PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833386

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833386

U.S. Over the Counter (OTC) Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

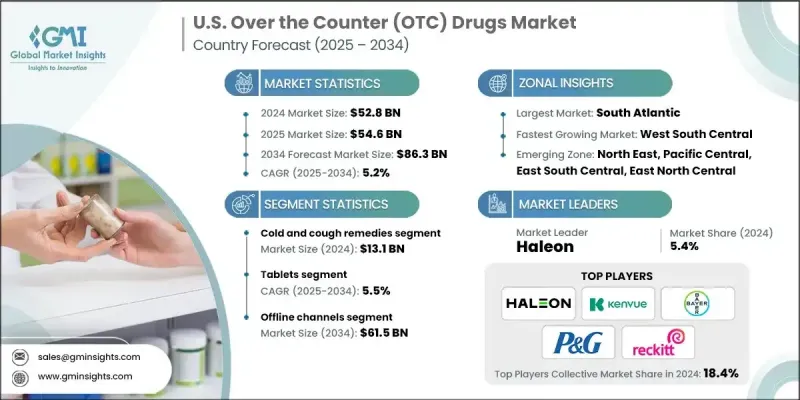

The U.S. Over the Counter Drugs Market was valued at USD 52.8 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 86.3 billion by 2034.

Consumers in the U.S. are increasingly taking charge of their own health by opting to self-manage minor ailments rather than immediately seeking professional medical care. A desire for convenience, time savings, and cost-effectiveness drives this growing trend. As a result, there is a rising demand for over-the-counter (OTC) drugs that are easily accessible without prescriptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.8 Billion |

| Forecast Value | $86.3 Billion |

| CAGR | 5.2% |

Cold and Cough Remedies Segment

The cold and cough remedies segment held a notable share in 2024, driven by seasonal fluctuations and ongoing consumer demand for quick relief from common respiratory ailments. This segment includes a diverse range of products such as syrups, lozenges, decongestants, and combination formulas designed to alleviate symptoms efficiently. Valued at over USD 4 billion, cold and cough remedies benefit from strong brand loyalty and continuous product innovation, including formulations free from artificial ingredients and added vitamins.

Rising Consumption of Tablets

The tablets segment generated significant revenues in 2024, driven by their convenience, dosage accuracy, and shelf stability. Spanning analgesics, antacids, and allergy medications, tablets offer consumers a familiar and easy-to-use dosage form, which drives consistent demand. Packaging improvements, such as blister packs and child-resistant features, further enhance product appeal and safety. To strengthen their foothold, companies prioritize product differentiation through unique formulations, clear labeling, and partnerships with retailers to secure premium shelf space.

Offline Channels to Gain Traction

The offline channels segment held a sizeable share in 2024. Consumers still value in-person advice from pharmacists and the immediate availability of products, particularly for urgent health needs. Retailers are investing in dedicated OTC sections and promotional displays to boost impulse purchases and brand visibility. Companies collaborate closely with these channels to execute co-marketing initiatives, loyalty programs, and educational campaigns, ensuring strong placement and sustained consumer engagement.

South Atlantic to Emerge as a Lucrative Region

South Atlantic over-the-counter (OTC) drugs market held a sustainable share in 2024. This growth is fueled by a diverse population, high health awareness, and a large elderly demographic prone to chronic conditions requiring OTC management. The region's extensive retail infrastructure, including major pharmacy chains and growing online adoption, facilitates easy product access.

Major players in the U.S. over-the-counter (OTC) drugs market are Himalaya Wellness Company, Bayer, Abbott Laboratories, Sanofi, Teva Pharmaceutical, Kenvue, Sun Pharma, Procter & Gamble Company, Cipla, Piramal Pharma, Reckitt, Taisho Pharmaceutical, Glenmark Pharmaceuticals, Perrigo Company, Dr. Reddy's Laboratories, Stada Arzneimittel, Alkem Laboratories, and Haleon.

