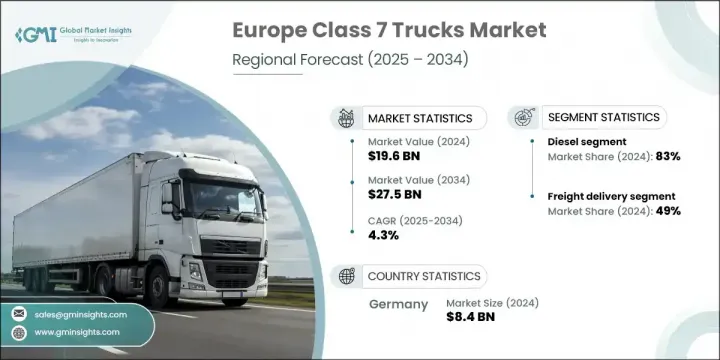

The Europe Class 7 Trucks Market was valued at USD 19.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 27.5 billion by 2034. Growth across the region is being shaped by a combination of strict emissions legislation, robust logistics infrastructure, and the accelerating need for mid-weight trucks in regional and urban delivery networks. With the expansion of e-commerce and the emphasis on low-emission transport, demand for class 7 vehicles that balance power with sustainability is gaining momentum.

As fuel prices rise and cities enforce stricter environmental standards, regional logistics is shifting toward more sustainable practices. Electric and smart mobility solutions are becoming increasingly relevant in urban freight, placing Europe at the center of clean transport innovation. Class 7 vehicles are expected to be key in bridging long-haul and last-mile logistics as micro-fulfillment networks expand. This transition aligns with the ongoing decentralization of warehousing and the evolution of intra-city freight operations across European markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.6 Billion |

| Forecast Value | $27.5 Billion |

| CAGR | 4.3% |

The diesel-powered class 7 trucks held an 83% share in 2024 and is forecast to grow at a CAGR of 3% through 2034. Their strong presence in the market is supported by well-established infrastructure and efficiency in high-load and long-distance transportation. While interest in electric and alternative fuel vehicles continues to rise, diesel remains widely used due to its torque advantages and proven reliability in demanding logistics operations. However, its slower pace of technology integration may challenge its growth in the face of tightening sustainability goals and regulatory shifts.

The freight delivery segment held 49% share and is expected to grow at a CAGR of 4% from 2025 to 2034. This growth is tied to the rising need for efficient regional and last-mile transport solutions driven by an expanding e-commerce sector and evolving consumer delivery expectations. Class 7 trucks offer a balanced combination of payload capacity and fuel economy, making them the preferred vehicle class for logistics service providers managing both city and cross-city operations.

Germany Class 7 Trucks Market accounted for 43% share and generated USD 8.4 billion in 2024. The country's leadership is fueled by a strong industrial base, sophisticated freight infrastructure, and a strategic geographic position in Europe. Supportive environmental policies and significant public investment in charging and fueling networks are encouraging adoption of sustainable transport technologies. Meanwhile, France is witnessing infrastructure upgrades and enhanced freight operations, as the country pushes forward with emissions regulations and digital logistics solutions to boost clean transportation capabilities.

The top companies influencing the Europe Class 7 Trucks Market include PACCAR, Scania, Volkswagen, MAN Truck & Bus, Volvo Truck, Daimler Truck, and Iveco. To maintain a competitive edge in the Europe class 7 trucks industry, leading companies are implementing a combination of innovation and regional expansion strategies. These include investing heavily in the development of electric and hybrid truck models to comply with evolving environmental regulations and meet sustainability goals. Manufacturers are also expanding their charging and refueling infrastructure partnerships, particularly in urban areas, to support fleet electrification. Strategic alliances with digital logistics firms are being used to integrate telematics and intelligent fleet management technologies, enhancing operational efficiency. Furthermore, companies are strengthening their aftermarket services, offering tailored maintenance and financing options to boost customer retention and encourage fleet upgrades.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fuel

