PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822622

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822622

Automatic Door Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

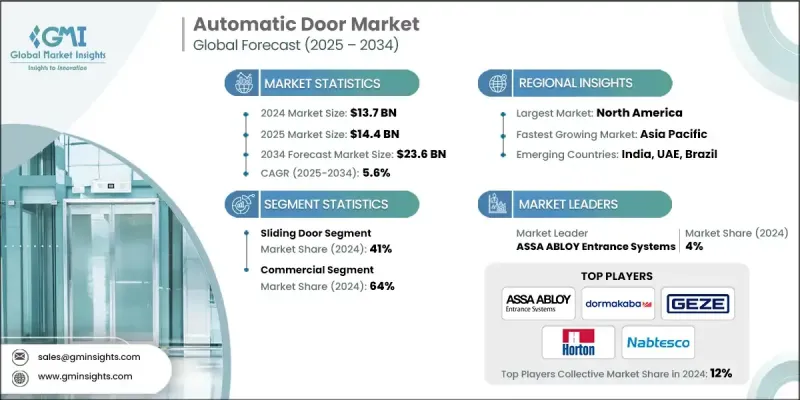

The Global Automatic Door Market was valued at USD 13.7 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 23.6 billion by 2034.

The heightened awareness of hygiene and public health, after the COVID-19 pandemic, has significantly accelerated the shift toward contactless technologies. Automatic doors have become a critical solution in minimizing physical touchpoints, especially in high-traffic environments such as hospitals, airports, retail stores, and office buildings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 Billion |

| Forecast Value | $23.6 Billion |

| CAGR | 5.6% |

Rising Demand for Sliding Door

The sliding door segment held a significant share in 2024, driven by its efficiency in high-traffic areas and ability to maximize space. These doors are favored in commercial environments such as airports, hospitals, and retail chains where continuous flow and ease of access are essential. Sliding doors offer a sleek, modern look and are often equipped with motion sensors for seamless operation. Their low-friction mechanism and minimal footprint make them a practical choice for both new constructions and retrofits. As building designs continue to emphasize open spaces and accessibility, demand for sliding automatic doors remains strong, contributing steadily to market growth.

Commercial Segment to Gain Traction

The commercial segment generated sizeable revenues in 2024, owing to the widespread adoption across shopping malls, office buildings, hospitality venues, and healthcare facilities. These spaces require reliable, user-friendly entry systems that can handle constant foot traffic without compromising on safety or aesthetics. Automatic doors in commercial applications not only improve user experience but also support energy efficiency by controlling airflow and temperature stability. As consumer expectations for convenience and hygiene continue to rise, businesses are prioritizing automated entry solutions to enhance operational efficiency and customer satisfaction.

Regional Insights

North America to Emerge as a Propelling Region

North America automatic door market held a robust share in 2024, backed by strong infrastructure, high construction standards, and regulatory emphasis on accessibility. The United States has witnessed increased adoption of touchless entry systems across healthcare, retail, and public sector buildings in the post-pandemic era. With a growing focus on energy-efficient and smart buildings, automatic doors are being integrated into modern construction as a functional and aesthetic element.

Major players in the automatic door market are Ultra Safe Security Doors, Dormakaba Group, GEZE GmbH, Record USA, Wilcox Door Service Inc., TORMAX USA Inc., Zhejiang Seacon Door Technology Co., Ltd., Royal Boon Edam International B.V., Panasonic Corporation, Stanley Access Technologies (a part of Dormakaba), Vortex Industries, Inc., Entrematic, ASSA ABLOY Entrance Systems, Nabtesco Corporation, and Horton Automatics.

To strengthen their market position, companies in the automatic door industry are deploying several targeted strategies. Product innovation remains central, with a focus on integrating IoT capabilities, advanced motion sensors, and energy-efficient components. Firms are also investing in strategic partnerships with construction and smart building technology providers to embed automatic doors into broader infrastructure projects. In addition, after-sales services, maintenance contracts, and customization options are being expanded to build customer loyalty and ensure recurring revenue. Geographic expansion through mergers, acquisitions, and distribution agreements helps brands access new markets, while adherence to regional safety and accessibility standards strengthens their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Door type

- 2.2.3 Function

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & Smart Infrastructure

- 3.2.1.2 Improving focus on hygiene & contactless access

- 3.2.1.3 Energy efficiency & security

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Large up-front installation and maintenance costs

- 3.2.2.2 Cybersecurity threats associated with smart door

- 3.2.3 Opportunities

- 3.2.3.1 Global growth of smart building and smart city initiatives

- 3.2.3.2 Unrealized opportunities in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By door type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Door Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Swinging door

- 5.3 Folding door

- 5.4 Revolving door

- 5.5 Bi-fold doors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Sensor based

- 6.3 Motion based

- 6.4 Push button

- 6.5 Access control

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ASSA ABLOY Entrance Systems

- 10.2 Dormakaba Group

- 10.3 GEZE GmbH

- 10.4 Horton Automatics

- 10.5 Nabtesco Corporation

- 10.6 Entrematic

- 10.7 Panasonic Corporation

- 10.8 Record USA

- 10.9 Royal Boon Edam International B.V.

- 10.10 Stanley Access Technologies (a part of Dormakaba)

- 10.11 TORMAX USA Inc.

- 10.12 Ultra Safe Security Doors

- 10.13 Vortex Industries, Inc.

- 10.14 Wilcox Door Service Inc.

- 10.15 Zhejiang Seacon Door Technology Co., Ltd.