PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876532

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876532

North America Insulin Pen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

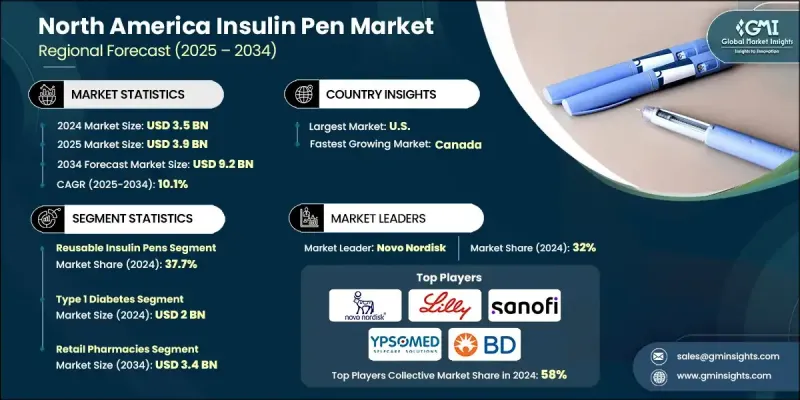

North America Insulin Pen Market was valued at USD 3.5 billion in 2024 and is estimate to grow at a CAGR of 10.1% to reach USD 9.2 billion by 2034.

The growth is driven by the rising incidence of diabetes in the region, increasing adoption of technologically advanced insulin pens, a shift toward self-administration and home-based care, and growing public health initiatives. Government programs and public health campaigns are playing a pivotal role in expanding access to diabetes care and advanced insulin delivery technologies. Rising diabetes prevalence has prompted authorities to implement comprehensive prevention, early diagnosis, and treatment strategies. Insulin pens, which include a cartridge, dose-adjustment dial, and disposable needle, offer patients a convenient and precise way to administer insulin. The growing emphasis on integrated care models and affordable treatment solutions is further accelerating insulin pen adoption across North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $9.2 Billion |

| CAGR | 10.1% |

The reusable insulin pens segment captured 37.7% share in 2024 owing to their long-term cost efficiency, durability, and ability to accommodate multiple cartridges. Unlike disposable pens that are prefilled and discarded after a single use, reusable insulin pens provide an eco-friendly and economical option while ensuring accurate dosing over repeated uses.

The type 1 diabetes segment reached USD 2 billion in 2024. Increasing cases of type 1 diabetes, which requires lifelong insulin therapy due to insufficient insulin production, are driving the demand for innovative insulin pens that enable accurate, multiple daily injections with ease and convenience.

Canada Insulin Pen Market was valued at USD 384.4 million in 2024. Rising prevalence of both type 1 and type 2 diabetes in Canada is increasing demand for consistent, reliable insulin delivery. Greater awareness among healthcare professionals and patients regarding benefits such as precision, ease of use, and reduced injection discomfort is further supporting adoption of insulin pens over traditional syringes.

Key players in the North America Insulin Pen Market include Novo Nordisk, Eli Lilly and Company, Sanofi, Becton, Dickinson and Company, Medtronic, Ypsomed, Owen Mumford, Medmix, Haselmeier, Gan & Lee Pharmaceuticals, Julphar, Biocon Biologics, and Valeritas. Companies in the North America Insulin Pen Market are leveraging several strategies to strengthen their presence. They are investing in research and development to enhance usability, accuracy, and digital connectivity of insulin pens. Strategic partnerships and collaborations expand distribution networks and reach. Mergers and acquisitions help acquire advanced technologies and consolidate market share. Firms focus on entering underserved and emerging regions to capture new growth opportunities. Product differentiation through innovative, patient-friendly designs improves brand recognition. Companies also prioritize clinician education programs and awareness campaigns to increase adoption while ensuring regulatory compliance and safety standards, enhancing credibility and long-term market positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Type trends

- 2.2.3 Indication trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes across North America

- 3.2.1.2 Increasing technological advancements in insulin pen

- 3.2.1.3 Shift toward self-administration and home healthcare

- 3.2.1.4 Growing government and public health initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable insulin pens

- 5.3 Disposable insulin pens

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes Market

Chapter 7 Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Biocon Biologics

- 9.3 Eli Lilly and Company

- 9.4 Gan & Lee Pharmaceuticals

- 9.5 Haselmeier

- 9.6 Julphar

- 9.7 Medtronic

- 9.8 Medmix

- 9.9 Novo Nordisk

- 9.10 Owen Mumford

- 9.11 Sanofi

- 9.12 Valeritas

- 9.13 Ypsomed