PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833407

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833407

Insulin Pen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

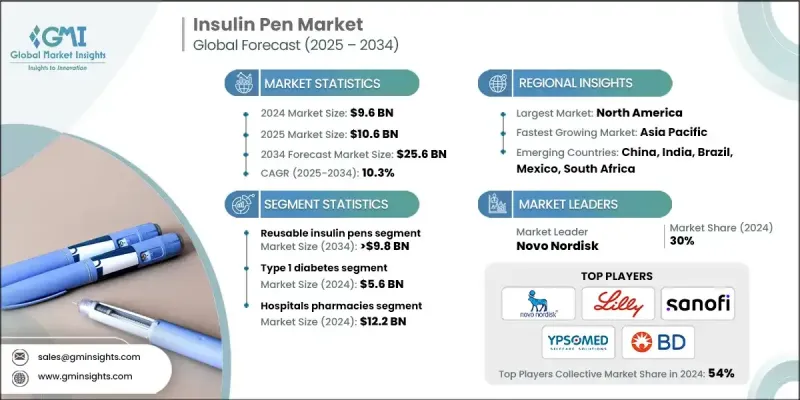

The Global Insulin Pen Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 25.6 billion by 2034.

The increasing number of people diagnosed with both Type 1 and Type 2 diabetes worldwide is a primary driver of insulin pen demand. As the diabetic population continues to grow, particularly in urban areas and among aging demographics, the need for convenient and reliable insulin delivery methods is escalating.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 10.3% |

Reusable Insulin Pens Segment

The reusable insulin pens segment is experiencing robust growth due to rising demand for cost-effective, sustainable, and user-friendly insulin delivery devices. The growth is driven by the long-term economic benefits reusable pens offer compared to disposable models. These pens are favored by patients requiring multiple daily injections, as they support dose precision and are compatible with a wide range of insulin cartridges.

Increasing Prevalence of Type 1 Diabetes Segment

The Type 1 diabetes segment held a robust share in 2024. As individuals with Type 1 diabetes require lifelong insulin therapy, there is a continuous need for efficient, portable, and discreet insulin delivery methods. Insulin pens, particularly those with smart dosing capabilities, are well-suited to this population due to their convenience and minimal training requirements.

Rising Adoption in Hospital Pharmacies

The hospital pharmacies segment held a sizeable share in 2024 in acute care settings and for newly diagnosed patients. The growth is driven by standardized dosing, infection control, and ease of staff training. Hospitals prefer insulin pens for their safety features and reduced risk of dosage errors. Manufacturers are responding by offering bulk packaging solutions, training modules for hospital staff, and extended shelf-life products to meet institutional needs.

North America Insulin Pen Market

North America insulin pen market held a sustainable share in 2024. High diabetes prevalence, advanced healthcare infrastructure, and widespread insurance coverage are key factors supporting this region's dominance. The U.S. is witnessing strong adoption of smart insulin pens and digital health platforms that streamline diabetes management. To reinforce their market position, companies are leveraging direct-to-consumer marketing, expanding distribution through retail pharmacies, and enhancing patient support programs.

Major players in the insulin pen market are Medmix, Julphar, Dongbao Pharmaceutical, Sanofi, Gan & Lee Pharmaceuticals, Novo Nordisk, Owen Mumford, Haselmeier, Ypsomed, Biocon Biologics, Eli Lilly and Co., Medtronic, Wockhardt, Becton, Dickinson and Company, and Suzhou Peng Ye Medical Devices.

To strengthen their foothold, leading companies in the insulin pen market are heavily focused on innovation, strategic partnerships, and patient-centric solutions. Many are investing in smart insulin pen technology, integrating Bluetooth connectivity, dose memory, and mobile app synchronization to offer better diabetes management tools. Collaborations with digital health platforms and glucose monitoring companies are also helping create more integrated care ecosystems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Indication trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in insulin pens

- 3.2.1.3 Enhanced awareness of self-management of diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin pens

- 3.2.2.2 Limited penetration in low-income regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart features and digital platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.7.1 By type

- 3.7.2 By region

- 3.8 Reimbursement landscape

- 3.9 Patent analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable insulin pens

- 5.3 Disposable insulin pens

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Biocon Biologics

- 9.3 Dongbao Pharmaceutical

- 9.4 Eli Lilly and Co

- 9.5 Gan & Lee Pharmaceuticals

- 9.6 Haselmeier

- 9.7 Julphar

- 9.8 Medmix

- 9.9 Medtronic

- 9.10 Novo Nordisk

- 9.11 Owen Mumford

- 9.12 Sanofi

- 9.13 Suzhou Peng Ye Medical Devices

- 9.14 Wockhardt

- 9.15 Ypsomed