PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801902

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801902

North America Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

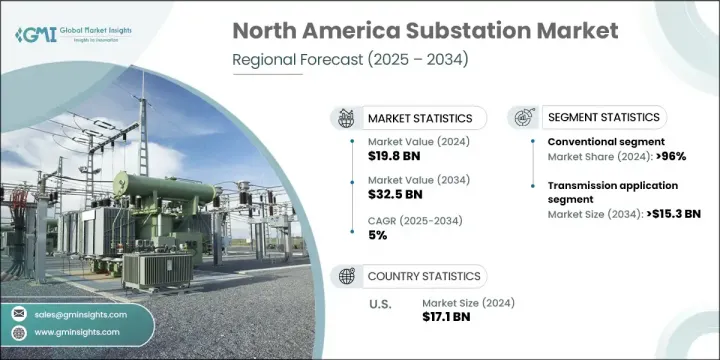

North America Substation Market was valued at USD 19.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 32.5 billion by 2034. Rising electrification across industrial sectors and the rapid expansion of data center infrastructure are significantly boosting substation demand across the region. According to the IEA's Electricity Mid-Year Update 2025, electricity consumption surged in early 2025 due to expanding industrial and digital infrastructure-even amidst broader economic uncertainty. This persistent rise in electricity usage is placing pressure on existing grid infrastructure, demanding continuous upgrades to substations to handle heavier loads and ensure stability across transmission and distribution networks.

In North America, the focus is increasingly shifting toward building substations that support renewable energy integration. Areas with strong wind and solar penetration are seeing substation designs that manage bidirectional energy flows and fluctuating output levels. Enhanced grid connections and substation advancements are playing a vital role in scaling distributed generation. There is a growing move toward integrating long-duration storage into substation design, which helps maintain grid balance and manage peak load demand. Utilities in several regions are investing in modern infrastructure that can support microgrid integration and use advanced modeling tools to optimize substation performance and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $32.5 Billion |

| CAGR | 5% |

The conventional substation segment captured 96% share in 2024 and is projected to grow at a CAGR of 4.9% through 2034. A primary driver behind this trend is the widespread need to replace aging infrastructure. Much of the current substation network was developed decades ago and is now approaching obsolescence. Utilities throughout the United States and Canada are prioritizing modernization to maintain safety, reliability, and operational continuity. According to findings under the U.S. Department of Energy's Grid Modernization Initiative, over 70% of the nation's transmission infrastructure is over 25 years old, reinforcing the urgency to rebuild and refurbish outdated systems.

The transmission segment held a 51.5% share in 2024 and is expected to generate USD 15.3 billion by 2034. The need to transmit energy from geographically remote renewable sources to cities is accelerating investment in high-voltage transmission substations. As interregional power connections grow, especially in areas experiencing renewable expansion, new substations are being added to enhance transmission capacity and support decarbonization goals. These projects are essential to improve grid reach and integrate large-scale clean energy into the system while maintaining system reliability.

United States Substation Market was valued at USD 17.1 billion in 2024, accounting for 86% share. The country is expected to experience substantial growth over the next decade. A strong shift toward electrification-particularly in sectors like heating, transport, and industrial manufacturing-is increasing the need for substation enhancements. These upgrades are critical to accommodate rising demand from electric vehicles, electric heating systems, and clean industrial processes. As multiple states push forward with decarbonization policies and energy transition plans, substation infrastructure remains central to supporting the electrified future.

Leading companies in the North America Substation Market include Siemens Energy, Schneider Electric, GE Vernova, Hitachi Energy, and ABB. Top-tier companies in the North America substation market are pursuing several strategic approaches to strengthen their competitive edge. Major players are prioritizing investments in smart substation technologies with digital automation and IoT capabilities to enhance performance and remote monitoring. Many firms are forming alliances with utility providers to support long-term grid modernization initiatives. Product innovation, especially in areas like modular substations and hybrid systems, is also a key growth lever. Companies are focusing on integrating AI and digital twin models to enable real-time operational analysis.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Component trends

- 2.1.4 Application trends

- 2.1.5 Connectivity trends

- 2.1.6 Voltage level trends

- 2.1.7 End use trends

- 2.1.8 Category trends

- 2.1.9 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import export trade analysis

- 3.3.1 Key importing countries

- 3.3.2 Key exporting countries

- 3.4 Price trend analysis, (USD/Unit)

- 3.4.1 By technology

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (Units, USD Million)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Digital

Chapter 6 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Substation automation systems

- 6.3 Communication network

- 6.4 Electrical systems

- 6.5 Monitoring & control systems

- 6.6 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (Units, USD Million)

- 7.1 Key trends

- 7.2 Transmission

- 7.3 Distribution

Chapter 8 Market Size and Forecast, By Connectivity, 2021 - 2034 (Units, USD Million)

- 8.1 Key trends

- 8.2 ≤ 33 kV

- 8.3 > 33 kV to ≤ 110 kV

- 8.4 > 110 kV to ≤ 220 kV

- 8.5 > 220 kV to ≤ 550 kV

- 8.6 > 550 kV

Chapter 9 Market Size and Forecast, By Voltage Level, 2021 - 2034 (Units, USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Size and Forecast, By End Use, 2021 - 2034 (Units, USD Million)

- 10.1 Key trends

- 10.2 Utility

- 10.3 Industrial

Chapter 11 Market Size and Forecast, By Category, 2021 - 2034 (Units, USD Million)

- 11.1 Key trends

- 11.2 New

- 11.3 Refurbished

Chapter 12 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, Units)

- 12.1 Key trends

- 12.2 U.S.

- 12.3 Canada

- 12.4 Mexico

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 CG Power & Industrial Solutions

- 13.3 Cisco Systems

- 13.4 Efacec

- 13.5 Eaton

- 13.6 Fuji Electric

- 13.7 GE Vernova

- 13.8 Hitachi Energy

- 13.9 L&T Electrical and Automation

- 13.10 Mitsubishi Electric Power Products

- 13.11 NR Electric

- 13.12 Open Systems International

- 13.13 Powell Industries

- 13.14 Rockwell Automation

- 13.15 S&C Electric Company

- 13.16 Schneider Electric

- 13.17 Siemens Energy

- 13.18 SIFANG

- 13.19 Tesco Automation

- 13.20 Texas Instruments Incorporated