PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833457

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833457

Asia Pacific Diabetes Care Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

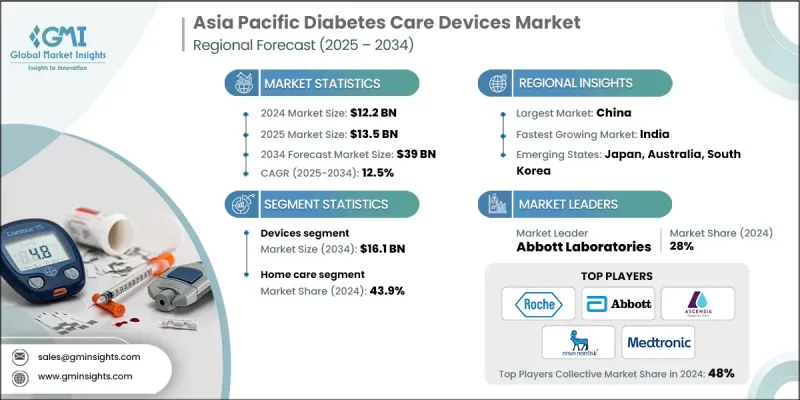

The Asia Pacific Diabetes Care Devices Market was valued at USD 12.2 billion in 2024 and is estimated to grow at a CAGR of 12.5% to reach USD 39 billion by 2034.

Asia Pacific region is experiencing a significant rise in diabetes, making it one of the most affected regions globally. Factors such as rapid urbanization, sedentary work environments, and increased consumption of high-calorie processed foods have contributed to the growing number of individuals diagnosed with both Type 1 and Type 2 diabetes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $39 Billion |

| CAGR | 12.5% |

Rising Adoption of Devices

The devices segment held a notable share in 2024, encompassing a wide range of products such as blood glucose monitors, insulin delivery systems, lancets, and continuous glucose monitors (CGMs). As diabetes rates climb across the region, demand for reliable, easy-to-use devices is accelerating across both urban and rural populations. Manufacturers are focusing on integrated systems that offer automated insulin dosing, Bluetooth connectivity, and app-based health tracking to improve patient adherence and outcomes.

Homecare to Gain Traction

The homecare segment generated significant revenues in 2024 as the region prefers to manage diabetes from the comfort of their homes. With the rising cost of clinical visits and growing emphasis on self-care, home-use devices like glucometers, insulin pens, and wearable CGMs are seeing strong adoption. Companies are prioritizing device portability, ease of use, and real-time connectivity in their product development strategies.

China to Emerge as a Lucrative Region

China diabetes care devices market held a notable share in 2024, driven by a massive diabetic population exceeding 140 million and increasing health consciousness among middle-income consumers. Chinese consumers are also becoming more receptive to wearable and connected devices that support long-term disease management. To strengthen their foothold, leading companies are localizing product offerings, forming joint ventures with Chinese healthcare firms, and navigating regulatory pathways to secure early market access.

Major players in the Asia Pacific diabetes care devices market are Sinocare, Eli Lilly and Company, Nova Biomedical, Bionime, Novo Nordisk, B. Braun Melsungen, Sanofi, Platinum Equity Advisors, Medtronic, Abbott Laboratories, ARKRAY, Ascensia Diabetes Care, F. Hoffmann-La Roche, Insulet, Dr. Reddy's Laboratories, Becton, Dickinson and Company.

To build a strong foothold in the Asia Pacific diabetes care devices market, companies are embracing a multi-tiered strategy focused on accessibility, innovation, and regional adaptability. Localization remains critical, with firms customizing device features, pricing, and user interfaces to fit cultural preferences and economic conditions across diverse markets. Strategic partnerships with hospitals, pharmacies, and digital health platforms help expand reach and reinforce brand credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Escalating diabetes prevalence across Asia Pacific

- 3.2.1.2 Advancement in technological in diabetes care devices

- 3.2.1.3 Increased public and private sector investments for diabetes care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diabetes care devices

- 3.2.2.2 Stringent regulatory landscape

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging Asia Pacific markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 China

- 3.4.2 Japan

- 3.4.3 India

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Diabetes epidemiology and disease burden analysis

- 3.6.1 Regional diabetes prevalence trends

- 3.6.2 Gestational diabetes prevalence

- 3.6.3 Complication rates and healthcare costs

- 3.7 Patent landscape analysis for diabetes device innovations

- 3.8 Clinical trial pipeline assessment for emerging technologies

- 3.9 Supply chain and distribution analysis

- 3.10 Reimbursement scenario

- 3.11 Pricing analysis, 2024

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Device

- 5.2.1 Blood glucose monitoring devices

- 5.2.1.1 Self-monitoring blood glucose meters

- 5.2.1.2 Continuous glucose monitors

- 5.2.2 Insulin delivery devices

- 5.2.2.1 Insulin pumps

- 5.2.2.1.1 Tubed pumps

- 5.2.2.1.2 Tubeless pumps

- 5.2.2.2 Pens

- 5.2.2.2.1 Reusable

- 5.2.2.2.2 Disposable

- 5.2.2.1 Insulin pumps

- 5.2.3 Other insulin delivery devices

- 5.2.1 Blood glucose monitoring devices

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

- 5.3.3 Pen needles

- 5.3.3.1 Standard

- 5.3.3.2 Safety

- 5.3.4 Syringes

- 5.3.5 Insulin pumps consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospital

- 6.3 Ambulatory surgical centres

- 6.4 Diagnostic centres

- 6.5 Homecare

- 6.6 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Japan

- 7.3 China

- 7.4 India

- 7.5 Australia

- 7.6 South Korea

- 7.7 Taiwan

- 7.8 Indonesia

- 7.9 Vietnam

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 ARKRAY

- 8.3 Ascensia Diabetes Care

- 8.4 B. Braun Melsungen

- 8.5 Becton, Dickinson and Company

- 8.6 Bionime

- 8.7 Dr. Reddy’s Laboratories

- 8.8 Eli Lilly and Company

- 8.9 F. Hoffmann-La Roche

- 8.10 Insulet

- 8.11 Medtronic

- 8.12 Nova Biomedical

- 8.13 Novo Nordisk

- 8.14 Platinum Equity Advisors

- 8.15 Sanofi

- 8.16 Sinocare