PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822564

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822564

Financial Wellness Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

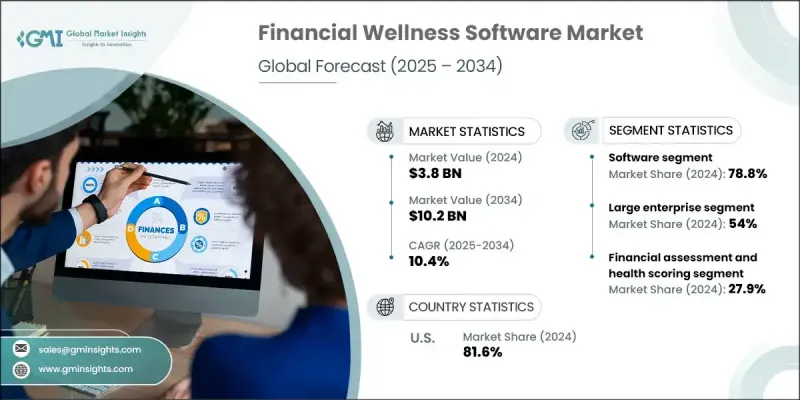

The Global Financial Wellness Software Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 10.2 billion by 2034.

The increasing financial stress experienced by employees across all income levels is fueling the market growth. With rising living costs, mounting personal debt, and economic uncertainty, more individuals are struggling to manage their finances effectively. This has prompted employers to invest in financial wellness platforms as part of their employee benefits strategy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 10.4% |

Rising Adoption in Software

The software segment held sustainable share in 2024 driven by scalable and tech-driven platforms that can be customized to employee needs. These software solutions offer robust tools budgeting, goal setting, debt management, and personalized financial advice all under one digital roof. With remote work and hybrid environments becoming the norm, cloud-based financial wellness software ensures 24/7 accessibility, secure data integration, and real-time updates.

Large Enterprise to Gain Traction

The large enterprise segment generated notable share in 2024, driven by growing investment in employee well-being programs. Big companies understand that financial stress doesn't just impact individuals however, it affects performance, morale, and turnover. With thousands of employees to support, large organizations are adopting scalable financial wellness platforms that offer personalized insights, analytics, and engagement tracking.

Growing Prevalence in Financial Assessment and Health Scoring

The financial assessment and health scoring segment is expected to generate significant share by 2034, as employers seek immeasurable ways to evaluate financial well-being. These tools help users understand where they stand through personalized financial health scores, identifying risk areas and offering actionable steps to improve them.

Regional Insights

U.S to Emerge as a Lucrative Region

U.S. financial wellness software market held sizeable share in 2024, owing to a combination of high financial literacy, employer-driven wellness initiatives, and a robust HR tech ecosystem. American companies are leading the charge when it comes to prioritizing employee financial health. With inflation, student loans, and retirement planning weighing heavily on workers, U.S. employers are proactively turning to digital platforms to offer real-time support.

Major players in the financial wellness software market include PayActiv, Thrive Global, LearnLux, Origin Financial, Prudential Financial, BrightDime, Mercer LLC, Financial Finesse, Enrich (iGrad Inc.), SmartDollar.

Leading players in the financial wellness software market are focusing on product innovation, strategic partnerships, and personalization to enhance their market presence. Many are investing in AI-driven platforms that deliver tailored financial advice, budgeting tools, and real-time support to users. Companies like LearnLux, Financial Finesse, and PayActiv are expanding their offerings through collaborations with employers, HR platforms, and benefits providers, integrating financial wellness tools directly into existing employee benefit ecosystems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Model

- 2.2.4 Organization Size

- 2.2.5 Solution

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Employee Financial Stress

- 3.2.1.2 Growing Adoption of Cloud & AI Technologies

- 3.2.1.3 Employer Focus on Holistic Employee Well-being

- 3.2.1.4 Regulatory and Government Incentives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data Privacy and Security Concerns

- 3.2.2.2 Integration with Legacy HR Systems

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with FinTech and Personalized Services

- 3.2.3.2 Adoption of Cloud-Based and Mobile-First Platforms

- 3.2.3.3 Integration with Corporate Benefits Platforms

- 3.2.3.4 Emergence of AI and Predictive Analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Skills gap analysis and workforce development

