PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844293

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844293

Coil Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

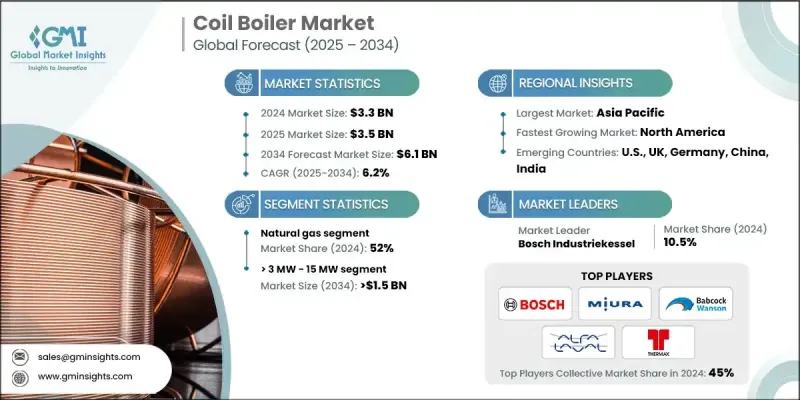

The Global Coil Boiler Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 6.1 billion by 2034.

This growth trajectory reflects the industry's increasing preference for compact, efficient, and quick-response boiler systems. With rising demand for energy-efficient solutions and stricter environmental regulations, businesses are shifting toward coil boiler systems that reduce startup time and optimize fuel usage. These systems are particularly well-suited for industries requiring consistent but flexible steam or hot water generation. The continuous coil design minimizes water storage and speeds up heat transfer, making coil boilers a cost-effective and space-saving alternative to traditional models. Technological advancements in combustion systems, emissions control, and modular boiler configurations are also accelerating adoption across various industrial sectors. Mobile and modular units are enabling flexible deployment for temporary and remote operations, while automation and intelligent control systems are becoming integral features to meet performance and compliance needs. In North America, especially the U.S., modernization initiatives and environmental standards are pushing industries to upgrade legacy equipment with more advanced, low-emission boiler solutions, reinforcing the coil boiler market's momentum over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 6.2% |

A coil boiler is designed to produce steam or hot water through a continuous coil heat exchanger that facilitates fast, direct heat transfer. Unlike shell-and-tube systems, the coil-based approach eliminates the need for large water volumes, allowing quicker start-up times and more consistent operation. The coil configuration ensures water flows through a serpentine path exposed directly to a heat source, making the entire process faster and more energy-efficient. As industries aim to optimize production without expanding facility footprints, the appeal of these compact and modular systems is growing steadily. Technological enhancements continue to shape this market, particularly innovations focused on combustion control, low-NOx emissions, and automation for operational efficiency and regulatory compliance.

The natural gas-fired coil boiler systems segment held a 52% share in 2024 and is forecasted to grow at a CAGR of 5.8% through 2034. These systems are increasingly selected for their ability to meet performance requirements with minimal environmental impact. Known for their high thermal efficiency and ability to handle fluctuating loads, gas-fired coil boilers are widely adopted in industries seeking a cleaner, more responsive heat source. The lower emissions profile compared to conventional boilers makes them a favorable option for businesses prioritizing sustainability and regulatory alignment.

In 2024, the coil boiler market for systems rated <= 290 kW generated USD 330 million. These lower-capacity units are valued for their ease of installation, fast heat-up capabilities, and compact design. Industries with constrained space or dynamic heat demands tend to favor this segment for its balance of energy performance and footprint efficiency. As production environments evolve, demand for these smaller capacity systems continues to rise, especially among operators looking for scalable and reliable solutions.

U.S. Coil Boiler Market held 84.3% share in 2024, generating USD 534.2 million driven by a strong industrial base, aggressive infrastructure modernization efforts, and tighter emission standards. Growing awareness around energy conservation and stricter compliance regulations are motivating manufacturers and plant operators to adopt advanced coil boiler systems. Market expansion is further supported by the shift from outdated, high-emission boilers to cleaner, more efficient models capable of meeting new performance benchmarks.

