PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766264

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766264

Distribution Substation Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

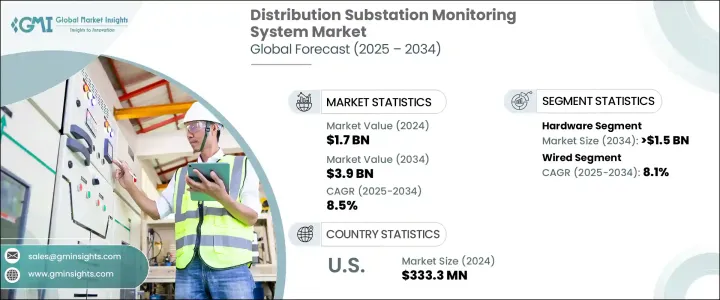

The Global Distribution Substation Monitoring System Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 3.9 billion by 2034. The market is expanding due to the increasing demand for efficient power distribution, especially in urban and industrial areas. As electricity consumption grows, utility companies are under pressure to minimize downtime and optimize system performance. Distribution substation monitoring systems play a critical role by providing real-time data and helping operators make informed decisions. The shift toward smart grid systems and the ongoing automation of substations are major factors driving market growth. Automation facilitates remote control of key components, reducing the need for manual inspections and enhancing both maintenance efficiency and cost-effectiveness.

Additionally, the increasing adoption of renewable energy sources such as wind and solar power continues to drive the demand for distribution substation monitoring systems. As power grids evolve to accommodate these intermittent energy sources, there is a growing need for advanced monitoring systems that ensure stable grid performance. Unlike traditional energy sources, wind and solar power can experience fluctuations based on weather conditions, which requires real-time monitoring to manage these variations effectively. The integration of renewable energy sources often involves complex grid management strategies, and monitoring systems help in optimizing the distribution of power, minimizing losses, and enhancing grid reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 8.5% |

In 2024, the software segment held 32.2% share. This growth is attributed to the increasing demand for advanced analytics, real-time data visualization, and centralized control. These software platforms are essential for transforming raw data from substations into actionable insights that can enhance grid performance, reduce downtime, and optimize decision-making. As utilities focus on improving system efficiency, software tools have become indispensable.

The wired segment, accounting for a significant portion of the market, is projected to grow at a CAGR of 8.1% through 2034. Wired systems like fiber optics and Ethernet-based networks offer reliable, secure, and interference-free data transmission. These systems are particularly preferred in critical substation environments, where real-time monitoring and high data integrity are crucial. Wired solutions provide better performance consistency and data protection compared to wireless technologies, which can be more prone to signal interference and cybersecurity issues. This makes wired technologies a top choice for utilities operating in areas with high-voltage equipment or dense urban populations.

U.S. Distribution Substation Monitoring System Market was valued at USD 333.3 million in 2024, with a significant shift towards renewable energy. Investments in solar and wind energy far outpace those in fossil fuels, reflecting the country's commitment to sustainable energy solutions. This trend is further supported by government funding, innovation acceleration, and a growing need for eco-friendly power distribution systems.

Key players in the Global Distribution Substation Monitoring System Market include ABB Ltd., Cadillac Automation and Controls, Cisco, Eaton Corporation, Emerson Electric, GE Vernova, Honeywell, iGRID t&D, Novatech, Schneider Electric, Schweitzer Engineering Laboratories, Inc., Sentient Energy, Siemens, Tekvel, and Trilliant Holdings Inc. To strengthen their market position, companies in the distribution substation monitoring system sector are focusing on continuous technological advancements.

They are investing in automation and integration with smart grid systems to offer more efficient, real-time monitoring solutions. Additionally, companies are forming strategic partnerships and expanding their product portfolios to cater to the growing demand for renewable energy integration. Many players are also focusing on enhancing the security and reliability of their wired solutions to attract clients in high-risk substation environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 Commercial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 On premises

- 8.3 Cloud based

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Cadillac Automation and Controls

- 10.3 Cisco

- 10.4 Eaton Corporation

- 10.5 Emerson Electric

- 10.6 GE Vernova

- 10.7 Honeywell

- 10.8 iGRID t&D

- 10.9 Novatech

- 10.10 Schneider Electric

- 10.11 Schweitzer Engineering Laboratories, Inc.

- 10.12 Sentient Energy

- 10.13 Siemens

- 10.14 Tekvel

- 10.15 Trilliant Holdings Inc.