PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833659

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833659

North America and Europe Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

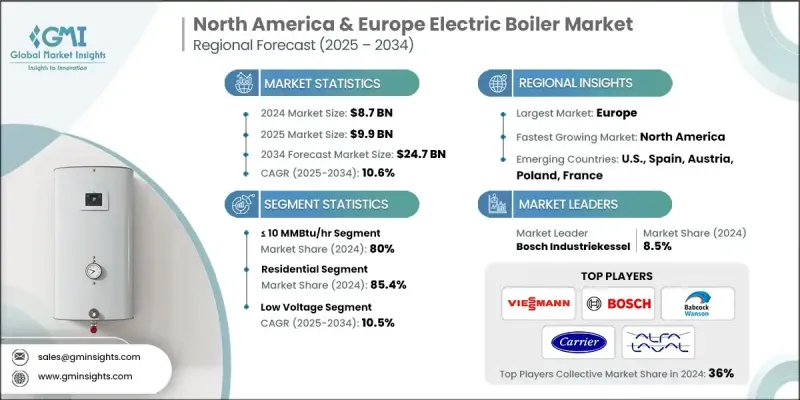

North America & Europe Electric Boiler Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 24.7 billion by 2034.

This growth is fueled by rising demand for energy-efficient heating systems, backed by policy-level support and fiscal incentives aimed at promoting low-carbon solutions. Electric boilers, which operate without combustion, are gaining popularity for their quiet operation, compact design, and minimal maintenance requirements. These systems offer high thermal efficiency and accurate temperature control, making them ideal for both domestic and industrial applications. Intensifying focus on zero-emission infrastructure, alongside regulatory pressure to reduce NOx and SOx emissions, is reshaping the industrial and commercial heating landscape across these regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $24.7 Billion |

| CAGR | 10.6% |

Ongoing investment in power grid modernization and significant improvements in electric boiler design, especially those focused on compactness and high capacity, are helping drive wider adoption. As industries increasingly transition from fossil-based systems to electrified heating solutions, R&D into more advanced boiler technologies continues to grow. The push for cleaner energy alternatives and decarbonization, coupled with rapid urban development and infrastructure expansion, is solidifying the market's position across residential, commercial, and industrial sectors.

The electric boiler segment in the >100-250 MMBtu/hr capacity range generated USD 145 million in 2024. Demand is supported by evolving regulatory standards promoting cleaner technologies and reduced fossil fuel dependency. These boilers are gaining traction for their compact footprint and reduced operational complexity, particularly in settings where floor space is a premium and downtime must be minimized. Favorable policy frameworks and financial benefits further reinforce adoption across large-scale industrial environments.

The commercial segment generated USD 1 billion in 2024. Growing upgrades across public infrastructure, particularly in educational institutions, are driving installations of modern electric boiler systems. Offices and commercial facilities are steadily moving toward electric HVAC systems in pursuit of long-term cost savings and carbon footprint reduction. As more businesses prioritize sustainable practices, the shift to fully electrified heating systems is accelerating across both new and retrofit projects.

North America Electric Boiler Market is expected to reach USD 2.2 billion by 2034. Advancing heating technology, paired with steady industrial growth, is driving product demand across multiple sectors. The region's resurgent manufacturing activity and continued capital infusion in infrastructure projects are enhancing market penetration. The growing interest in high-efficiency, low-maintenance heating systems is reinforcing adoption across both urban and rural areas.

Key players in the North America & Europe Electric Boiler Market include Lochinvar, Bosch Industriekessel, Cerney, Ariston Holding, KOSPEL, Cleaver-Brooks, CARRIER, Bradford White Corporation, WM Technologies, Ecotherm Austria, Clayton Industries, STIEBEL ELTRON, Thermona, Precision Boiler, Thermon, Vapor Power International, Vaillant Group, ALFA LAVAL, Babcock Wanson, Ferroli, Danstoker, Fulton, Hi-Therm Boilers, FONDITAL, Vattenfall, Viessmann, and Flexiheat UK. Leading companies in the North America & Europe Electric Boiler Market are focusing on product innovation and energy efficiency to strengthen their market positions. Many are advancing R&D to develop compact, high-capacity boilers with enhanced thermal control and reduced maintenance needs. Expanding smart integration features for real-time monitoring and diagnostics is also becoming a key differentiator. Strategic partnerships with utility providers and government-backed initiatives allow companies to tap into larger projects, especially in urban redevelopment and green infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of electric boiler

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By region

- 3.8.2 By voltage rating

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future prospects

- 3.11 Digital transformation & industry 4.0 integration

- 3.12 Sustainability initiatives & ESG compliance

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 10 MMBtu/hr

- 5.3 > 10 - 50 MMBtu/hr

- 5.4 > 50 - 100 MMBtu/hr

- 5.5 > 100 - 250 MMBtu/hr

- 5.6 > 250 MMBtu/hr

Chapter 6 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Low voltage

- 6.3 Medium voltage

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Offices

- 7.3.2 Healthcare facilities

- 7.3.3 Educational institutions

- 7.3.4 Lodgings

- 7.3.5 Retail stores

- 7.3.6 Others

- 7.4 Industrial

- 7.4.1 Food processing

- 7.4.2 Pulp & paper

- 7.4.3 Chemical

- 7.4.4 Refinery

- 7.4.5 Primary metal

- 7.4.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 ACV

- 9.3 Ariston Holding

- 9.4 Babcock Wanson

- 9.5 Bosch Industriekessel

- 9.6 Bradford White Corporation

- 9.7 CARRIER

- 9.8 Cerney S.A

- 9.9 Clayton Industries

- 9.10 Cleaver-Brooks

- 9.11 Danstoker

- 9.12 Ecotherm Austria

- 9.13 Ferroli

- 9.14 Flexiheat UK

- 9.15 FONDITAL

- 9.16 Fulton

- 9.17 Hi-Therm Boilers

- 9.18 KOSPEL

- 9.19 Lochinvar

- 9.20 Precision Boiler

- 9.21 STIEBEL ELTRON GmbH & Co. KG

- 9.22 Thermon

- 9.23 Thermona

- 9.24 Vaillant Group

- 9.25 Vapor Power International

- 9.26 Vattenfall

- 9.27 Viessmann

- 9.28 WM Technologies LLC