- 2.2.3 Horsepower

- 2.2.4 Application

- 2.2.5 Ownership

- 2.2.6 Transmission

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Value chain analysis

- 3.2.1 Upstream value chain

- 3.2.2 Midstream value chain

- 3.2.3 Downstream value chain

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Stricter emission norms and transition to low-emission vehicles

- 3.3.1.2 Digitalization of logistics and fleet connectivity

- 3.3.1.3 Surge in regional freight movement due to e-commerce growth

- 3.3.1.4 Government incentives and infrastructure support for clean transport

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial cost of electric and hydrogen trucks

- 3.3.2.2 Limited charging and refuelling infrastructure

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion of urban micro-warehousing and last-mile delivery networks

- 3.3.3.2 Advancements in battery and hydrogen fuel technologies

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Europe

- 3.5.1.1 EU emission standards and type approval

- 3.5.1.1.1 Euro VI standards and future euro VII

- 3.5.1.1.2 CO2 standards for heavy-duty vehicles

- 3.5.1.1.3 Alternative fuels infrastructure directive

- 3.5.1.2 Safety and performance regulations

- 3.5.1.2.1 General safety regulation (GSR)

- 3.5.1.2.2 Automated driving system regulations

- 3.5.1.2.3 Cybersecurity and software update regulations

- 3.5.1.1 EU emission standards and type approval

- 3.5.1 Europe

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Internal combustion engine technologies

- 3.8.1.1.1 Euro VI diesel engine advancements

- 3.8.1.1.2 Biodiesel and HVO integration

- 3.8.1.1.3 SCR and DPF technologies

- 3.8.1.2 Transmission technologies

- 3.8.1.2.1 Automated manual transmissions (AMT)

- 3.8.1.2.2 Continuously variable transmissions

- 3.8.1.3 Safety and driver assistance systems

- 3.8.1.3.1 Advanced emergency braking systems

- 3.8.1.3.2 Lane departure warning systems

- 3.8.1.3.3 Blind spot detection and monitoring

- 3.8.1.1 Internal combustion engine technologies

- 3.8.2 Emerging technologies

- 3.8.2.1 Electrification technologies

- 3.8.2.1.1 Battery electric vehicle (BEV) systems

- 3.8.2.1.2 Plug-in hybrid electric vehicle (PHEV) technologies

- 3.8.2.1.3 Fuel cell electric vehicle (FCEV) systems

- 3.8.2.1.4 Advanced battery technologies and solid-state batteries

- 3.8.2.2 Autonomous driving technologies

- 3.8.2.2.1 Level 2+ automation systems

- 3.8.2.2.2 Level 3-4 autonomous capabilities

- 3.8.2.2.3 Sensor fusion technologies

- 3.8.2.2.4 AI and machine learning integration

- 3.8.2.3 Connected Vehicle Technologies

- 3.8.2.3.1 5G connectivity and edge computing

- 3.8.2.3.2 Vehicle-to-everything (V2X) communication

- 3.8.2.3.3 Digital twin and predictive maintenance

- 3.8.2.3.4 Blockchain and cybersecurity solutions

- 3.8.2.1 Electrification technologies

- 3.8.1 Current technological trends

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.10.3.1 European Trade Flow Analysis

- 3.10.3.1.1 Intra-EU trade patterns and single market impact

- 3.10.3.1.2 Extra-EU imports and export markets

- 3.10.3.1.3 Brexit impact on UK-EU trade

- 3.10.3.1.4 Trade volume and value trends

- 3.10.3.2 Export market performance

- 3.10.3.2.1 European manufacturers global reach

- 3.10.3.2.2 Technology export and licensing

- 3.10.3.2.3 Emerging market penetration

- 3.10.3.3 Import dependency analysis and supply security

- 3.10.3.4 Trade policy impact and tariff analysis

- 3.10.3.5 Carbon border adjustment mechanism impact

- 3.10.3.1 European Trade Flow Analysis

- 3.11 Cost breakdown analysis

- 3.11.1 Manufacturing cost structure

- 3.11.1.1 Raw material costs and supply chain impact

- 3.11.1.2 Component costs and technology integration

- 3.11.1.3 Labor costs across European manufacturing hubs

- 3.11.1.4 Regulatory compliance and certification costs

- 3.11.2 Total cost of ownership (TCO) analysis

- 3.11.2.1 Vehicle acquisition costs and financing

- 3.11.2.2 Operational costs (Energy, Maintenance, Insurance)

