PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833455

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833455

Europe Over the Counter (OTC) Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

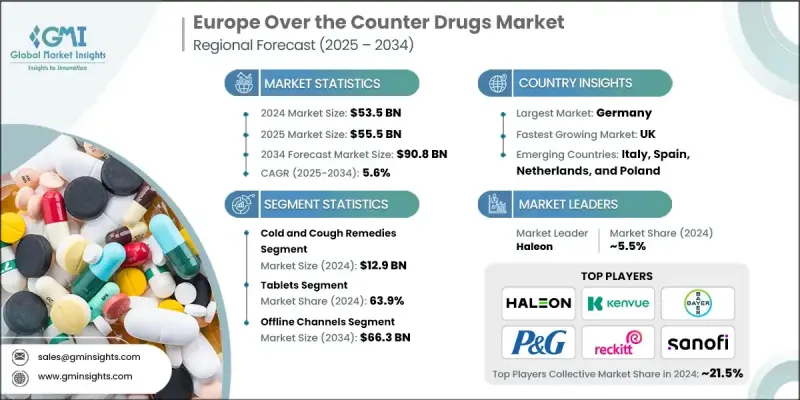

The Europe Over the Counter Drugs Market was valued at USD 53.5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 90.8 billion by 2034.

Europe has one of the world's oldest populations. As people age, they often deal with chronic but manageable health conditions (e.g., joint pain, insomnia, digestive issues) that can be treated with OTC medications. This demographic shift steadily increases demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.5 Billion |

| Forecast Value | $90.8 Billion |

| CAGR | 5.6% |

Increasing Prevalence of Cold and Cough Remedies

The cold and cough remedies segment held a significant share in 2024, driven by seasonal fluctuations, rising air pollution, and consumer preference for quick symptom relief. Consumers increasingly seek multi-symptom relief solutions, pushing brands to innovate with combination products that target sore throat, nasal congestion, and dry cough in a single dose.

Rising Consumption of Tablets

The tablets segment generated robust revenues in 2024, owing to their convenience, longer shelf life, and cost-effectiveness. From pain relief to digestive health, tablets dominate across a broad range of indications. Their scalability in manufacturing and ease of packaging also make them ideal for large-scale distribution, especially in value-driven retail settings.

Offline Channel to Gain Traction

The offline channel segment will witness a strong CAGR through 2034, fueled by pharmacies, drugstores, and health shops. While digitalization is on the rise, many consumers still prefer face-to-face consultation with pharmacists before purchasing OTC products, especially in countries like Germany and France, where professional guidance is culturally ingrained in healthcare decisions.

Germany to Emerge as a Propelling Region

Germany over the counter (OTC) drugs market held a sizeable share in 2024, backed by a well-structured pharmacy network and strong consumer inclination toward self-care. German consumers value product quality and often favor herbal or natural alternatives, which has encouraged companies to invest in clean-label and plant-based formulations. Regulatory frameworks are strict but stable, allowing brands to operate with a clear understanding of market boundaries.

Major players in the Europe over the counter drugs market are Few of the prominent players operating in the Europe OTC drugs industry include: Glenmark Pharmaceuticals, Sanofi, Taisho Pharmaceutical, Bayer, Haleon, Procter & Gamble Company, Teva Pharmaceutical, Cooper Consumer Health, Cipla, Stada Arzneimittel, Kenvue, Himalaya Wellness Company, Reckitt, Alkem Laboratories, Abbott Laboratories, Dr. Reddy's Laboratories, Perrigo Company, Piramal Pharma, and Sun Pharma.

To strengthen their position in Europe over the counter (OTC) drugs market, companies are implementing a mix of product innovation, geographic expansion, and consumer engagement strategies. Many focus on Rx-to-OTC switches to expand their product portfolios with minimal R&D risk. Brand diversification through herbal, vegan, and sugar-free variants is another popular approach, targeting niche consumer segments. In-store visibility campaigns, strategic retail partnerships, and pharmacist-led promotions are being used to win in the offline channel. Digital marketing is also playing a growing role, with personalized ads, influencer collaborations, and mobile health apps driving direct-to-consumer engagement. In markets like Germany and France, localization of products and messaging is essential to align with cultural expectations and regulatory nuances.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Country trends

- 2.2.3 Drug category trends

- 2.2.4 Formulation type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Rising adoption of self-medication trends

- 3.2.1.4 Expansion of digital commerce and e-pharmacy platforms

- 3.2.1.5 Development of innovative formulations and expanding indications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concerns about misuse or drug abuse

- 3.2.2.2 Side effects associated with the drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing cultural acceptance of self-care

- 3.2.3.2 Growing adoption of natural and herbal OTC products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Prescription to nonprescription switch list

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cold and cough remedies

- 5.3 Vitamins and supplements

- 5.4 Digestive and intestinal remedies

- 5.5 Skin treatment

- 5.6 Analgesics

- 5.7 Sleeping aids

- 5.8 Other drug categories

Chapter 6 Market Estimates and Forecast, By Formulation Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Liquids

- 6.4 Ointments

- 6.5 Sprays

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Offline channels

- 7.3.1 Hospital pharmacies

- 7.3.2 Retail pharmacies

- 7.3.3 Other offline channels

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Germany

- 8.3 UK

- 8.4 France

- 8.5 Italy

- 8.6 Spain

- 8.7 Netherlands

- 8.8 Poland

- 8.9 Rest of Europe

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Alkem Laboratories

- 9.3 Bayer

- 9.4 Cipla

- 9.5 Cooper Consumer Health

- 9.6 Dr. Reddy’s Laboratories

- 9.7 Glenmark Pharmaceuticals

- 9.8 Haleon

- 9.9 Himalaya Wellness Company

- 9.10 Kenvue

- 9.11 Perrigo Company

- 9.12 Piramal Pharma

- 9.13 Procter & Gamble Company

- 9.14 Reckitt

- 9.15 Sanofi

- 9.16 Stada Arzneimittel

- 9.17 Sun Pharma

- 9.18 Taisho Pharmaceutical

- 9.19 Teva Pharmaceutical