PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822611

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822611

Smart Water Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

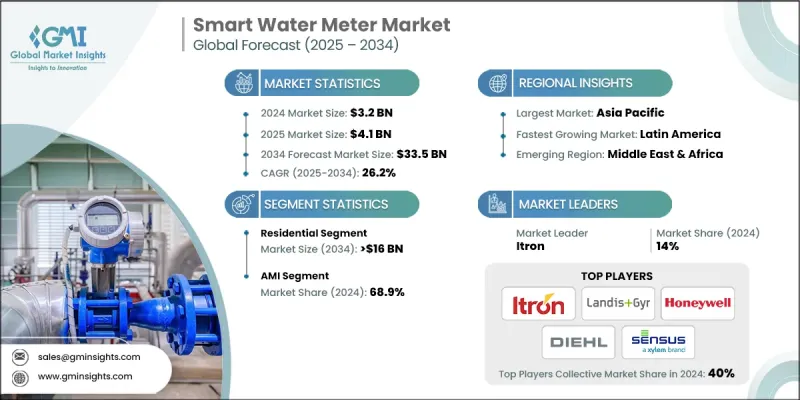

The Global Smart Water Meter Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 26.2% to reach USD 33.5 billion by 2034, driven by the demand for real-time data and the expansion of smart city initiatives. According to a report by the United Nations, urban areas are expected to house 68% of the world's population by 2050, highlighting the need for efficient water management systems. Real-time data allows for precise monitoring, quick detection of issues, and optimized water management, enhancing operational efficiency and resource conservation. As smart city projects proliferate, integrating smart water meters into urban infrastructure becomes crucial for improving overall water management and infrastructure connectivity. This growing emphasis on advanced data solutions and smart technology integration fuels market expansion and adoption across various sectors.

For instance, in June 2024, LAISON introduced a Sigfox-enabled smart water meter designed to meet the increasing demand for advanced water management solutions in the market. The integration of Sigfox technology enhances connectivity and data transmission capabilities, catering to the need for reliable real-time monitoring. This innovation reflects the market trend towards advanced, connected systems and supports the broader adoption of smart water meters across various sectors. The smart water meter industry is fragmented based on application, technology, product, and region. The commercial segment will see a considerable surge by 2032, attributed to the high demand for accurate water usage monitoring in businesses and industries. Commercial establishments require precise water management to optimize operational efficiency, reduce costs, and comply with regulatory requirements. Smart water meters offer real-time data, leak detection, and automated billing, making them ideal for large-scale water consumers. The need for efficient water resource management in commercial applications drives significant adoption, solidifying this segment's dominant market position.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $33.5 Billion |

| CAGR | 26.2% |

The hot water meter segment will garner remarkable gains by 2032, fueled by the rising need for precise monitoring of hot water usage in residential, commercial, and industrial settings. Accurate measurement of hot water consumption helps optimize energy usage, reduce costs, and ensure efficient resource management. The integration of advanced technologies in smart hot water meters allows for real-time data collection and improved billing accuracy. This growing demand for effective hot water management solutions drives the dominance of this segment in the market. Asia Pacific smart water meter market share will secure a moderate CAGR through 2032, owing to rapid urbanization, increasing population, and rising water scarcity issues. Governments in the region are investing heavily in smart infrastructure to improve water management and efficiency. The growing adoption of smart city initiatives and advancements in IoT technology further drive the market. High demand for accurate water usage monitoring in both residential and commercial sectors positions APAC as a central contributor to the global smart water meter industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 AMI

- 6.3 AMR

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Hot water meter

- 7.3 Cold water meter

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Apator S.A.

- 9.3 Arad Group:

- 9.4 Badger Meter, Inc.

- 9.5 BMETERS S.r.l

- 9.6 Diehl Stiftung & Co. KG

- 9.7 Honeywell International Inc.

- 9.8 Itron Inc.

- 9.9 Kamstrup

- 9.10 Landis+Gyr

- 9.11 Neptune Technology Group Inc.

- 9.12 Ningbo Water Meter Co., Ltd.

- 9.13 Schneider Electric

- 9.14 Siemens

- 9.15 Sontex SA

- 9.16 Xylem (Sensus)

- 9.17 ZENNER International GmbH & Co. KG

- 9.18 Suez

- 9.19 Baylan Water Meters

- 9.20 BOVE Technology