To maintain and expand their presence in the U.S. Over the Counter (OTC) Drugs Market, companies are prioritizing innovation, including the development of natural and combination formulations that address multiple symptoms simultaneously. Digital marketing and social media engagement are being leveraged to educate consumers and promote product benefits effectively. Firms are also strengthening supply chain efficiency and retail partnerships to ensure consistent product availability across both offline and online channels.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Zone trends

- 2.2.3 Drug category trends

- 2.2.4 Formulation type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer awareness of self-medication and disease management

- 3.2.1.2 High cost of prescription drugs leading to a shift towards OTC drugs

- 3.2.1.3 Favorable regulatory support for OTC drug approvals

- 3.2.1.4 Expansion of digital commerce and e-pharmacy platforms

- 3.2.1.5 Rising prevalence of chronic diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concern towards misuse or risk of self-diagnosis

- 3.2.2.2 Potential side effects and interactions due to medication

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing shift towards natural and herbal OTC products

- 3.2.3.2 Expanding women's health and specialty segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Prescription to nonprescription switch list

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cold and cough remedies

- 5.3 Vitamins and supplements

- 5.4 Digestive and intestinal remedies

- 5.5 Skin treatment

- 5.6 Analgesics

- 5.7 Sleeping aids

- 5.8 Other drug categories

Chapter 6 Market Estimates and Forecast, By Formulation Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Liquids

- 6.4 Ointments

- 6.5 Sprays

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Offline channels

- 7.3.1 Hospital pharmacies

- 7.3.2 Retail pharmacies

- 7.3.3 Other offline channels

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North East

- 8.2.1 Connecticut

- 8.2.2 Maine

- 8.2.3 Massachusetts

- 8.2.4 New Hampshire

- 8.2.5 Rhode Island

- 8.2.6 Vermont

- 8.2.7 New Jersey

- 8.2.8 New York

- 8.2.9 Pennsylvania

- 8.3 East North Central

- 8.3.1 Wisconsin

- 8.3.2 Michigan

- 8.3.3 Illinois

- 8.3.4 Indiana

- 8.3.5 Ohio

- 8.4 West North Central

- 8.4.1 North Dakota

- 8.4.2 South Dakota

- 8.4.3 Nebraska

- 8.4.4 Kansas

- 8.4.5 Minnesota

- 8.4.6 Iowa

- 8.4.7 Missouri

- 8.5 South Atlantic

- 8.5.1 Delaware

- 8.5.2 Maryland

- 8.5.3 District of Columbia

- 8.5.4 Virginia

- 8.5.5 West Virginia

- 8.5.6 North Carolina

- 8.5.7 South Carolina

- 8.5.8 Georgia

- 8.5.9 Florida

- 8.6 East South Central

- 8.6.1 Kentucky

- 8.6.2 Tennessee

- 8.6.3 Mississippi

- 8.6.4 Alabama

- 8.7 West South Central

- 8.7.1 Oklahoma

- 8.7.2 Texas

- 8.7.3 Arkansas

- 8.7.4 Louisiana

- 8.8 Mountain States

- 8.8.1 Idaho

- 8.8.2 Montana

- 8.8.3 Wyoming

- 8.8.4 Nevada

- 8.8.5 Utah

- 8.8.6 Colorado

- 8.8.7 Arizona

- 8.8.8 New Mexico

- 8.9 Pacific Central

- 8.9.1 California

- 8.9.2 Alaska

- 8.9.3 Hawaii

- 8.9.4 Oregon

- 8.9.5 Washington

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Alkem Laboratories

- 9.3 Bayer

- 9.4 Cipla

- 9.5 Dr. Reddy’s Laboratories

- 9.6 Glenmark Pharmaceuticals

- 9.7 Haleon

- 9.8 Himalaya Wellness Company

- 9.9 Kenvue

- 9.10 Perrigo Company

- 9.11 Piramal Pharma

- 9.12 Procter & Gamble Company

- 9.13 Reckitt

- 9.14 Sanofi

- 9.15 Stada Arzneimittel

- 9.16 Sun Pharma

- 9.17 Taisho Pharmaceutical

- 9.18 Teva Pharmaceutical