PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833410

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833410

U.S. Diabetes Care Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

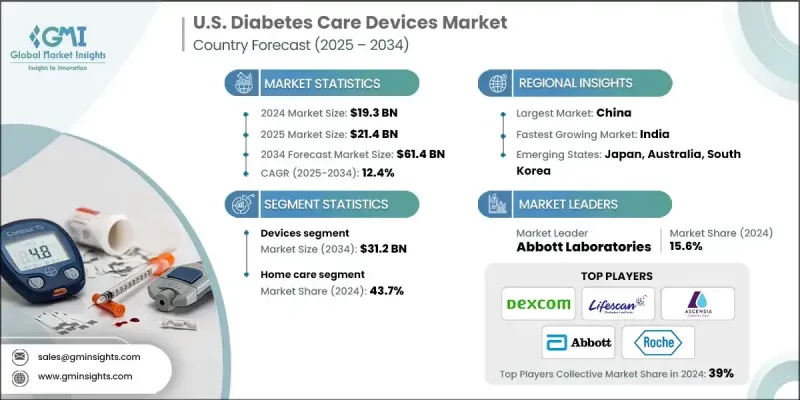

The U.S. Diabetes Care Devices Market was valued at USD 19.3 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 61.4 billion by 2034.

The widespread incidence of diabetes, combined with a growing aging population and the rise in sedentary lifestyles, is creating an urgent need for effective management tools. As individuals with diabetes require consistent monitoring and control of their blood glucose levels to prevent complications such as heart disease, kidney failure, and nerve damage, the demand for advanced diabetes care devices continues to surge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.3 Billion |

| Forecast Value | $61.4 Billion |

| CAGR | 12.4% |

Rising Adoption of Devices

The devices segment held a notable share in 2024, encompassing blood glucose meters, test strips, insulin pens, insulin pumps, and continuous glucose monitoring (CGM) systems. Companies are responding by introducing localized, cost-effective devices with smart features such as Bluetooth connectivity and mobile app integration. To strengthen their foothold, leading players are forming partnerships with local distributors, expanding regional manufacturing, and customizing product lines to meet cultural and economic preferences in urban and rural markets alike.

Homecare to Gain Traction

The home care segment in the U.S. diabetes care devices market generated a significant share in 2024 as more patients shifted toward self-management and at-home monitoring. Factors such as the rising cost of in-clinic care, growing health consciousness, and the increasing prevalence of type 2 diabetes among middle-aged adults have all contributed to this trend. Companies are prioritizing ease of use, portability, and affordability while ensuring accuracy and reliability. Key strategies to capture this segment include launching direct-to-consumer online platforms, offering multilingual user support, and partnering with digital health apps to deliver personalized insights and remote monitoring capabilities.

Major players in the U.S. diabetes care devices market are Abbott Laboratories, Sinocare, Medtronic, Tandem Diabetes Care, Bionime, Dexcom, Eli Lilly and Company, F. Hoffmann-La Roche, LifeScan, Becton, Dickinson and Company, DarioHealth, Ypsomed Holding, Insulet, Nova Biomedical, Novo Nordisk, Ascensia Diabetes Care, Dr. Reddy's Laboratories, ARKRAY, and B. Braun Melsungen.

Leading companies in the diabetes care devices market are heavily investing in research and development (R&D) to create innovative products that offer better accuracy, convenience, and integration with digital health tools. For instance, companies like Abbott Laboratories and Dexcom have introduced advanced continuous glucose monitoring (CGM) systems with real-time data syncing, enabling patients and healthcare providers to make more informed decisions. These advancements aim to improve patient outcomes and drive long-term market growth. Many companies are forming strategic partnerships with healthcare providers, technology companies, and insurance firms to expand their reach and access to new customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of diabetes across the U.S.

- 3.2.1.2 Shift toward value-based and remote care

- 3.2.1.3 Favorable reimbursement policy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diabetes care devices

- 3.2.2.2 Rigorous regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and smart ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.5.2.1 Non-Invasive glucose monitoring technologies

- 3.5.2.2 Nanotechnology applications

- 3.6 Diabetes epidemiology and disease burden analysis

- 3.6.1 U.S. diabetes prevalence trends

- 3.6.2 Gestational diabetes prevalence

- 3.6.3 Complication rates and healthcare costs

- 3.7 Patent landscape analysis for diabetes device innovations

- 3.8 Clinical trial pipeline assessment for emerging technologies

- 3.9 Patient behavior and technology adoption patterns in diabetes care devices

- 3.10 Reimbursement scenario

- 3.10.1 Coding and reimbursement

- 3.10.2 Reimbursement policies and public healthcare sector insurance coverage for insulin delivery systems

- 3.11 Pricing analysis, 2024

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Blood glucose monitoring devices

- 5.2.1.1 Self-monitoring blood glucose meters

- 5.2.1.2 Continuous glucose monitors

- 5.2.2 Insulin delivery devices

- 5.2.2.1 Insulin pumps

- 5.2.2.1.1 Tubed pumps

- 5.2.2.1.2 Tubeless pumps

- 5.2.2.2 Pens

- 5.2.2.2.1 Reusable

- 5.2.2.2.2 Disposable

- 5.2.2.3 Other insulin delivery devices

- 5.2.2.1 Insulin pumps

- 5.2.1 Blood glucose monitoring devices

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

- 5.3.3 Pen needles

- 5.3.3.1 Standard

- 5.3.3.2 Safety

- 5.3.4 Syringes

- 5.3.5 Insulin pumps consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospital

- 6.3 Ambulatory surgical centers

- 6.4 Diagnostic centers

- 6.5 Homecare

- 6.6 Other end use

Chapter 7 Company Profiles

- 7.1 Abbott Laboratories

- 7.2 ARKRAY

- 7.3 Ascensia Diabetes Care

- 7.4 B. Braun Melsungen

- 7.5 Becton, Dickinson and Company

- 7.6 Bionime

- 7.7 DarioHealth

- 7.8 Dexcom

- 7.9 Dr. Reddy’s Laboratories

- 7.10 Eli Lilly and Company

- 7.11 F. Hoffmann-La Roche

- 7.12 Insulet

- 7.13 LifeScan

- 7.14 Medtronic

- 7.15 Nova Biomedical

- 7.16 Novo Nordisk

- 7.17 Sanofi

- 7.18 Sinocare

- 7.19 Tandem Diabetes Care

- 7.20 Ypsomed Holding