- 3.8.1 Current data center skills shortage assessment

- 3.8.2 Future workforce requirements

- 3.8.3 Reskilling and upskilling initiatives

- 3.8.4 Corporate training vs individual certification

- 3.8.5 Academic institution partnerships

- 3.8.6 Government training programs

- 3.8.7 Career path development in data center management

- 3.9 Pricing analysis and cost models

- 3.9.1 Infrastructure cost structure analysis

- 3.9.2 Vendor pricing strategies

- 3.9.3 Subscription vs consumption-based models

- 3.9.4 Colocation pricing packages

- 3.9.5 Power usage cost breakdown

- 3.9.6 ROI assessment for investment

- 3.9.7 Cost comparison across regions

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Employee benefits and wellness market context

- 3.12.1 Global employee benefits market evolution

- 3.12.1.1 Market size and growth trends analysis

- 3.12.1.2 Benefits program modernization and digital transformation

- 3.12.1.3 Employee expectations and experience enhancement

- 3.12.1.4 Generational differences in benefits preferences

- 3.12.2 Financial stress and employee wellbeing crisis

- 3.12.2.1 Financial stress impact on employee productivity

- 3.12.2.2 Mental health and financial wellness correlation

- 3.12.2.3 Absenteeism and turnover cost analysis

- 3.12.2.4 Healthcare cost impact and medical debt issues

- 3.12.3 Workplace wellness program evolution

- 3.12.3.1 Traditional wellness to holistic wellbeing shift

- 3.12.3.2 Physical, mental, and financial wellness integration

- 3.12.3.3 Preventive care and early intervention focus

- 3.12.3.4 ROI measurement and program effectiveness

- 3.12.4 HR technology and benefits administration transformation

- 3.12.4.1 HRIS and benefits platform integration

- 3.12.4.2 Self-service and employee experience enhancement

- 3.12.4.3 Data analytics and personalization capabilities

- 3.12.4.4 Mobile-first and digital-native solutions

- 3.12.1 Global employee benefits market evolution

- 3.13 Financial wellness landscape and consumer behavior

- 3.13.1 Personal financial management challenges

- 3.13.1.1 Household debt and credit management issues

- 3.13.1.2 Retirement savings and planning inadequacy

- 3.13.1.3 Emergency fund and financial resilience gaps

- 3.13.1.4 Financial literacy and education deficits

- 3.13.2 Behavioral finance and decision-making psychology

- 3.13.2.1 Cognitive biases and financial decision making

- 3.13.2.2 Behavioral nudges and intervention effectiveness

- 3.13.2.3 Habit formation and sustainable behavior change

- 3.13.2.4 Gamification and engagement psychology

- 3.13.3 Digital financial services adoption trends

- 3.13.3.1 Mobile banking and digital payment adoption

- 3.13.3.2 Robo-advisory and automated investment growth

- 3.13.3.3 Personal finance app usage and engagement

- 3.13.3.4 Ai-powered financial coaching and guidance

- 3.13.4 Generational financial behavior and preferences

- 3.13.4.1 Millennials and digital-first financial management

- 3.13.4.2 Generation Z and mobile-native expectations

- 3.13.4.3 Generation X and retirement planning focus

- 3.13.4.4 Baby boomers and traditional financial services

- 3.13.1 Personal financial management challenges

- 3.14 Financial wellness software features and capabilities

- 3.14.1 Financial assessment and health scoring

- 3.14.1.1 Comprehensive financial health assessment

- 3.14.1.2 Credit score monitoring and improvement

- 3.14.1.3 Debt-to-income ratio and debt management

- 3.14.1.4 Savings rate and emergency fund analysis

- 3.14.2 Budgeting and expense management

- 3.14.2.1 Automated expense categorization and tracking

- 3.14.2.2 Budget creation and goal setting

- 3.14.2.3 Spending pattern analysis and insights

- 3.14.2.4 Bill reminder and payment automation

- 3.14.3 Savings and investment guidance

- 3.14.3.1 Automated savings and round-up programs

- 3.14.3.2 Investment education and portfolio guidance

- 3.14.3.3 Retirement planning and 401(K) optimization

- 3.14.3.4 Goal-based savings and investment strategies

- 3.14.4 Debt management and credit improvement

- 3.14.4.1 Debt consolidation and payoff strategies

- 3.14.4.2 Credit score improvement and monitoring

- 3.14.4.3 Student loan management and forgiveness programs

- 3.14.4.4 Mortgage and home buying guidance

- 3.14.5 Financial education and coaching

- 3.14.5.1 Personalized financial education content

- 3.14.5.2 Interactive learning modules and assessments

- 3.14.5.3 One-on-one financial coaching and counseling

- 3.14.5.4 Peer learning and community features

- 3.14.1 Financial assessment and health scoring

- 3.15 Data security and privacy framework

- 3.15.1 Financial data protection and security

