PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822586

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822586

MEA Barge Transportation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

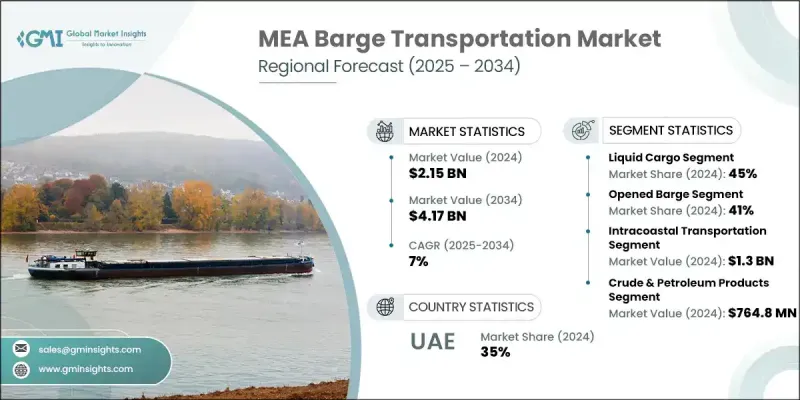

The MEA Barge Transportation Market was valued at USD 2.15 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 4.17 billion by 2034.

The Middle East and Africa (MEA) barge transportation market is driven by increasing intra-regional trade, port expansions, and demand for cost-effective bulk logistics. Barge transport operators are still at the initial stage of adopting digital tracking and automated scheduling and fleet management platforms to improve overall efficiency and transparency. However, real-time cargo monitoring with route optimization tools has helped provide predictability in delivery schedules for domestic and cross-border trade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.15 Billion |

| Forecast Value | $4.17 Billion |

| CAGR | 7% |

The MEA barge transportation sector growth is heavily linked to the increase in trade of oil, gas, minerals, and agricultural commodities. Crude oil and refined products movements will continue to dominate for many countries, such as Nigeria and Iraq, that mainly rely on inland waterways for transporting these commodities, while countries like Sudan and Egypt are exploring barge transport as a more efficient way to discharge grains and fertilizers. This need to ensure secure and low-cost transport of these fundamental goods is translating into increased demand for barge operations, thereby strengthening inland energy and agricultural trade corridors as glaring market growth strategies.

The liquid cargo segment held a 45% share in 2024 and is expected to grow at a CAGR of 6% through 2025-2034. In the MEA barge transportation market, liquid cargo makes up the largest segment, and the region is heavily reliant on petroleum products, chemicals, and refined oil by barge. Inland waterways and coastal barge routes are utilized to facilitate the movements of crude oil, diesel, and gasoline in countries like Nigeria, Iraq, and Egypt. The barge for liquid bulk is not only efficient but also significantly lower in cost and safer to move, which is important in meeting the demands of industrial operations and continuously providing supplies for export and energy. Barge transportation of liquid cargo is an essential part of the fluidity and legacy of the energy supply chain in the region.

The opened barge segment held a 41% share in 2024, and the segment is expected to grow at a CAGR of 8% from 2025 to 2034. Opened barges represent the largest segment in the MEA barge transportation market due to their versatility in carrying bulk commodities such as coal, iron ore, grains, construction materials, and containers. Their open-top design makes it easy to load and unload heavy and oversized cargo efficiently, and they are typically the cheapest option for transporting goods by water, whether inland or coastal.

UAE Barge Transportation Market held a 35% share and generated USD 384.3 million in 2024. The largest market for barge transportation in the Middle East is in the UAE. This is due to its favorable location along some of the world's largest shipping lanes, as well as with important ports such as Jebel Ali, Abu Dhabi, Khalifa, and Fujairah operating as regional hubs for bulk cargo (notably crude oil, petroleum products, and containers). As barges are a lower-cost option for intra-port and coastal logistics, and with the extensive infrastructure, modern port facilities, and the presence of global shipping companies, the UAE remains the largest regional market for barge transport.

