PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801870

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801870

Asia Pacific Class 7 Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

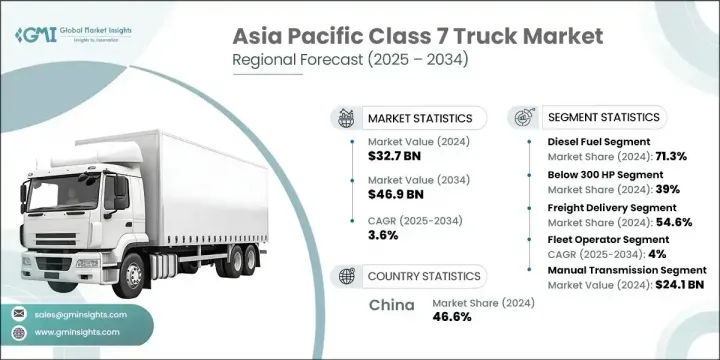

The Asia Pacific Class 7 Truck Market was valued at USD 32.7 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 46.9 billion by 2034. This growth reflects the evolving nature of logistics, infrastructure, and industrial sectors across the region. Class 7 trucks-defined by a gross vehicle weight rating (GVWR) between 26,001 and 33,000 lbs-are increasingly becoming core assets in both heavy-duty and fleet operations. Enhanced usage of driver-assist systems, telematics, and alternative fuels is driving a shift from traditional transportation roles to more advanced and strategic applications. Companies now demand smarter fleet solutions, especially in mining, freight, and infrastructure-related sectors.

The surge in digital transformation following the pandemic pushed operators to adopt advanced technologies, including predictive maintenance and real-time tracking. Smaller enterprises are also embracing digitized fleet services, aided by leasing models and subscription-based ownership structures, particularly in countries across South and Southeast Asia. These developments are making it easier for businesses in construction and logistics to scale operations while managing vehicles more efficiently in a dynamic freight environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.7 Billion |

| Forecast Value | $46.9 Billion |

| CAGR | 3.6% |

Diesel-powered Class 7 trucks from the fuel segment held 71.3% share in 2024, and this segment is forecasted to grow at a CAGR of 3.9% through 2034. Diesel remains the fuel of choice due to its widespread availability, cost-effectiveness, and capacity to support high-load and long-distance operations. Favorable infrastructure for diesel distribution across countries like Japan, Australia, and China continues to bolster its use in both urban and rural freight movement. The superior energy density and total cost of ownership advantages contribute to the enduring preference for diesel trucks among large and small fleet operators alike.

Trucks with power output below 300 horsepower held a 39% share in 2024 and will grow at a CAGR of 3.8% between 2025 and 2034. This horsepower range delivers the right balance of fuel efficiency, power, and emissions compliance. It serves as the backbone for transportation within infrastructure development and medium- to long-haul logistics. The segment remains a top choice for operations requiring performance and reliability without compromising operational costs.

China Class 7 Truck Market held a 46.6% share, generating USD 15.3 billion in 2024. Market growth is primarily fueled by ongoing infrastructure development, strong freight demand, and government support for modernization. China's dominant role is supported by a robust logistics ecosystem and a push toward industrial upgrading, where mid-to-heavy trucks are essential. Regulatory policies are also prompting manufacturers to advance fuel-efficient engines, telematics, and cleaner drivetrain technologies to meet tightening emissions requirements.

Prominent players shaping the Asia Pacific Class 7 Truck Market include Hino Motors, SHACMAN, Daimler Truck, FAW Jiefang, Hyundai Motor Company, Ashok Leyland, Tata Motors, Volvo Group, Isuzu Motors, and Sinotruk Group. Major OEMs are prioritizing innovation in drivetrain technologies and emissions control systems to align with regional regulations. Many are increasing R&D investment in telematics, fuel efficiency, and lightweight design to stay competitive. To expand market access, companies are forming joint ventures and supply chain partnerships within the region. Flexible financing models, such as leasing and truck-as-a-service (TaaS), are being introduced to attract SMEs. Some are building localized assembly and service centers to enhance after-sales support and reduce import dependency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fuel

- 2.2.3 Horsepower

- 2.2.4 Application

- 2.2.5 Ownership

- 2.2.6 Transmission

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Value chain analysis

- 3.2.1 Upstream value chain

- 3.2.2 Midstream value chain

- 3.2.3 Downstream value chain

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Infrastructure development and urbanization

- 3.3.1.2 E-commerce and logistics growth

- 3.3.1.3 Government infrastructure spending

- 3.3.1.4 Fleet modernization initiatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment costs

- 3.3.2.2 Regulatory compliance challenges

- 3.3.2.3 Economic uncertainties and raw material price fluctuations

- 3.3.2.4 Driver shortage crisis

- 3.3.3 Market opportunities

- 3.3.3.1 Electric vehicle transition

- 3.3.3.2 Autonomous driving technology integration

- 3.3.3.3 Connected vehicle solutions

- 3.3.3.4 Emerging market penetration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 China