- 3.15.1.1 Bank-level security and encryption standards

- 3.15.1.2 Multi-factor authentication and access control

- 3.15.1.3 Data tokenization and PCI DSS compliance

- 3.15.1.4 Fraud detection and prevention systems

- 3.15.2 Privacy compliance and regulatory framework

- 3.15.2.1 GDPR and data protection regulation compliance

- 3.15.2.2 CCPA and state privacy law compliance

- 3.15.2.3 HIPAA and health information protection

- 3.15.2.4 SOC 2 and security audit compliance

- 3.15.3 Data governance and management

- 3.15.3.1 Data classification and handling procedures

- 3.15.3.2 Consent management and user control

- 3.15.3.3 Data retention and deletion policies

- 3.15.3.4 Third-party data sharing and partnerships

- 3.15.4 Incident response and business continuity

- 3.15.4.1 Security incident response and recovery

- 3.15.4.2 Business continuity and disaster recovery

- 3.15.4.3 Vendor risk management and due diligence

- 3.15.4.4 Insurance and liability coverage

- 3.15.1 Financial data protection and security

- 3.16 Employee engagement and behavioral change

- 3.16.1 User adoption and engagement strategies

- 3.16.1.1 Onboarding and initial user experience

- 3.16.1.2 Gamification and incentive programs

- 3.16.1.3 Social features and peer comparison

- 3.16.1.4 Push notifications and reminder systems

- 3.16.2 Behavioral change and habit formation

- 3.16.2.1 Behavioral economics and nudge theory application

- 3.16.2.2 Goal setting and progress tracking

- 3.16.2.3 Micro-learning and bite-sized content

- 3.16.2.4 Celebration and achievement recognition

- 3.16.3 Personalization and customization

- 3.16.3.1 Individual financial situation assessment

- 3.16.3.2 Personalized recommendations and action plans

- 3.16.3.3 Cultural and demographic customization

- 3.16.3.4 Learning style and preference adaptation

- 3.16.4 Measurement and analytics

- 3.16.4.1 Engagement metrics and usage analytics

- 3.16.4.2 Behavioral change measurement and tracking

- 3.16.4.3 Financial outcome assessment and correlation

- 3.16.4.4 Program effectiveness and ROI calculation

- 3.16.1 User adoption and engagement strategies

- 3.17 Integration and ecosystem connectivity

- 3.17.1 HR information system (HRIS) integration

- 3.17.1.1 Employee data synchronization and management

- 3.17.1.2 Single sign-on (SSO) and authentication

- 3.17.1.3 Payroll system integration and data flow

- 3.17.1.4 Benefits enrollment and administration integration

- 3.17.2 Financial institution and banking integration

- 3.17.2.1 Bank account aggregation and transaction data

- 3.17.2.2 Credit score and credit report integration

- 3.17.2.3 Investment account and 401(K) connectivity

- 3.17.2.4 Loan and mortgage information integration

- 3.17.3 Third-party service provider integration

- 3.17.3.1 Financial planning and advisory services

- 3.17.3.2 Credit counseling and debt management services

- 3.17.3.3 Insurance and protection product integration

- 3.17.3.4 Educational content and learning platform integration

- 3.17.4 Wellness platform and ecosystem integration

- 3.17.4.1 Physical wellness and health platform integration

- 3.17.4.2 Mental health and EAP program connectivity

- 3.17.4.3 Benefits administration platform integration

- 3.17.4.4 Rewards and recognition program integration

- 3.17.1 HR information system (HRIS) integration

- 3.18 Personalization and AI-powered insights

- 3.18.1 Artificial intelligence and machine learning applications

- 3.18.1.1 Predictive analytics and risk assessment

- 3.18.1.2 Personalized recommendation engines

- 3.18.1.3 Natural language processing and chatbots

- 3.18.1.4 Behavioral pattern recognition and analysis

- 3.18.2 Data-driven personalization and customization

- 3.18.2.1 Individual financial profile and situation analysis

- 3.18.2.2 Goal-based recommendations and action plans

- 3.18.2.3 Life event detection and adaptive guidance

- 3.18.2.4 Risk tolerance and investment preference assessment

- 3.18.3 Behavioral insights and intervention strategies

- 3.18.3.1 Spending pattern analysis and alerts

- 3.18.3.2 Savings opportunity identification and automation

- 3.18.3.3 Debt reduction strategy optimization

- 3.18.3.4 Financial goal achievement tracking and support

- 3.18.4 Continuous learning and model improvement

- 3.18.4.1 User feedback integration and model training

- 3.18.4.2 A/B testing and optimization

- 3.18.4.3 Outcome measurement and algorithm refinement

- 3.18.4.4 Bias detection and fairness optimization

- 3.18.1 Artificial intelligence and machine learning applications

- 3.19 Future technology roadmap and innovation timeline

- 3.19.1 Technology evolution and enhancement (2024-2034)