The top companies in the MEA Barge Transportation Market are Gulf Agency Company, ADNOC Logistics & Services, ARTCo Barge & Stevedoring, Astro Offshore, African Marine Solutions, CMA CGM, and A.P. Moller - Maersk. To solidify their market position and expand their footprint, companies in the MEA barge transportation sector focus on several strategic initiatives. They are investing in digital transformation by integrating real-time tracking and automated fleet management systems to enhance operational efficiency and transparency. Building strong partnerships with port authorities, logistics providers, and key commodity producers allows them to secure steady cargo volumes and streamline supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 MEA

- 1.2.2 Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.3.3 GMI proprietary AI system

- 1.3.3.1 AI-Powered research enhancement

- 1.3.3.2 Source consistency protocol

- 1.3.3.3 AI accuracy metrics

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Quantified market impact analysis

- 1.5.2.1 Mathematical impact of growth parameters on forecast

- 1.5.2.2 Scenario Analysis Framework

- 1.6 Research assumptions and limitations

- 1.7 Research Trail & Confidence Scoring

- 1.7.1 Research Trail Components

- 1.7.2 Scoring Components

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Cargo

- 2.2.3 Barge Fleet

- 2.2.4 Barging Activity

- 2.2.5 Size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 MEA economic landscape

- 3.2.1.1 Regional economic integration and trade patterns

- 3.2.1.1.1 African continental free trade area impact

- 3.2.1.1.2 Gulf cooperation council trade dynamics

- 3.2.1.1.3 Intra-regional trade growth and opportunities

- 3.2.1.1.4 Global trade integration and export corridors

- 3.2.1.2 Key economic sectors and commodity flows

- 3.2.1.2.1 Oil and gas transportation requirements

- 3.2.1.2.2 Mining and Mineral Export Logistics

- 3.2.1.2.3 Agricultural product distribution networks

- 3.2.1.2.4 Manufacturing and industrial cargo movements

- 3.2.1.3 Economic development and infrastructure investment

- 3.2.1.3.1 National development plans and vision programs

- 3.2.1.3.2 Infrastructure investment and funding sources

- 3.2.1.3.3 Public-private partnership models

- 3.2.1.3.4 International development finance and support

- 3.2.1.1 Regional economic integration and trade patterns

- 3.3 Impact on forces

- 3.3.1 Growth drivers

- 3.3.1.1 Expansion of oil & gas exploration and production activities

- 3.3.1.2 Rising mineral and agricultural commodity exports

- 3.3.1.3 Government investment in port and inland waterway infrastructure

- 3.3.1.4 Increasing demand for low-carbon freight solutions

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Limited navigable inland waterways in arid regions

- 3.3.2.2 Vulnerability to climate change and water level fluctuations

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion of cross-border trade corridors

