PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876547

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876547

Europe Insulin Pen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

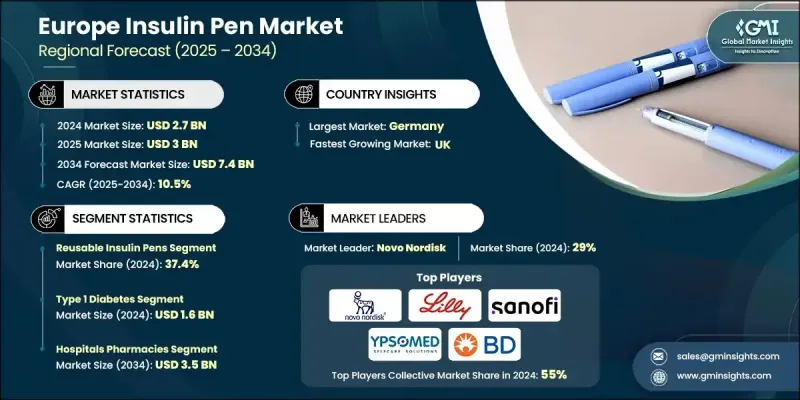

Europe Insulin Pen Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 7.4 billion by 2034.

Market expansion is driven by the rising prevalence of diabetes across Europe, the growing elderly population, and supportive government policies that promote diabetes management and reimbursement. Continuous technological innovations are further fueling market growth as manufacturers introduce advanced features to improve usability and treatment precision. Modern insulin pens now incorporate digital functionalities such as Bluetooth connectivity, dosage memory, and mobile app integration, which enhance monitoring and allow real-time communication with healthcare professionals. These innovations are transforming insulin delivery into a more personalized and efficient process, improving compliance and patient outcomes. Insulin pens are designed to offer accurate, safe, and convenient insulin administration and are available as disposable or reusable versions, depending on patient preferences and treatment requirements. The ongoing shift toward digital healthcare solutions and connected devices is reinforcing the use of insulin pens across Europe, where both patients and providers are prioritizing comfort, accuracy, and self-management in diabetes care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 billion |

| Forecast Value | $7.4 billion |

| CAGR | 10.5% |

The disposable insulin pen segment is expected to register a CAGR of 10.5% during 2025-2034. Disposable pens currently dominate the European market due to their convenience, affordability, and wide accessibility. They are especially favored by newly diagnosed patients because they eliminate the need for refilling or cleaning. The simplicity of disposable designs reduces the likelihood of dosing mistakes and makes them ideal for seniors, individuals with limited dexterity, or healthcare staff assisting multiple patients. Their practical benefits have contributed to widespread adoption across home care and clinical settings, making them a preferred option in Europe's diabetes management landscape.

The type 1 diabetes segment generated USD 1.6 billion in 2024. This segment maintains dominance in the European insulin pen market as individuals with type 1 diabetes require lifelong insulin therapy. Since patients typically begin treatment early, insulin pens have become a standard method for daily injections due to their portability, precision, and ease of handling. The ongoing demand from this patient group ensures steady market growth, as they rely on consistent, accurate insulin administration to maintain glycemic control.

Germany Insulin Pen Market was valued at USD 379 million in 2024. The country's strong healthcare system, emphasis on chronic disease management, and widespread patient education have supported early adoption of insulin pen technology. These devices are highly valued for their dosing accuracy, user-friendly design, and portability, contributing to improved adherence and better long-term outcomes in both clinical and home care environments.

Key companies active in the Europe Insulin Pen Market include Eli Lilly and Company, Medtronic, Novo Nordisk, Haselmeier, Medmix, Sanofi, Ypsomed, Wockhardt, Becton, Dickinson and Company, Owen Mumford, Biocon Biologics, and Gan & Lee Pharmaceuticals. Leading manufacturers in the Europe Insulin Pen Market are focusing on innovation, strategic partnerships, and geographic expansion to strengthen their competitive edge. Companies are investing heavily in the development of next-generation smart insulin pens featuring digital connectivity, data synchronization, and integration with glucose monitoring systems. Many are forming collaborations with digital health and technology firms to create comprehensive diabetes management ecosystems. Firms are also expanding production facilities across Europe to ensure localized manufacturing and better supply chain efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Type trends

- 2.2.3 Indication trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising diabetes prevalence across Europe

- 3.2.1.2 Increasing technological advancements in insulin pen

- 3.2.1.3 Rising government support and reimbursement policies

- 3.2.1.4 Growing geriatric population base

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced pens

- 3.2.2.2 Limited awareness and education

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and data analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable insulin pens

- 5.3 Disposable insulin pens

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Germany

- 8.3 UK

- 8.4 France

- 8.5 Italy

- 8.6 Spain

- 8.7 Netherlands

- 8.8 Sweden

- 8.9 Belgium

- 8.10 Denmark

- 8.11 Finland

- 8.12 Norway

- 8.13 Lithuania

- 8.14 Latvia

- 8.15 Estonia

- 8.16 Russia

- 8.17 Poland

- 8.18 Switzerland

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Biocon Biologics

- 9.3 Eli Lilly and Company

- 9.4 Gan & Lee Pharmaceuticals

- 9.5 Haselmeier

- 9.6 Medtronic

- 9.7 Medmix

- 9.8 Novo Nordisk

- 9.9 Owen Mumford

- 9.10 Sanofi

- 9.11 Ypsomed

- 9.12 Wockhardt