The coil boiler market features a broad mix of industry leaders and emerging players, including Bryan Steam, Bosch Industriekessel, Thermax, Babcock Wanson, Hurst Boiler & Welding, Ross Boilers, ALFA LAVAL, Unical AG, Vapor Power International, PARKER BOILER, Kawasaki Thermal Engineering, ICI Caldaie, NTI Boilers, Miura America, Cochran, CERTUSS, Ascentec, Maxtherm Boilers, Thermodyne Boilers, HTT ENERGY, Devotion Boiler, Rentech Boiler System, Forbes Marshall, Cannon Bono, Heat11, GekaKonus, Industrial Boilers, and Clayton Industries. To strengthen their market position, companies in the coil boiler industry are adopting several forward-focused strategies. Continuous investment in R&D remains a priority, with a focus on improving energy efficiency, reducing emissions, and integrating intelligent control systems. Many players are expanding their product portfolios to cater to varying capacity needs and load profiles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of coil boilers

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future prospects

- 3.11 Strategic scenario planning

- 3.12 Investment opportunity assessment

- 3.13 Strategic partnership & alliance opportunities

- 3.14 Market entry strategy framework

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Electric

- 5.5 Renewables

- 5.6 Dual fuel

- 5.7 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Hot water

- 6.3 Steam

- 6.4 Thermal fluid

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Chemical

- 7.4 Pharmaceutical & hospital

- 7.5 Pulp & paper

- 7.6 Metal processing

- 7.7 Textile

- 7.8 Oil & fats refining

- 7.9 Others

Chapter 8 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 ≤ 290 kW

- 8.3 > 290 kW - 1.5 MW

- 8.4 > 1.5 MW - 3 MW

- 8.5 > 3 MW - 15 MW

- 8.6 > 15 MW

Chapter 9 Market Size and Forecast, By Pressure, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 ≤ 10 bar

- 9.3 > 10 bar - 25 bar

- 9.4 > 25 bar

Chapter 10 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 Greenfield

- 10.3 Brownfield

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 France

- 11.3.2 UK

- 11.3.3 Poland

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Austria

- 11.3.7 Germany

- 11.3.8 Sweden

- 11.3.9 Norway

- 11.3.10 Denmark

- 11.3.11 Finland

- 11.3.12 Ireland

- 11.3.13 Ukraine

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Philippines

- 11.4.4 Japan

- 11.4.5 South Korea

- 11.4.6 North Korea

- 11.4.7 Australia

- 11.4.8 Indonesia

- 11.4.9 Pakistan

- 11.4.10 Bangladesh

- 11.4.11 Vietnam

- 11.4.12 Taiwan

- 11.4.13 Hong Kong

- 11.4.14 Kazakhstan

- 11.4.15 Thailand

- 11.4.16 Malaysia

- 11.4.17 Singapore

- 11.4.18 Uzbekistan

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 Iran

- 11.5.3 UAE

- 11.5.4 Egypt

- 11.5.5 Nigeria

- 11.5.6 Kenya

- 11.5.7 Morocco

- 11.5.8 South Africa

- 11.5.9 Tunisia

- 11.5.10 Algeria

- 11.5.11 Turkey

- 11.5.12 Arab Republic

- 11.5.13 Jordan

- 11.5.14 Iraq

- 11.6 Latin America

- 11.6.1 Argentina

- 11.6.2 Chile

- 11.6.3 Brazil

- 11.6.4 Colombia

Chapter 12 Company Profiles

- 12.1 ALFA LAVAL

- 12.2 Ascentec GmbH

- 12.3 Babcock Wanson

- 12.4 Bosch Industriekessel

- 12.5 Bryan Steam

- 12.6 Cannon Bono S.p.A.

- 12.7 CERTUSS

- 12.8 Clayton Industries

- 12.9 Cochran

- 12.10 Devotion Boiler

- 12.11 Forbes Marshall

- 12.12 Fulton

- 12.13 GekaKonus

- 12.14 Heat11

- 12.15 HTT ENERGY GMBH

- 12.16 Hurst Boiler & Welding Co.

- 12.17 ICI Caldaie

- 12.18 Industrial Boilers Ltd.

- 12.19 Kawasaki Thermal Engineering Co., Ltd.

- 12.20 Maxtherm Boilers

- 12.21 Miura America Co.

- 12.22 NTI Boilers

- 12.23 PARKER BOILER

- 12.24 Rentech Boiler System

- 12.25 Ross Boilers

- 12.26 SAZ BOILERS

- 12.27 Thermax

- 12.28 Thermodyne Boilers