- 3.5.2 India

- 3.5.3 Japan

- 3.5.4 South Korea

- 3.5.5 ANZ

- 3.5.6 Vietnam

- 3.5.7 Indonesia

- 3.5.8 Philippines

- 3.5.9 Singapore

- 3.5.10 Rest of Asia Pacific

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current Technology Analysis

- 3.8.1.1 Internal Combustion Engine Technologies

- 3.8.1.1.1 Diesel Engine Advancements

- 3.8.1.1.2 CNG/LNG Engine Systems

- 3.8.1.1.3 Emission Control Technologies

- 3.8.1.2 Transmission Technologies

- 3.8.1.2.1 Manual and Automated Manual Transmissions

- 3.8.1.2.2 Automatic Transmission Systems

- 3.8.1.3 Safety and Driver Assistance Systems

- 3.8.1.3.1 Anti-lock Braking Systems (ABS)

- 3.8.1.3.2 Electronic Stability Control (ESC)

- 3.8.1.3.3 Advanced Driver Assistance Systems (ADAS)

- 3.8.1.1 Internal Combustion Engine Technologies

- 3.8.2 Emerging Technology Trends

- 3.8.2.1 Electrification Technologies

- 3.8.2.1.1 Battery Electric Vehicle (BEV) Systems

- 3.8.2.1.2 Hybrid Electric Vehicle (HEV) Technologies

- 3.8.2.1.3 Fuel Cell Electric Vehicle (FCEV) Systems

- 3.8.2.1.4 Battery Technology Advancements

- 3.8.2.2 Autonomous Driving Technologies

- 3.8.2.2.1 Level 1-2 Automation Systems

- 3.8.2.2.2 Level 3-4 Autonomous Capabilities

- 3.8.2.2.3 Sensor Technologies (LiDAR, Cameras, Radar)

- 3.8.2.2.4 AI and Machine Learning Integration

- 3.8.2.3 Connected Vehicle Technologies

- 3.8.2.3.1 Vehicle-to-Everything (V2X) Communication

- 3.8.2.3.2 Telematics and Fleet Management

- 3.8.2.3.3 Over-the-Air (OTA) Updates

- 3.8.2.3.4 IoT Integration and Data Analytics

- 3.8.2.1 Electrification Technologies

- 3.8.1 Current Technology Analysis

- 3.9 Price trends

- 3.9.1 By countries

- 3.9.2 By product

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost breakdown analysis

- 3.12.1 Manufacturing cost structure

- 3.12.1.1 Raw material costs and supply chain impact

- 3.12.1.2 Component costs and technology integration

- 3.12.1.3 Labor costs across European manufacturing hubs

- 3.12.1.4 Regulatory compliance and certification costs

- 3.12.2 Total cost of ownership (TCO) analysis

- 3.12.2.1 Vehicle acquisition costs and financing

- 3.12.2.2 Operational costs (Energy, Maintenance, Insurance)

- 3.12.2.3 Depreciation and residual value analysis

- 3.12.2.4 Regulatory and compliance costs

- 3.12.1 Manufacturing cost structure

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 China

- 4.2.2 India

- 4.2.3 Japan

- 4.2.4 South Korea

- 4.2.5 ANZ

- 4.2.6 Vietnam

- 4.2.7 Indonesia

- 4.2.8 Philippines

- 4.2.9 Singapore

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Natural gas

- 5.4 Hybrid electric

- 5.5 Zero emission vehicles

Chapter 6 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 300HP

- 6.3 300HP-400HP

- 6.4 Above 400HP

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Freight delivery

- 7.3 Utility services

- 7.4 Construction and Mining

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Ownership, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Fleet operator

- 8.3 Independent operator

Chapter 9 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Manual transmission

- 9.3 Automatic transmission

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 China

- 10.3 India

- 10.4 Japan

- 10.5 South Korea

- 10.6 ANZ

- 10.7 Vietnam

- 10.8 Indonesia

- 10.9 Philippines

- 10.10 Singapore

- 10.11 Rest of Asia Pacific

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Daimler Truck

- 11.1.2 Dongfeng Motor

- 11.1.3 FAW

- 11.1.4 FOTON Motor

- 11.1.5 Hino Motors

- 11.1.6 Isuzu Motors

- 11.1.7 Mitsubishi Fuso

- 11.1.8 SINOTRUK

- 11.1.9 UD Trucks

- 11.1.10 Volvo Trucks

- 11.2 Regional players

- 11.2.1 Ashok Leyland

- 11.2.2 Beiben

- 11.2.3 BYD

- 11.2.4 Chenglong

- 11.2.5 Daewoo

- 11.2.6 Eicher Motors

- 11.2.7 Force Motors

- 11.2.8 Hyundai

- 11.2.9 JAC Motors

- 11.2.10 Kia

- 11.2.11 Mahindra & Mahindra

- 11.2.12 SHACMAN

- 11.2.13 SML Isuzu

- 11.2.14 Tata Motors

- 11.3 Emerging Players

- 11.3.1 Ankai Automobile

- 11.3.2 Chery

- 11.3.3 Lion Electric

- 11.3.4 Nikola

- 11.3.5 Rivian Automotive

- 11.3.6 SAIC Maxus

- 11.3.7 Workhorse

- 11.3.8 Yutong