- 3.3.3.2 Adoption of technologically advanced, automated barges

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Patent analysis

- 3.6 Waterway infrastructure and navigation analysis

- 3.6.1.1 Major waterway systems and navigation routes

- 3.6.1.2 Nile river system and navigation potential

- 3.6.1.3 Niger river and West African waterway network

- 3.6.1.4 Congo river basin and Central African routes

- 3.6.2 Arabian gulf and red sea coastal routes

- 3.6.2.1 Port infrastructure and terminal facilities

- 3.6.2.2 Major ports and barge terminal capabilities

- 3.6.2.3 Inland port development and investment

- 3.6.2.4 Cargo handling equipment and technology

- 3.6.3 Storage and warehousing facilities

- 3.6.3.1 Navigation infrastructure and channel maintenance

- 3.6.3.2 Channel depth and width requirements

- 3.6.3.3 Dredging and maintenance programs

- 3.6.3.4 Navigation aids and safety systems

- 3.6.4 Lock and dam systems development

- 3.6.4.1 Infrastructure investment and development projects

- 3.6.4.2 Government infrastructure investment programs

- 3.6.4.3 International development bank funding

- 3.6.4.4 Private sector investment and PPP models

- 3.6.4.5 Regional cooperation and cross-border projects

- 3.7 Regulatory environment and policy framework

- 3.7.1 National maritime and inland waterway regulations

- 3.7.1.1 Vessel registration and licensing requirements

- 3.7.1.2 Safety and environmental standards

- 3.7.1.3 Crew certification and training requirements

- 3.7.1.4 Cargo handling and security regulations

- 3.7.2 International maritime conventions and standards

- 3.7.2.1 IMO conventions and regional implementation

- 3.7.2.2 Solas and safety standards compliance

- 3.7.2.3 MARPOL environmental protection requirements

- 3.7.2.4 International labor organization standards

- 3.7.3 Trade facilitation and customs procedures

- 3.7.3.1 Customs clearance and documentation requirements

- 3.7.3.2 Transit and cross-border procedures

- 3.7.3.3 Trade agreement benefits and preferences

- 3.7.3.4 Digital trade facilitation initiatives

- 3.7.4 Environmental regulations and sustainability requirements

- 3.7.4.1 Emission standards and environmental protection

- 3.7.4.2 Ballast water management requirements

- 3.7.4.3 Waste management and pollution prevention

- 3.7.4.4 Climate change mitigation and adaptation

- 3.7.1 National maritime and inland waterway regulations

- 3.8 Fleet composition and vessel technology analysis

- 3.8.1 Barge fleet characteristics and specifications

- 3.8.1.1 Vessel size and capacity analysis

- 3.8.1.2 Cargo-specific barge design and configuration

- 3.8.1.3 Age profile and fleet modernization needs

- 3.8.1.4 Ownership structure and fleet management

- 3.8.2 Propulsion and navigation technology

- 3.8.2.1 Engine technology and fuel efficiency

- 3.8.2.2 Navigation and communication systems

- 3.8.2.3 Automation and remote monitoring capabilities

- 3.8.2.4 Safety and emergency response systems

- 3.8.3 Cargo handling and loading systems

- 3.8.3.1 Specialized cargo handling equipment

- 3.8.3.2 Loading and unloading efficiency systems

- 3.8.3.3 Cargo securing and safety systems

- 3.8.3.4 Environmental protection and containment

- 3.8.4 Fleet optimization and capacity management

- 3.8.4.1 Route optimization and scheduling systems

- 3.8.4.2 Capacity utilization and load factor analysis

- 3.8.4.3 Maintenance and lifecycle management

- 3.8.4.4 Fleet expansion and investment planning

- 3.8.1 Barge fleet characteristics and specifications

- 3.9 Cost structure and pricing analysis

- 3.9.1 Operating cost components and structure

- 3.9.1.1 Fuel costs and energy efficiency (30-40%)

- 3.9.1.2 Crew and labor costs (20-25%)

- 3.9.1.3 Maintenance and repair costs (15-20%)

- 3.9.1.4 Insurance and regulatory compliance (8-12%)

- 3.9.1.5 Port charges and navigation fees (5-10%)

