PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801896

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801896

Europe Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

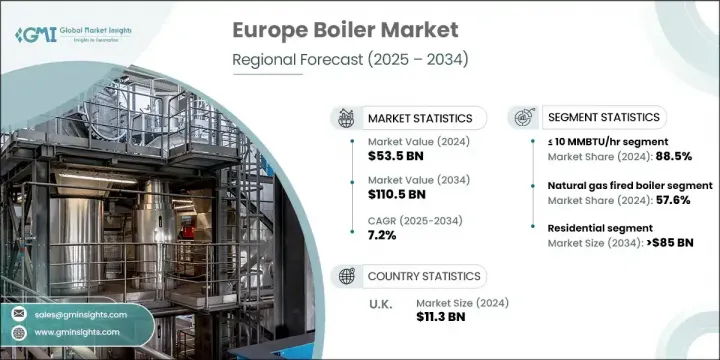

Europe Boiler Market was valued at USD 53.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 110.5 billion by 2034. The region's heating industry is entering a critical transformation phase, influenced by the urgent need to cut greenhouse gas emissions, adopt cleaner energy technologies, and upgrade outdated heating systems. Government mandates across Europe are pushing for a systematic phase-out of older, high-emission boilers, favoring the shift toward efficient, low-emission alternatives. These policies are creating a strong foundation for sustained market growth. European countries are also focusing on the construction of energy-optimized buildings and integrating advanced space heating systems, further accelerating demand. Severe winters and renewed construction activity are fueling the use of heating technologies across both the residential and commercial segments.

The boilers rated at <= 10 MMBTU/hr segment held 88.5% share and is anticipated to grow at a CAGR of 7% through 2034. This category sees extensive deployment in homes and smaller commercial spaces, with increasing urbanization and lifestyle improvements encouraging the upgrade to efficient systems. Supportive government rebates and energy-efficiency programs also play a significant role in consumer adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.5 Billion |

| Forecast Value | $110.5 Billion |

| CAGR | 7.2% |

The oil-fired boiler segment will reach USD 15 billion by 2034, with its growth attributed to the wide availability of fuel and the industry's move toward more efficient heating technologies. Continued expansion in commercial sectors and industrial applications contributes to the segment's momentum, supported by rising energy demands across various industries.

U.K. Boiler Market was valued at USD 11.3 billion in 2024. Key drivers include expansion in large-scale retail operations and strong activity in the refining and metal processing industries. Continued industrial investment, along with the ongoing construction of modern energy-compliant buildings, is solidifying the UK's leadership in regional demand for heating equipment.

Major companies shaping the Europe Boiler Market include Ariston Holding, Bosch Industriekessel, BDR Thermea Group, Babcock Wanson, and Vaillant Group. To strengthen their position in the competitive European boiler market, key manufacturers are adopting multi-tiered strategies. These include ramping up R&D investments to create advanced, energy-efficient boiler systems tailored to both regulatory demands and end-user preferences. Many are forming partnerships with regional distributors and utility providers to expand their market reach and improve service delivery. Others are focusing on hybrid heating systems that combine traditional fuel sources with renewables. At the same time, companies are localizing production and enhancing after-sales services to offer quicker response times, drive customer satisfaction, and build long-term relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material availability & sourcing analysis

- 3.1.1.2 Manufacturing capacity assessment

- 3.1.1.3 Supply chain resilience & risk factors

- 3.1.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of boilers

- 3.8 Price trend analysis

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & industry 4.0 integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & financial landscape

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 France

- 4.2.2 UK

- 4.2.3 Poland

- 4.2.4 Italy

- 4.2.5 Spain

- 4.2.6 Austria

- 4.2.7 Germany

- 4.2.8 Sweden

- 4.2.9 Russia

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 10 MMBTU/hr

- 5.3 > 10 - 50 MMBTU/hr

- 5.4 > 50 - 100 MMBTU/hr

- 5.5 > 100 - 250 MMBTU/hr

- 5.6 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Natural gas

- 6.3 Oil

- 6.4 Coal

- 6.5 Electric

- 6.6 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Offices

- 7.3.2 Healthcare facilities

- 7.3.3 Educational institutions

- 7.3.4 Lodgings

- 7.3.5 Retail stores

- 7.3.6 Others

- 7.4 Industrial

- 7.4.1 Food processing

- 7.4.2 Pulp & paper

- 7.4.3 Chemical

- 7.4.4 Refinery

- 7.4.5 Primary metal

- 7.4.6 Others

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 France

- 8.3 UK

- 8.4 Poland

- 8.5 Italy

- 8.6 Spain

- 8.7 Austria

- 8.8 Germany

- 8.9 Sweden

- 8.10 Russia

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 ACV

- 9.3 Ariston Holding

- 9.4 Babcock & Wilcox

- 9.5 Babcock Wanson

- 9.6 BDR Thermea Group

- 9.7 Bosch Industriekessel

- 9.8 Bradford White Corporation

- 9.9 Carrier

- 9.10 Clayton Industries

- 9.11 DAIKIN INDUSTRIES

- 9.12 Doosan Enerbility

- 9.13 FERROLI

- 9.14 Forbes Marshall

- 9.15 Fulton

- 9.16 Hurst Boiler & Welding

- 9.17 IHI Corporation

- 9.18 John Wood Group

- 9.19 Lennox International

- 9.20 Mitsubishi Heavy Industries

- 9.21 Miura America

- 9.22 Rentech Boilers

- 9.23 Thermax

- 9.24 Vaillant Group

- 9.25 Vattenfall

- 9.26 Weil-McLain