- 3.19.1.1 AI and machine learning advancement

- 3.19.1.2 Voice interface and conversational AI

- 3.19.1.3 Augmented reality and immersive learning

- 3.19.1.4 Blockchain and secure identity management

- 3.19.2 Financial services integration and innovation

- 3.19.2.1 Embedded finance and banking-as-a-service

- 3.19.2.2 Real-time payments and instant settlement

- 3.19.2.3 Open banking and data portability enhancement

- 3.19.2.4 Central bank digital currency (CBDC) integration

- 3.19.3 Behavioral science and psychology integration

- 3.19.3.1 Advanced behavioral nudging and intervention

- 3.19.3.2 Neuroeconomics and brain science application

- 3.19.3.3 Social psychology and peer influence integration

- 3.19.3.4 Habit formation and behavior change optimization

- 3.19.4 Platform evolution and ecosystem development

- 3.19.4.1 Super app and comprehensive platform development

- 3.19.4.2 Marketplace and third-party integration

- 3.19.4.3 B2B2C and white-label platform expansion

- 3.19.4.4 Industry-specific and vertical solution development

- 3.19.1 Technology evolution and enhancement (2024-2034)

- 3.20 Technology & innovation landscape

- 3.20.1 Technology & architecture

- 3.20.1.1 Microservices, cloud, mobile, APIs, security, AI/ML, blockchain, AR/VR, data management, integration

- 3.20.1.2 DevOps & continuous deployment (CI/CD, automated testing, release management)

- 3.20.1.3 Performance, uptime, and SLAS (latency, disaster recovery, high-availability)

- 3.20.1.4 Low-code/no-code enablement (customization, workflow automation)

- 3.20.2 Data & analytics

- 3.20.2.1 Real-time analytics, data lake/warehouse, privacy, consent, monetization

- 3.20.2.2 Explainable AI (XAI)

- 3.20.2.3 Data sovereignty (cross-border data transfer, residency)

- 3.20.2.4 Synthetic data (model training/testing, privacy)

- 3.20.3 User experience & accessibility

- 3.20.3.1 Mobile-first, accessibility, personalization

- 3.20.3.2 Omnichannel experience (web, mobile, chat, voice, in-person)

- 3.20.3.3 Localization (language, currency, regulatory, cultural adaptation)

- 3.20.4 Innovation & emerging trends

- 3.20.4.1 Blockchain, AR/VR, conversational UI, embedded finance, biometrics

- 3.20.4.2 Quantum computing (impact on encryption, security, analytics)

- 3.20.4.3 Personalized nudging at scale (hyper-personalized, context-aware interventions)

- 3.20.4.4 Wearables integration (health-financial wellness convergence)

- 3.20.1 Technology & architecture

- 3.21 Use cases

- 3.21.1 Cybersecurity and data protection analysis

- 3.21.2 Interoperability and standards analysis

- 3.21.3 Training and change management

- 3.21.4 Digital transformation impact analysis

- 3.21.5 Emerging use cases and applications

- 3.22 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Financial assessment and health scoring

- 8.3 Budgeting and expense management

- 8.4 Savings and investment guidance

- 8.5 Debt management and credit improvement

- 8.6 Financial education and coaching

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Healthcare

- 9.5 Manufacturing

- 9.6 Retail & E-commerce

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Betterment at Work

- 11.1.2 Enrich (iGrad Inc.)

- 11.1.3 Financial Finesse

- 11.1.4 LearnLux

- 11.1.5 Mercer LLC

- 11.1.6 Origin Financial

- 11.1.7 PayActiv

- 11.1.8 Prudential Financial

- 11.1.9 Salary Finance

- 11.1.10 SmartDollar (Dave Ramsey Solutions)

- 11.1.11 SoFi at Work

- 11.2 Regional Players

- 11.2.1 BrightDime

- 11.2.2 BrightPlan

- 11.2.3 Commonwealth

- 11.2.4 Edukate

- 11.2.5 Even Responsible Finance

- 11.2.6 FinFit

- 11.2.7 Holisticly

- 11.2.8 My Secure Advantage (MSA)

- 11.2.9 Thrive Global