- 3.9.2 Capital investment and asset utilization

- 3.9.2.1 Vessel acquisition and financing costs

- 3.9.2.2 Infrastructure investment requirements

- 3.9.2.3 Asset utilization and return on investment

- 3.9.2.4 Depreciation and asset lifecycle management

- 3.9.3 Pricing models and revenue optimization

- 3.9.3.1 Freight rate structures and pricing mechanisms

- 3.9.3.2 Contract vs spot market pricing

- 3.9.3.3 Volume discounts and long-term agreements

- 3.9.3.4 Fuel surcharge and cost pass-through mechanisms

- 3.9.4 Competitive pricing and market positioning

- 3.9.4.1 Price comparison with alternative transport modes

- 3.9.4.2 Value proposition and service differentiation

- 3.9.4.3 Market pricing trends and elasticity

- 3.9.4.4 Competitiveness and efficiency gains

- 3.9.1 Operating cost components and structure

- 3.10 Technology & innovation landscape

- 3.10.1 Current technology adoption

- 3.10.1.1 Digital platform development and integration

- 3.10.1.2 Automation and process optimization

- 3.10.1.3 Data analytics and business intelligence

- 3.10.1.4 Cloud computing and system integration

- 3.10.2 Emerging technologies and innovation trends

- 3.10.2.1 Internet of things (IoT) and sensor networks

- 3.10.2.2 Artificial intelligence and machine learning

- 3.10.2.3 Blockchain and distributed ledger technology

- 3.10.2.4 Autonomous vessel technology development

- 3.10.3 Communication and connectivity solutions

- 3.10.3.1 Satellite communication and tracking systems

- 3.10.3.2 Mobile and wireless connectivity

- 3.10.3.3 Real-time data exchange and integration

- 3.10.3.4 Customer communication and service platforms

- 3.10.4 Innovative investment and technology partnerships

- 3.10.4.1 R&D investment and technology development

- 3.10.4.2 Technology partnership and collaboration

- 3.10.4.3 Startup ecosystem and innovation hubs

- 3.10.4.4 Government support and innovation programs

- 3.10.1 Current technology adoption

- 3.11 Safety and security framework

- 3.11.1 Maritime safety standards and protocols

- 3.11.1.1 Vessel safety equipment and systems

- 3.11.1.2 Crew training and safety certification

- 3.11.1.3 Emergency response and contingency planning

- 3.11.1.4 Accident investigation and prevention

- 3.11.2 Security measures and risk management

- 3.11.2.1 Cargo security and anti-theft measures

- 3.11.2.2 Port security and access control

- 3.11.2.3 Cybersecurity and digital system protection

- 3.11.2.4 Piracy and maritime crime prevention

- 3.11.3 Insurance and risk transfer mechanisms

- 3.11.3.1 Marine insurance coverage and requirements

- 3.11.3.2 Cargo insurance and liability protection

- 3.11.3.3 Business interruption and operational risk

- 3.11.3.4 Risk assessment and premium optimization

- 3.11.4 Crisis management and business continuity

- 3.11.4.1 Crisis response and communication protocols

- 3.11.4.2 Business continuity planning and recovery

- 3.11.4.3 Supply chain disruption management

- 3.11.4.4 Stakeholder communication and coordination

- 3.11.1 Maritime safety standards and protocols

- 3.12 Human capital and workforce development

- 3.12.1 Workforce requirements and skill demands

- 3.12.1.1 Crew and operational staff requirements

- 3.12.1.2 Technical and engineering skills needs

- 3.12.1.3 Management and administrative capabilities

- 3.12.1.4 Digital and technology skills development

- 3.12.2 Training and certification programs

- 3.12.2.1 Maritime training institutions and programs

- 3.12.2.2 International certification and standards

- 3.12.2.3 Continuing education and skill upgrading

- 3.12.2.4 Safety and emergency response training

- 3.12.3 Labor market dynamics and employment

- 3.12.3.1 Labor availability and recruitment challenges

- 3.12.3.2 Wage levels and employment conditions

- 3.12.3.3 Labor mobility and cross-border employment

- 3.12.3.4 Gender equality and diverse initiatives

- 3.12.4 Capacity building and development programs

- 3.12.4.1 Government workforce development initiatives

- 3.12.4.2 International development program support

- 3.12.4.3 Private sector training and development

- 3.12.4.4 Regional cooperation and knowledge sharing

- 3.12.1 Workforce requirements and skill demands

- 3.13 Financial analysis and investment intelligence

- 3.13.1 Market financial performance and profitability

- 3.13.1.1 Revenue growth analysis and market size

- 3.13.1.2 Profitability margins and cost management

- 3.13.1.3 Return on investment and asset utilization

- 3.13.1.4 Financial performance benchmarking

- 3.13.2 Investment requirements and capital allocation

- 3.13.2.1 Fleet investment and vessel acquisition

- 3.13.2.2 Infrastructure development investment

- 3.13.2.3 Technology and digitalization investment

- 3.13.2.4 Working capital and operational funding

- 3.13.3 Financing models and capital sources

- 3.13.3.1 Traditional bank financing and credit

- 3.13.3.2 Development finance and multilateral lending

- 3.13.3.3 Private equity and investment funds

- 3.13.3.4 Government grants and subsidies

- 3.13.4 Economic impact and value creation

- 3.13.4.1 Economic impact assessment and GDP contribution

- 3.13.4.2 Employment creation and skills development

- 3.13.4.3 Trade facilitation and economic integration

- 3.13.4.4 Regional development and infrastructure benefits

- 3.13.1 Market financial performance and profitability

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Production statistics

- 3.16.1 Production and consumption hubs

- 3.16.2 Export and import analysis

- 3.16.3 Trade flow patterns

- 3.17 Sustainability analysis

- 3.17.1 Environmental performance and carbon footprint

- 3.17.1.1 Greenhouse gas emissions and carbon intensity

- 3.17.1.2 Air quality impact and local emissions

- 3.17.1.3 Water quality protection and pollution prevention

- 3.17.1.4 Noise pollution and community impact

- 3.17.2 Sustainable transportation solutions

- 3.17.2.1 Alternative fuel and propulsion systems

- 3.17.2.2 Energy efficiency and optimization technologies

- 3.17.2.3 Renewable energy integration opportunities

- 3.17.2.4 Green shipping practices and certification

- 3.17.3 Environmental compliance and regulations

- 3.17.3.1 International environmental standards compliance

- 3.17.3.2 National environmental regulations and permits

- 3.17.3.3 Environmental impact assessment requirements

- 3.17.3.4 Monitoring and reporting obligations

- 3.17.4 Climate change adaptation and resilience

- 3.17.4.1 Climate change impact on waterway operations

- 3.17.4.2 Adaptation strategies and infrastructure resilience

- 3.17.4.3 Water level management and seasonal variations

- 3.17.4.4 Extreme weather event preparedness

- 3.17.1 Environmental performance and carbon footprint

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Market structure and competitive dynamics