- 3.11.2.3 Depreciation and residual value analysis

- 3.11.2.4 Regulatory and compliance costs

- 3.11.1 Manufacturing cost structure

- 3.12 Patent analysis

- 3.12.1 European patent filing trends analysis

- 3.12.1.1 EPO patent activity by country

- 3.12.1.2 Technology-wise patent distribution

- 3.12.1.3 Company-wise patent portfolio analysis

- 3.12.2 Key patent categories

- 3.12.2.1 Clean propulsion technology patents

- 3.12.2.2 Electric vehicle and battery patents

- 3.12.2.3 Autonomous driving and AI patents

- 3.12.2.4 Connected vehicle and IoT patents

- 3.12.3 Patent landscape competitive analysis

- 3.12.3.1 Emerging technology patent trends

- 3.12.3.2 Patent licensing and cross-licensing activities

- 3.12.3.3 Intellectual property strategy assessment

- 3.12.1 European patent filing trends analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Northern Europe

- 4.2.4 Southern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Fuel, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Natural gas

- 5.4 Hybrid electric

- 5.5 Zero-emission vehicles (ZEVs)

Chapter 6 Market Estimates & Forecast, By Horsepower, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Below 300 HP

- 6.3 300-400 HP

- 6.4 Above 400 HP

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Freight delivery

- 7.3 Utility services

- 7.4 Construction & mining

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Ownership, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Fleet operator

- 8.3 Independent operator

Chapter 9 Market Estimates & Forecast, By Transmission, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 Manual transmission

- 9.3 Automatic transmission

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 France

- 10.2.3 UK

- 10.2.4 Netherlands

- 10.2.5 Belgium

- 10.2.6 Austria

- 10.2.7 Switzerland

- 10.2.8 Ireland

- 10.2.9 Luxembourg

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Czech Republic

- 10.3.3 Hungary

- 10.3.4 Romania

- 10.3.5 Slovakia

- 10.3.6 Bulgaria

- 10.3.7 Ukraine

- 10.3.8 Serbia

- 10.4 Northern Europe

- 10.4.1 Sweden

- 10.4.2 Denmark

- 10.4.3 Norway

- 10.4.4 Finland

- 10.4.5 Iceland

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Croatia

- 10.5.5 Slovenia

- 10.5.6 Albania

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Ashok Leyland

- 11.1.2 Daimler Truck

- 11.1.3 Iveco

- 11.1.4 Kamaz

- 11.1.5 MAN Truck & Bus

- 11.1.6 PACCAR (DAF)

- 11.1.7 Renault Trucks

- 11.1.8 Scania

- 11.1.9 Tata Motors

- 11.1.10 TRATON Group

- 11.1.11 UD Trucks

- 11.1.12 Volkswagen Truck

- 11.1.13 Volvo Trucks

- 11.2 Regional players

- 11.2.1 ACMAT

- 11.2.2 BelAZ

- 11.2.3 Csepel Holding

- 11.2.4 FAP Corporation

- 11.2.5 Ginaf Trucks

- 11.2.6 Roman S.A.

- 11.2.7 Sisu Auto

- 11.2.8 Tatra Trucks

- 11.2.9 Terborg Group

- 11.3 Emerging players

- 11.3.1 Avia Motors

- 11.3.2 BMC Automotive

- 11.3.3 Chavdar

- 11.3.4 ELVO

- 11.3.5 FAP

- 11.3.6 Jelcz

- 11.3.7 Kioleides Group

- 11.3.8 KrAZ

- 11.3.9 Madara

- 11.3.10 Minerva

- 11.3.11 Temax

- 11.3.12 Vanaja