- 4.3.1 Market concentration and operator landscape

- 4.3.2 Competitive intensity and service differentiation

- 4.3.3 Market share distribution and route control

- 4.3.4 Barriers to entry and competitive advantages

- 4.4 Strategic group analysis and positioning framework

- 4.4.1 Service scope vs geographic coverage matrix

- 4.4.2 Asset ownership vs service integration strategy

- 4.4.3 Cargo specialization vs diversification approach

- 4.4.4 Regional vs international market focus

- 4.5 Competitive strategy assessment and benchmarking

- 4.5.1 Operational excellence and cost leadership

- 4.5.2 Service differentiation and value creation

- 4.5.3 Market expansion and route development

- 4.5.4 Technology innovation and digital transformation

- 4.6 Competitive positioning matrix

- 4.7 Strategic outlook matrix

- 4.8 Key developments

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Cargo, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Liquid cargo

- 5.3 Gaseous cargo

- 5.4 Dry cargo

Chapter 6 Market Estimates & Forecast, By Barge Fleet, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Covered barge

- 6.3 Opened barge

- 6.4 Tank barge

Chapter 7 Market Estimates & Forecast, By Barging Activity, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Intracoastal transportation

- 7.3 Inland water transport

Chapter 8 Market Estimates & Forecast, By Size, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 140ft to 180ft

- 8.3 195ft to 250ft

- 8.4 260ft to 300ft

- 8.5 300ft and above

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 Coal

- 9.3 Crude & petroleum products

- 9.4 Liquid chemicals

- 9.5 Food pulp & other liquid

- 9.6 Agricultural products

- 9.7 Metal ores and fabricated metal products

- 9.8 Pharmaceuticals

- 9.9 Dry & gaseous chemicals

- 9.10 LPG, CNG, and other gaseous products

- 9.11 Electronics & digital equipment

- 9.12 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Units)

- 10.1 Middle East

- 10.1.1 Bahrain

- 10.1.2 Kuwait

- 10.1.3 Oman

- 10.1.4 Qatar

- 10.1.5 Saudi Arabia

- 10.1.6 UAE

- 10.2 North Africa

- 10.2.1 Algeria

- 10.2.2 Egypt

- 10.2.3 Libya

- 10.2.4 Morocco

- 10.2.5 Tunisia

- 10.3 West Africa

- 10.3.1 Ghana

- 10.3.2 Guinea

- 10.3.3 Liberia

- 10.3.4 Nigeria

- 10.3.5 Senegal

- 10.3.6 Togo

- 10.4 East Africa

- 10.4.1 Somalia

- 10.4.2 Kenya

- 10.4.3 Somalia

- 10.4.4 Tanzania

- 10.4.5 Djibouti

- 10.5 Southern Africa

- 10.5.1 Angola

- 10.5.2 Mozambique

- 10.5.3 South Africa

- 10.5.4 Namibia

- 10.5.5 Madagascar

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 DP World (UAE)

- 11.1.2 Bollore Logistics

- 11.1.3 Maersk Line

- 11.1.4 CMA CGM

- 11.1.5 MSC (Mediterranean Shipping Company)

- 11.1.6 Kirby Corporation

- 11.2 Regional Players

- 11.2.1 National Marine Dredging Company (UAE)

- 11.2.2 Saudi Arabian Maritime Company

- 11.2.3 Egyptian River Transport Authority

- 11.2.4 Nigerian Inland Waterways Authority

- 11.2.5 South African Port Authorities

- 11.2.6 Moroccan National Ports Agency

- 11.2.7 Gulf Agency Company

- 11.2.8 GAC Marine

- 11.2.9 Marquette Transportation Company

- 11.2.10 Astro Offshore

- 11.2.11 Liwa Marine Services

- 11.2.12 Marine Core & Charter

- 11.3 Emerging Players

- 11.3.1 African Logistics Network

- 11.3.2 Gulf Marine Services

- 11.3.3 Nile River Transportation Company

- 11.3.4 West African Barge Operators Consortium